How to save money – 70 tips to cut living costs

Are you looking to cut the cost of living? Here are 70 frugal living ideas that could help your dollar go further.

The frugal living movement is going from strength to strength, as inflation takes a bite out of the budget and sends groceries, fuel and energy prices skywards. So, as $12 lettuces haunt shelves and power bill hikes drive householders to switch off heaters and instead tape cardboard over their windows, we’ve put together a list of 70 ideas designed to help kickstart the journey towards a more thrifty life and #savemoney.

1. Start smart

A good place to start if you want to save money and live more frugally is to work out where you are spending it. Keep a spending diary for a couple of weeks – or go through your bank statements – to build up a picture of your habits when it comes to your finances. Then, write a budget. That way, you will be able to work out how much you can comfortably save while still covering those essential expenses. (Canstar has a handy app that may help you save money through budgeting related content.)

2. Write down your goal

Psychologists say that when you write down your goals, you are more likely to achieve them. One study found that those who did were 42% more successful than those who did not. “Goal setting in psychology is an essential tool for self-motivation and self-drivenness,” writes Indian counsellor Madhuleena Roy Chowdhury in Positive Psychology.

One widely-used rule of thumb for ensuring your goals are effective is to ensure they’re ‘SMART’ – Specific, Measurable, Achievable, Relevant and Time-based. For example: “I want to save for a trip to Noosa, which will cost $2,000, so I need to save $45 a week for the next 45 weeks.” Write it down and then put it up somewhere you can regularly see it – perhaps on the fridge, or on the back of your front door, or in your wallet.

3. Make saving fun

‘Saving’ does not have to mean ‘chore’. There are plenty of ways that you could turn cutting expenses and saving money into something enjoyable. You could ‘gamify’ your savings habit (try typing “savings games” into Pinterest, for example), such as savings bingo, or try a savings ‘challenge’. Popular examples are the 52-week savings challenge, where you put away $1 in the first week, $2 in the second and so on until you are saving $52 (for a grand total of $1,378 plus interest in a year); the 52-week dice challenge (where you save whatever amount comes up on the dice each week); or the weather-saving challenge, where you take the highest temperature on a certain day of the week and save a corresponding amount. There are also several apps that can help.

4. Recognise ’emotional spending’ and try to avoid it

The frugal living movement is all about conscious consumption. Emotional spending, also known as retail therapy or impulse buying, is when someone spends money as a way to change their mood. If it’s just a simple purchase which doesn’t impact your financial wellbeing, some studies have shown that this might not be so bad in moderation. But if you are trying to save, it could pose a problem. Even a relatively small amount can add up – a $10 impulse buy three times a week would add up to $1,560 a year, for example. And prolonged retail therapy could have a negative impact in the long term, not only on your finances but also on your mental health, a number of studies have found. One way to combat the urge to shop is to recognise when you are in an ‘impulse buying’ mood, and engage in positive mood-enhancing activities instead, such as exercising or spending time outdoors – doing something that you enjoy.

5. Join a ‘savings movement’

If you need the motivation of a group to help keep you on track, there are a plethora of savings groups to join on social media. For example, there’s a ‘Buy Nothing‘ movement, where members give away items to other members who need them; myriad ‘savings hacks’ communities, which share everything from meal-planning ideas to which stores are having sales; and co-op groups where people buy food or other items in bulk and share the cost. (However, it pays to do your research before jumping into one of these groups to ensure that they are legitimate, and to also be careful giving out any personal or financial information.) Some movements to investigate could include website communities such as She’s On The Money, Facebook private groups such as “Frugal Families – Living Well on a Budget” and “Frugal Homemaking and Living”, and Reddit, which also has a plethora of information shared by users, such as on the Australian Specific Frugal Tips subReddit. Pinterest, too, has many “Pinfluencers” (Pintrest influencers) that pin tips, such as Yaz – The Wallet Moth, and Emma, while Instagram has the ever-popular hashtags #frugalliving, #savingmoney and #frugallife. (It’s good to keep in mind that sometimes social media influencers can receive payment for their posts.)

6. Start a coin jar

Throwing your silver and gold coins into a (non-opening) coin jar or tin each day can help build up a savings stash, and lighten your pocket at the same time. One Brisbane man who threw his spare change into a bucket and cashed it in seven years later had accumulated a whopping $888.05. However, before taking large amounts of change into a bank, make sure there are no fees attached to exchanging them for notes or for it to be electronically deposited into your account. And don’t forget that you could be earning interest on your coins if you put them in a savings account.

7. Shop at a physical grocery store (but remember to remain socially distanced)

A surprising finding by Roy Morgan research in 2019 found Aussie shoppers who bought their groceries online tended to spend more than those who visited ‘bricks and mortar’ stores. The study found that for Woolworths customers, those who shopped online spent an average of $186 a week compared to those who shopped in a physical shop, at $103. For Coles shoppers, it was $158 versus $97 a week. If you do prefer to shop online – or have to because of social isolation requirements – it could be a good idea to make a list and stick to it, no matter how good the ‘online only’ specials seem to be. You could also consider checking out Canstar Blue’s latest customer satisfaction ratings for online grocery shopping.

8. One shop, once a week: Fight back against temptation tactics

Doing one large grocery shop per week, rather than several small ones, could help to cut down on impulse buys, takeaway and wastage. To do that, though, it could mean you have to plan ahead, such as by writing a weekly meal menu so you can get everything you need in one shopping trip. And if you have all the ingredients at your fingertips, it’s easier to resist the temptation to order delivery or takeaway – it can be quicker to cook a simple meal at home than it is to order via an app and wait for it to arrive.

9. Use a shopping list app

How many times have you gone to the shops and bought that extra bottle of tomato sauce only to return home and find three more in the cupboard? Shopping without a list can mean unnecessary purchases, which means less in your savings account. And you could make it even easier to keep track of your shopping lists by storing them on a smartphone app.

10. Meal prep like a pro

‘Meal prepping’ – or preparing many meals at once and storing them for later consumption – could help you ward off impulse take-away food purchases and allow you to cash in on bulk-buy benefits. There is a large and enthusiastic community of meal prepper bloggers and enthusiasts, who swap recipes and ideas to help people prepare a week – and sometimes longer – of meals. You might also consider comparing healthy meal delivery services for a minimum effort option.

11. Make use of leftovers

Australians throw away up to 20% of the food they buy, according to the Do Something! Foodwise campaign commissioned by the NSW Government. While the environmental cost of this waste is high, it also means roughly 20% of the money the nation spends on groceries ends up in the bin. Plan how you might use excess food and you could cut down on wastage, and therefore the amount of food you have to buy in the first place. Cook larger portions of your meals and freeze them to use as leftovers. Pizzas, bolognese sauce, curries, lasagne and soup all freeze well and can also be handy lunch options.

12. Use your own coffee machine

With a flat white costing Australians an average of $4, according to Statista, it could pay to look at changing your morning ritual if it involves buying a takeaway coffee. Shouting yourself a coffee each day for a year could cost more than $900 – multiply that by the number of hits you need a day and it could add up to thousands of dollars a year. It could be more economical to buy a coffee machine. If you choose a coffee pod machine, you could economise further by switching to reusable pods, which supplier Crema Joe said could save “an average household [more than] $400 a year”. (The company has a capsule cost calculator).

13. Swap meat for veg, even occasionally

When it comes to meat versus veggies, the latter is usually cheaper. For example, swapping the 500g pack of beef mince – about $8 from major supermarket chains – in your tacos with a couple of tins of beans – about $1 each – could save you $6 on one meal. If you did this once a week, that’s $312 a year, for an example where a fairly inexpensive meat is exchanged with an even cheaper non-meat alternative. We’re not saying you should necessarily go vegetarian, but eating less meat and more vegetables could help you stick to your weekly budget.

14. Buy frozen veggies

And while on the subject of vegetables, the frozen variety can often be cheaper than their fresh counterparts and, if stored correctly, can have a long shelf life. Contrary to popular belief, they can also be just as nutritious as fresh vegetables which have been transported, according to some studies.

15. Go grocery shopping on a full stomach

Some studies show that hunger may cause you to buy extra or unnecessary items while doing your weekly grocery shop, and that the food you’re likely to buy when hungry-shopping, could very well be high in calories, too. You may be able to avoid being caught out this way by eating beforehand.

16. Swap brands and look down for savings

Next time you go to the supermarket, consider buying the cheaper generic-brand versions of some of the things on your list. Depending on the items, there could be little to no difference in quality, but the price saving could add up over time. You might have to tilt your head up or bend down to find the cheaper products, though, as there are reports that some supermarkets put their cheaper items on the top or bottom shelves, reserving eye-level space for the more profitable items.

17. Pay your bills on time to avoid late fees and maybe even grab a discount

Paying your bills on time is a great way to help keep your credit record cleaner, as well as avoiding having to pay interest or annoying – and often expensive – late fees. These late fees can really add up, especially if you use some buy now, pay later services, which might not charge interest but can slug you if you are late in paying. If you struggle with your bills, consider setting up a regular repayment amount to even out your cash flow. Some energy providers will also offer a discount to customers who pay on time. You might also be able to save by paying in advance, or by direct debit.

18. Monitor your bank balance

It is a good idea to regularly check your account to make sure you have not been charged for any purchases you didn’t make. If you suspect this, contact your bank, card issuer or other financial institution immediately, and report it.

19. Audit your bank accounts to see if you are paying fees

To avoid paying fees for being overdrawn on your transaction account, check your bank balance regularly. Some banks have apps that keep tabs on your spending and can send you alerts when you are getting close to overdrawing your account. It could also be a good idea to go back through past statements and add up any account-keeping fees you’ve been charged. You could ring your bank to ask for a better deal when it comes to these types of charges. Or you could swap to a different transaction account that is fee-free. It’s a good idea to keep in mind that the interest paid on fee-free accounts could be different to those paid on accounts that charge fees – check with your bank.

20. Check how much interest you are paying on your credit card

If you have a credit card, check what purchase rate is being applied to your transactions. Credit card purchase rates can vary up to above 20%, based on products in Canstar’s database at the time of writing, so it might be worthwhile to compare yours to its competitors. As a general rule, the most cost-effective way to use credit cards is to pay them off in full each month to avoid racking up excessive interest charges. There is a range of relatively low-interest and low fee cards that are available, as well as cards that might have more fees and charges but offer perks such as reward points that may suit some consumers.

21. Phone your bank and ask for a discount on your home loan interest rate

Interest rates are on the rise in Australia, and if you have a home loan with a variable interest rate, perhaps it’s time to compare your rate against those available from other lenders. Once you are armed with this knowledge, you could call your lender and haggle for a better deal. (It’s a good idea to read documentation such as the Target Market Determination (TMD) and the Key Facts Sheet (KFS), of your current loan and any you are considering, so you understand the terms and conditions, fees and charges, and interest rate.)

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Up to $4,000 when you take out a IMB home loan. Minimum loan amounts and LVR restrictions apply. Offer available until further notice. See provider website for full details. Exclusions, terms and conditions apply.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

10% min deposit

10% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

40% min deposit

40% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

40% min deposit

40% min deposit

Redraw facility

Redraw facility

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promoted products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promoted products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

22. Shop around for your car insurance

The cost of a comprehensive insurance policy can vary significantly, based on an analysis of policies in Canstar’s database. It could be possible to save on insurance by going for a cheaper provider and considering deals and offers, such as discounts for purchasing the policy online. Just be sure to check the relevant documents from the provider like the Product Disclosure Statement and Target Market Determination, and consider contacting the insurer you’re considering, to make sure the new policy provides the level of cover that you need. You can check out Canstar’s most recent car insurance Star Ratings and compare policies on Canstar s database.

23. Review your health insurance

Have you reviewed your health insurance cover lately? It might be possible to reduce premiums by dropping unnecessary cover (such as pregnancy if you are not planning on having any children in the next year, for example), by adjusting your excess (providing you consider yourself to be in a position to cover the extra payment upon hospital admission) or by swapping funds (although waiting times will apply for some medical services).

Psychiatric services

Psychiatric services

Rehabilitation

Rehabilitation

General dental

General dental

Physiotherapy

Physiotherapy

Psychiatric services

Psychiatric services

Rehabilitation

Rehabilitation

General dental

General dental

Physiotherapy

Physiotherapy

Psychiatric services

Psychiatric services

Rehabilitation

Rehabilitation

General dental

General dental

Physiotherapy

Physiotherapy

Psychiatric services

Psychiatric services

Rehabilitation

Rehabilitation

General dental

General dental

Physiotherapy

Physiotherapy

Psychiatric services

Psychiatric services

Rehabilitation

Rehabilitation

General dental

General dental

Physiotherapy

Physiotherapy

Psychiatric services

Psychiatric services

Rehabilitation

Rehabilitation

General dental

General dental

Physiotherapy

Physiotherapy

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promoted products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promoted products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

24. Review your personal insurance

Another step could be to review your personal insurance, including your life, total and permanent disability, trauma and income protection insurance. Some of this insurance can be taken out via your superannuation fund, so consider whether you may have a double-up between standalone insurance and cover via your super. Is your current level of cover right for your needs?

25. Review your superannuation fund

Do you know how much your superannuation fund is charging you in fees, or what its returns have been over the last few years? A small difference in fees and/or performance could make a big difference over time to your retirement nest egg. It could be worth investigating how the performance of your super fund compares to the national average or other funds, although bear in mind that past performance is not a reliable indicator of future performance. The economic fallout from coronavirus has also affected the recent performance of most funds. Changing your super to one that charges lower fees or offers higher performance may not help out with savings that you can access right now, but it could potentially be a boon further down the track.

Online rollover

Online rollover

Online application

Online application

Online rollover

Online rollover

Online application

Online application

Online rollover

Online rollover

Online application

Online application

Online rollover

Online rollover

Online application

Online application

Online rollover

Online rollover

Online application

Online application

Canstar may earn a fee for referrals from its website tables and from Promotion or Sponsorship of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees.

On our ratings results, comparison tables and some other advertising, we may provide links to third party websites. The primary purpose of these links is to help consumers continue their journey from the ‘research phase’ to the ‘purchasing’ phase. If customers purchase a product after clicking a certain link, Canstar may be paid a commission or fee by the referral partner. Where products are displayed in a comparison table, the display order is not influenced by commercial arrangements and the display sort order is disclosed at the top of the table.

Sponsored or Promoted products are clearly disclosed as such on the website page. They may appear in a number of areas of the website, such as in comparison tables, on hub pages, and in articles. The table position of the Sponsored or Promoted product does not indicate any ranking or rating by Canstar.

Sponsored or Promoted products table

- Sponsored or promoted products that are in a table separate to the comparison tables in this article are displayed from lowest to highest annual cost.

- Performance figures shown for Sponsored or Promoted products reflect net investment performance, i.e. net of investment tax, investment management fees and the applicable administration fees based on an account balance of $50,000. To learn more about performance information, click here.

- Please note that all information about performance returns is historical. Past performance should not be relied upon as an indicator of future performance; unit prices and the value of your investment may fall as well as rise.

26. Track down lost money in bank accounts

It could be possible to find money you didn’t even know you had (or had forgotten about). The Australian Government has a website where you can search for ‘lost money’ sitting in bank accounts, company shares or life insurance policies. Meanwhile, the Australian Taxation Office (ATO) offers some tips on tracking down any ‘lost’ super you may have in old accounts.

27. Update your telecommunications contracts

There are hundreds of different phone plans available in Australia. It might be a good idea to review yours periodically, to ensure that it’s cost-effective and suits your needs overall.

28. Seek cheaper ways to connect internationally

Instead of paying a hefty phone bill for those overseas calls, you could consider using an app on your phone or desktop computer while connected to WiFi. This could provide a cheaper alternative than a traditional style of phone call. There are many apps on the market to choose from, with some providing texting and call options including video functionality – although it’s a good idea to monitor your data usage closely while using these applications. And be sure that you are not using your mobile data plan, which can be more expensive if you go over your monthly cap. For example, the popular FaceTime app uses 30MB of mobile data for 10 minutes on a video call, according to Canstar Blue.

29. Avoid streaming on your phone using mobile data

In a similar vein, streaming music or video from your preferred mobile device can eat into your data allowance and potentially cost a lot in download costs (depending on your plan). Some providers may offer an automatic data ‘top-up’ for a fee, once a user goes over their plan limit, which could be an unexpected expense. Consider downloading your favourite tracks, podcast, audio books or any other files to your phone while connected to WiFi. During this time of coronavirus, it could be a good idea to take a look at your phone’s data plan, too, to see if your use has changed if you are working from home and using WiFi more, for example.

→ The best broadband plans for working from home | Canstar Blue

30. Review your electricity and gas use

Cut bills by acting energy-wise in the home, which could mean swapping hot water washes for cold, changing light bulbs to more energy-efficient ones, turning off appliances which use a lot of standby power when you aren’t using them, and buying energy-efficient appliances. Also, it could pay dividends to compare your energy or gas plan against what’s on offer on the market, to help ensure it’s competitive.

31. Pay yourself (your savings account) first

An age-old savings tip from many experts, this idea involves setting up an automatic transfer of money from your pay to a savings account, right after you are paid. This way, you can make it easier for yourself to prioritise savings over discretionary spending. However, it’s also important to make sure that you can cover your bills, so make the amount the appropriate size for your budget.

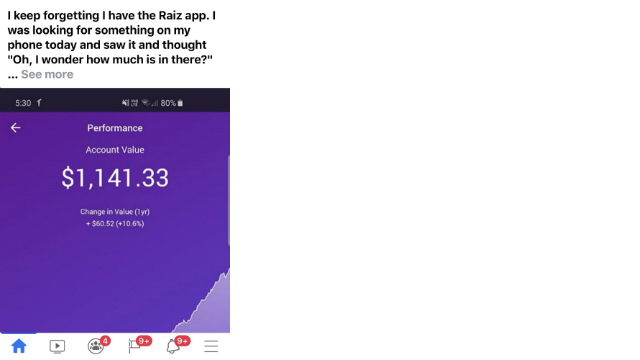

32. Use ’rounding up’ programs

There are a number of apps that ’round up’ the price of your purchases to the nearest dollar, putting the difference into a savings account or micro-investment scheme. While most charge a regular fee for use, these small amounts deposited regularly can really add up over time. It’s wise to check the terms and conditions of individual apps, however, to ensure that you are using the application that is right for your circumstances.

33. Get your bills online

Some institutions, such as certain electricity retailers, internet suppliers and banks, charge fees for paper statements. This means that if you don’t mind going paperless and getting your statements online, you may be able to save a bit of money. Some people may also be eligible for an exemption from fees, so it could be worth checking this with your provider if you prefer to receive paper statements.

34. Get discounts at the bowser

There are a range of fuel discount loyalty programs on offer at various petrol stations across Australia. Certain car insurance providers may also offer similar benefits. There are some free fuel saver apps available for your phone which can show you some of the cheaper fuel prices in your area.

35. Get bonus interest on your savings account

Some providers offer additional ‘bonus’ interest on your savings account if you meet certain criteria, such as making a minimum monthly deposit or making no withdrawals. Sometimes the bonus rate expires after an introductory period. Check to see if your institution has a bonus rate, or consider switching to a savings account with a higher interest rate to help you save money faster.

36. Organise your tax receipts

You may want to consider filing your receipts to help you maximise your deductions when it comes time to prepare your tax return. There are many apps available to help you do this, including one from the ATO called myDeductions. If you have any concerns or questions about this process, it could be worth speaking to a professional tax accountant or financial adviser.

37. Check your family is registered for the Medicare Safety Net

If you are eligible, you may want to ensure you and your partner are registered as a family for the Medicare Safety Net, rather than as two individuals. This will lower your Medicare Safety Net threshold, according to the Australian Government’s Services Australia website. If your out-of-pocket expenses for Medicare-claimable services goes over this threshold, Medicare will start refunding your costs at a higher rate, Services Australia adds. For example, Medicare may pay you back up to 80% of your out-of-hospital Medicare-claimable costs, such as when visiting the GP.

38. Keep things in working order

Keeping your appliances and your car in working order can help you save on regular repairs, and will prolong their use. For example, regularly checking your oil can protect your engine from damage and help you get more mileage out of your car, and making sure your tyres are inflated to the correct pressure can help save money on fuel.

39. Fix it yourself

Some items in your home should be fixed by a professional for safety reasons (e.g. complex electrical issues), but some tasks you may be able to do yourself. From sewing buttons back on shirts, to darning socks, to unclogging drains and replacing tap washers, there are plenty of online tutorials and videos you can use to step you through the process. You’ll not only be saving money by not having to pay someone else to fix it, you also may not have to buy a new item – saving something that would otherwise become landfill. However, keep in mind that going DIY for repairs can sometimes risk voiding warranties.

40. Buy clothes that don’t need dry cleaning

Check the tags of clothes before you buy them to see what care they need. If they say “dryclean only”, you could be locking yourself in to the added expense and time involved in using the local dry cleaner. If you really can’t live without the item, such as if you need to buy a suit for work, you could try ringing around local drycleaning businesses to see which offers the lowest price – there are often discounts for taking multiple items in to clean at the same time, and loyalty programs for frequent customers.

41. Make your own greeting cards

Buying greeting cards at the shops can cost you generally between $3-$10 per card, sometimes even more. Save on the cost and make your own card with paper and pen, or use a free online template and print at home. There are also plenty of online tutorials that can help you to make a card into an artful gift.

42. Start doing Secret Santa for Christmas

Instead of buying each family member or friend an individual Christmas gift, you could suggest doing a Secret Santa arrangement. This is where everyone only needs to buy one present, which is placed into a sack. Each person then draws one present from that sack. Another way to run Secret Santa is to put everyone’s name into a hat, and have each person draw one name out, buying for that person but gifting it anonymously. Typically, these arrangements also have a price cap. It could save you money and time but this means everyone still receives a gift.

43. Check your calendar to save money on gifts

Planning ahead can often save money compared to making last-minute gift purchases, as it can give you the time to find sales and specials and to buy in bulk. You could even consider starting a ‘gifts cupboard’, where you store items that could be used as gifts (and keep wrapping paper, sticky tape and ribbon, too). And there’s always the option of giving people home-made presents, such as baked goods, or regifting unwanted presents you have received.

44. Delay gratification: Follow the 10-second rule

Whenever you feel like you want to add an impulse or non-essential item to your cart, it could be a good idea to stop for 10 seconds and think about why you’re buying it and whether you need it or not. For example, if you’re tempted to pick up a cold drink at the cash register after a grocery shop, stop and count to 10. If you still feel you need it, buy it, but you may find the impulse has passed and you can wait for a drink until you get to that water bottle in your car.

45. Delete credit card numbers

If you use an online payment service like PayPal, you might want to delete your stored credit card numbers from your account. That means when you want to buy something you’ll have to get out your credit card and re-enter your details, and that may give you enough time to reconsider your purchase.

46. Calculate the value of your impulse buys in hours of work

If all else fails and you find that it’s hard to resist impulse buying, calculate how many hours of work it takes to earn the purchase price of an unnecessary item you’re considering. For example, say you wanted to buy a 600mL bottle of a major brand cola soft drink – $3. Based on the average hourly wage per hour in Australia, which is about $46 among full-time workers, it would take about four minutes of work for that drink. A $10 splurge, meanwhile, would take more than 13 minutes of work to pay off. This can be a very convincing way for you to sort the impulse buys from the real wants.

By the way, if you smoke, the average cost of one cigarette is now $1. So if you smoke a packet of 40 a day for seven days of the week, or 280 cigarettes a week, you are working more than six hours a week to pay for them, based on the average Australian wage mentioned earlier. That’s nearly a day’s work. And if you are earning less than $46 an hour, that time increases.

47. Use your local library

Save money on entertainment by borrowing instead of buying. Books, ebooks, magazines, audiobooks and DVDs are all available for free to enjoy at public libraries across the country. If you want to borrow these items and take them home, you’ll typically need to visit your local library and show proof of your current address and photo ID to get a library card. Bear in mind that in many cases, you may be charged fees if you are late in returning any items you have borrowed.

48. Make your own cleaning products

Check online for a range of recipes to make your own cleaning products such as detergents, disinfectants or stain removers. Baking soda, vinegar, vanilla, table salt and lemon juice are just some of the items from your pantry you can use. However, be careful when dealing with dangerous chemicals, and consider avoiding the use of particularly dangerous ones such as ammonia and chlorine when making your own products. Also make sure to keep your cleaning products out of reach of any children or pets, and be aware of dangerous combinations of chemicals that shouldn’t be mixed together, such as ammonia and bleach, vinegar and bleach or vinegar and hydrogen peroxide.

49. Look for coupons or cashback opportunities

There are plenty of coupon sites online (some examples include Shop A Docket, Cashrewards, Shopback, Groupon and All The Deals), which may have offers in your area or nearby. This can also be a good way to save money when purchasing gifts. Make sure to check the terms and conditions of each offer before making a purchase.

→ Related article: 10 food & drink discount apps

50. Consider joining a customer rewards program

Think about stores where you commonly do your shopping and find out if they have a rewards program. If they do, consider if it is worth signing up. Some may provide discounts, gift cards or other rewards. There are also a range of non-store programs that could reward you for shopping at various different online retailers, such as Super Rewards, which contributes a certain percentage of your shop to your super account. Before signing up to one of these programs, it might be a good idea to learn what personal data they may collect about you, and ensure you are comfortable with the payoff.

51. Shop out of season

Try getting your warm coats in summer and your singlets and shorts in the winter with last season’s stock. Outlets can be good places to search and could result in saving on the extra dollars that are sometimes added to the price tags of sought-after in-season clothing.

52. Reuse, reuse, reuse

From gift wrapping to food containers and plastic bags, many items we have around the home can be reused to save on buying new. This will not only help you save money, but could help out the environment, too.

53. Rationalise your subscription services

While some streaming entertainment services seem to only cost a small amount each per month, the total cost of these services can quickly add up. For example, if you had the basic plans for Stan, Netflix, Disney+ and YouTube Premium, that would cost $47.97 a month, which is more than $575 a year. It could be worth weighing up which services you use the most, and reducing your spend accordingly. If you need help deciding which streaming service is right for you, you might want to take a look at Canstar Blue’s ratings for Australian Pay TV & Streaming services. There are also many free streaming services available, offering quality content, such as ABC’s iView and SBS On Demand.

54. Price match

Check flyers or online brochures to see the costs of items at different retailers or service providers and use this information to find the best price. Then, you could ask your preferred store if it will beat its competitors’ prices.

55. Shared expenses: use splitting and repayment tools

You may be able to save money by keeping track of what others owe you and what you owe others. Consider using an app to accurately split costs and to send reminders when the people you split the bill with forget to pay up.

→ Related article: 6 budgeting & savings apps

56. Use air conditioning more efficiently

Aircon can feel like a necessity during Australia’s long summer days. And if you have a reverse-cycle unit, it can also keep you toasty and warm on those brutal winter mornings. But the running costs of an air conditioner can add up when it comes to energy bills. It is possible to improve its efficiency by making sure that it is on an optimum temperature, which could in turn save you money (See related article: What is your air con temperature setting costing you? for help in this area).

In summer, manufacturer Daikin recommends you should only run your aircon in places you need it, and that when you have it on you should keep your windows covered to cut down the impact of the sun, turn off any appliances that could be emitting heat (such as those running on standby power or lights which aren’t needed), and keep the filter clean. In winter, similar rules apply – keep your blinds drawn to prevent heat exchange, shut your doors and windows to reduce draughts and only heat rooms people are using.

57. Get your head out of the fridge

Know what you want from the fridge before opening it. Fridges and freezers can use a lot of power if their doors are opened and closed multiple times, or held open for an extended period, as the temperature inside needs to reset. This can impact your energy bills.

58. Save on electricity and air-dry

Hang your clothes out to dry instead of using a more energy-intensive dryer. If the weather isn’t ideal or you don’t have the yard space for a full clothesline, consider using a clothes airer or line under cover. This could help save you a noticeable amount on your energy bills each year.

For example, using a three-star energy rated standard electric 4 kg clothes dryer five times a week to dry just 1.4 kg of wet washing per load costs about $104 a year, compared to just $27 if you were to cut back and run the same load only once a week, according to Sustainability Victoria (using an assumed electricity tariff of 31.9c/kWh, based on a “typical Melbourne tariff”).

59. Freeze food

Extend the shelf life of some products by popping them in the freezer. The list of foods that can typically be stored in the freezer includes staples such as flour, rice, dry oats and butter, in addition to well-known candidates like meat and bread. It is even possible to freeze beaten eggs or egg whites – however, the yolk normally doesn’t store well for long periods in the freezer, according to the American Egg Board.

60. Save on water costs

If you would like to save on your water bills, take shorter showers, use a water- and energy-saving dishwasher and washing machine, and use any excess water (including from water bottles) to water your plants.

61. Participate in free online surveys for cash

There are some companies who pay people to complete market research surveys. Some examples include Swagbucks, My Opinions or Toluna. You may want to compare these paid survey websites to find the best option for you. However, beware of potential scams and check the terms and conditions of each website, and be particularly cautious when giving out personal information and banking details.

→ Related story: 20 quirky side hustle ideas to help you make money

62. Take your reusable bags to the supermarket

Save on buying plastic bags by putting your reusable options in the car, at your workplace or wrap one up in your handbag or satchel, ready for your next shop. And if you leave your bags in the car and only remember at the checkout, there’s always the option of packing your bags in the carpark (chances are, you wouldn’t be the only one).

63. Collect and cash in

There are container deposit schemes operating in many Australian states and territories. This usually involves people taking certain types of glass and plastic containers to a drop-off point, and receiving a cash payment in exchange. According to Planet Ark, every state and territory except Victoria has a scheme, or is soon to have one. Victoria has pledged to introduce a container deposit scheme by 2023, WA residents scored a 10-cent refund scheme from 1 October, 2020 and Tasmanians can expect theirs to begin in 2023.

64. Check your payslip

With news of “wage theft” rife in recent years – employers not paying their employees the correct wage or the correct amount of super – it could pay to check your payslip. Check the amount that you are being paid against what your employment contract states, and check that the right amount of super is also stated. And then check your actual super account, to make sure the right amount of money is being transferred into it.

65. Grow your own

If you have a green thumb – or think you might like to develop one – one option could be to cut grocery bills by growing your own fruits, vegetables and herbs. A packet of seeds is usually only a few dollars but, if you’ve got the knack, could supply a bountiful crop. However, if you are starting from scratch, it could mean spending money on setting up a garden or investing in pots, potting mix and tools.

66. Propagate plants

Why limit yourself to buying new plants when you could also propagate some of them for virtually nothing? It could be possible to take root vegetables (such as sweet potatoes or potatoes), or herbs and vegetables with roots attached (such as the ends of leeks, spring onions or even garlic) – and plant them in the ground. There are a number of online tutorials that can help you to learn how to do this.

67. Learn for free

Want to expand your mind but don’t want to blow the budget? There are myriad online courses that could help. Many state and territory governments, as well as universities and TAFEs, announced online free courses to help reskill people impacted by the COVID-19 crisis. Or, you could choose from a range of Massive Open Online Courses (MOOCs), offered by thousands of higher education providers worldwide, or investigate Australian courses such as FutureLearn and Open University’s OpenLearn program. If you do have a little cash to spend on education from a traditional further education provider, you could be eligible for financial help from the government via its Study Assist program (although some eligibility conditions may apply, such as income thresholds).

68. Ditch the printer

It could be wise to check out the cost of replacement cartridges before taking home that super-cheap printer, Saved by Michelle columnist Michelle Collins says. A reader told her he had to “dump” $300 worth of “non-genuine cartridges” when his printer automatically updated its software, and stopped accepting all but more expensive, genuine printer cartridges. If you want to save money, it could be worth carrying out a comparison exercise to see how much you’ll pay for cartridges in the long term.

69. Know your refund rights

To reduce wastage when it comes to spending money, ensure that what you buy does what it is meant to. And if it doesn’t, don’t be afraid to ask for a refund, replacement or repair. The Australian Competition and Consumer Commission says that “if a product or service you buy fails to meet a consumer guarantee, you have the right to ask for a repair, replacement or refund under the Australian Consumer Law”, although it adds that while “you can ask a business for your preference of a free repair, replacement or refund,” you may not always be entitled to one, depending on your circumstances.

70. Get help

If you are in financial strife, consider taking advantage of the free financial counselling services available in every state. The Financial Counselling Australia website has a ‘Find a financial counsellor’ tool which can help you find financial counsellors around Australia.

Additional reporting: Elise Donaldson, James Hurwood, Justine Davies

Top image source: Bloomicon (Shutterstock)

A journalist for more than two decades, Amanda Horswill has reported on a galaxy of subjects, including property, lifestyle, hyper-local news, data journalism, the Arts and careers.

She’s served as the Editor of Brisbane News, Deputy Features Editor for The Sunday Mail, Deputy Editor – Digital at Quest Community News, and a host of other senior positions at News Corp, prior to joining Canstar.

Amanda is fascinated with the ever-changing world of finance. A passionate believer in the motto “knowledge is power”, she strives to translate the news into practical information that will help readers make informed decisions about their future. While at Canstar, her work was regularly referenced by publishers such as the Sydney Morning Herald , The Age, The New Daily and Yahoo Finance.

Amanda holds a Bachelor of Arts (Journalism, Media Studies and Production, and Public Relations) and a Graduate Certificate in Editing and Publishing, from the University of Southern Queensland.

Try our Savings Accounts comparison tool to instantly compare Canstar expert rated options.