Public Sector Superannuation accumulation plan (PSSap)

Who can join PSSap?

Only Commonwealth Government employees can join PSSap.

Former employees of the Commonwealth Government can also join, if they served at least 12 continuous months (check with the fund to confirm if you’re eligible). The fund replaced the PSS fund in 2005.

Before committing to a particular fund, consider comparing your options with Canstar and checking out our choosing a super fund checklist. You can also read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for PSSap to help decide whether it is suitable for your needs. It’s available on the PSSap website.

If you do decide to join PSSap, fill out a Superannuation Standard Choice Form and give it to your employer.

PSSap super investment options

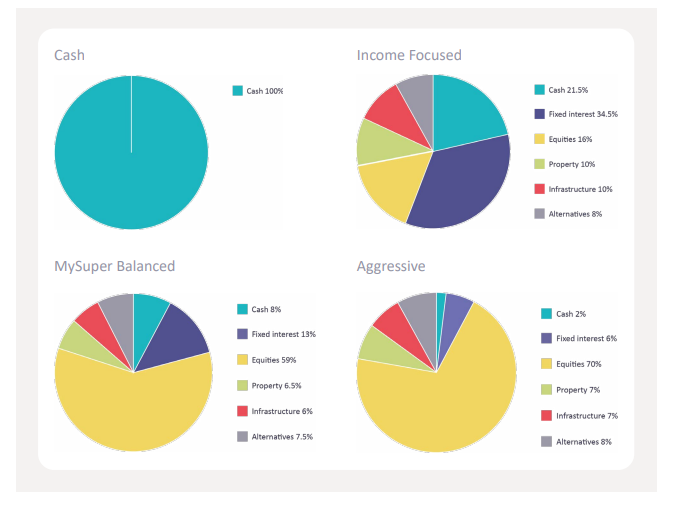

PSSap offers four investment options when a member opens an account. The CSC states that members’ money is “pooled” into a super trust and is then invested “in line with the investment options you choose”.

What are PSSap super fund’s asset classes?

PSSap’s investment options are “made up of a mix” of the following asset classes:

- Cash – the investment is kept as cash, either as deposits with banks or guaranteed, short-term money market securities

- Fixed interest – includes lending to borrowers, government bonds and corporate credit

- Equities – Australian and international shares and private equities

- Property – investing in real estate such as commercial properties or in property trusts

- Infrastructure – investing in public works and services

- Alternatives – activities that don’t fall “within the main asset class groupings”, such as hedge funds or absolute return funds.

What are the PSSap super investment options?

Fund members can choose four different types of investment options, which apply different mixes of the above asset classes. Each has its own investment purpose, according to CSC documents:

- Cash – to reserve its capital and earn a pre-tax return that’s close to the Bloomberg AusBond Bank Bill Index, by investing 100% in cash assets

- Income focused – to outperform the Consumer Price Index (CPI) by 2% per year after fees and tax, over 10 years

- MySuper Balanced (or Balanced for Ancillary customers) – to outperform the CPI by 3.5% a year after fees and tax, over 10 years

- Aggressive – to outperform the CPI by 4.5% per year after fees and tax, over 10 years

Read the PDS and TMD for more information.