What is tax depreciation?

Claiming tax depreciation on your investment can make a significant difference in the amount of tax you pay each year, as Tuan Duong, Founder of Duo Tax, explains to Canstar.

In this guide, we break down everything you need to know about the basics of tax depreciation, including how to claim your depreciation deductions through a depreciation schedule.

What is tax depreciation?

As a building gets older, its structure and assets are naturally subjected to general wear and tear. In other words, each year, the value of the building decreases and, thus, depreciates. Fortunately, the Australian Taxation Office (ATO) allows property investors to claim this decrease in value as a tax deduction – as long as the deduction only relates to the building and not the land, and as long as the property is being used to generate an income for the investor.

What assets can you depreciate?

You can depreciate two different types of assets in Australia:

- division 43 assets (capital works)

- division 40 assets (plant and equipment)

Note that the ATO says land isn’t eligible under either of these categories, so any depreciation in the value of your land can’t be claimed as a tax deduction.

Division 43 assets and capital works deductions

Capital works deductions are income tax deductions that investors can claim on the decrease in value of division 43 assets – that is, the structural components of a property (such as a sealed driveway or retaining wall) as well as its permanent fixtures (i.e. things that can’t easily be removed from the property, such as tiles, walls or a roof).

You could also claim capital works deductions for the expenses you incurred completing any structural improvements on the property. For example, suppose you built an extra room on your investment property. In that case, you may be eligible to claim a capital works deduction for the costs of that addition.

Division 40 or plant and equipment assets

The term “plant and equipment” refers to the fixtures and fittings found within a building. These are generally known as easily removable assets (compared to permanent fixtures) and can include items such as:

- a fridge

- a dishwasher

- storage shelves

- furniture

Some assets are harder to remove, but are still considered plant and equipment because they aren’t permanently fixed to the property. Some examples include:

- bathroom accessories

- wooden flooring

- air-conditioning units

- heater lighting

- an oven and cooktop

Apply in minutes. No Unloan Fees.

Fee-free extra repayments and redraw.

$0 ANZ set up or ongoing fees

Competitive interest rates

Unlimited repayments and redraw

Fast approval

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promoted products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promoted products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

What rules apply for tax depreciation?

There are specific rules that relate to claiming tax depreciation on different types of investment property assets.

Capital works deduction rules

The structure of a residential building, if it was constructed after 15 September 1987, generally has an effective life of 40 years under Australia’s tax laws. This means that assuming the initial construction of your house occurred after this date, you can generally claim the wear and tear on division 43 assets each year for up to 40 years from the date it was built.

You can claim a capital works deduction on:

- buildings or extensions, alterations, or improvements to a building

- alterations and improvements to a leased building, including shop fitouts and leasehold improvements

- structural improvements such as sealed driveways, fences and retaining walls

- earthworks for environmental protection, such as embankments.

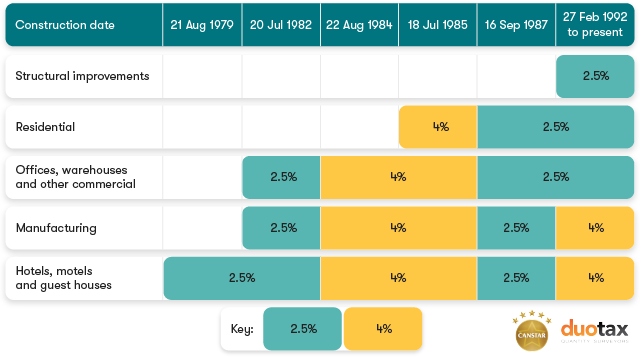

The depreciation rate for capital works deduction differs depending on when the construction commenced and what type of building it is, as the following infographic illustrates.

The depreciation rate for capital works deductions

Plant and equipment deduction rules

For any plant and equipment assets costing $300 or less, the ATO allows you to claim their entire cost as an immediate tax deduction, assuming you mainly use them to help generate income (such as rent from tenants) but not to run a business.

Plant and equipment assets that cost more than $300 can be claimed according to their effective life. The effective life of a depreciating asset is how long it can be used to produce an income.

Plant and equipment assets found in the property will generally wear out more rapidly than the actual structure of the building. Therefore, the effective life of these depreciating assets is typically shorter.

So while you can claim capital works deductions over 40 years, you can only claim plant and equipment deductions over their effective life.

Each financial year, the Commissioner issues a Taxation Ruling in which he or she decides on the effective life for several different depreciating assets in various industries.

For example, a washing machine, which is subject to a fair amount of wear and tear, has an effective life of six years based on the Commissioner’s current ruling.

However, depending on the particular asset in question, the ATO allows you to work out its effective life yourself (or with the help of a professional tax adviser), based on factors such as the manufacturer’s specifications and the past experience people have had with similar assets.

You can only claim depreciation deductions for plant and equipment assets that you personally purchased, either on their own or as inclusions in a newly-built property – so you can’t claim on previously used assets.

How is tax depreciation calculated?

The ATO prescribes two methods to calculate tax depreciation:

- the prime cost method

- the diminishing value method

Both methods can be used to calculate and then claim your tax depreciation deductions.

Prime cost method

The prime cost depreciation method, also known as the straight-line method or the simplified depreciation method, calculates the decrease in value of an asset over its effective life at a fixed rate each year.

The prime cost formula for working out the depreciation of an asset each year is as follows:

Asset’s cost × (days held ÷ 365) × (100% ÷ asset’s effective life)

As a hypothetical example, if an asset cost $50,000, had an effective life of 10 years and you owned it the entire time, you could claim 10% of its cost in each of the ten years:

$50,000 × (365 ÷ 365) × 10% = $5,000

The depreciation calculations will continue until the final value of the asset reaches zero, after which time you can no longer claim depreciation on it.

Diminishing value method

The diminishing value depreciation method allows for a higher depreciation deduction in the first few years of property ownership.

The diminishing value formula is as follows:

Base value × (days held ÷ 365) × (200% ÷ asset’s effective life)

So, if an asset cost $50,000 and had an effective life of 10 years, your first year’s deduction would be:

$50,000 × (365 ÷ 365) × (200% ÷ 10) = $50,000 × 20% = $10,000

For subsequent years, the base value is reduced by the difference between the current year and the following year. In this example, the base value for the second year of the asset would be $40,000 ($50,000 minus the $10,000 deduction).

The second year’s deduction would then be calculated as:

$40,000 × (365 ÷ 365) × (200% ÷ 10) = $40,000 × 20% = $8,000

In the third year, the base value would be $32,000, and the claim would be $6,400.

In the fourth year, the base value would be $25,600, and the claim would be $5,120.

The depreciation calculations will continue until the final value of the asset reaches zero.

How can you claim tax depreciation?

To claim your property’s depreciation deductions, you’ll have to identify the value of the property and all its fittings and fixtures. In order to do this, you’ll typically need to consult with a quantity surveyor. A quantity surveyor is someone who’s qualified to compile a tax depreciation schedule for both residential and commercial property investors.

A tax depreciation schedule will identify the value of both your Division 40 and Division 43 assets, and list how much each of them has depreciated and will depreciate in the future. Once you’ve received your depreciation schedule, you can simply hand it over to your accountant, if you have one, and they can submit the results in your tax return each financial year.

Key takeaways

Depreciation deductions can significantly reduce your taxable income each year and thus save you from having to pay more income tax than you need to.

But many investors miss out on the opportunity to save significant amounts of money – in some cases thousands of dollars each year – because they don’t realise the significance of obtaining a depreciation schedule.

It’s generally a good idea to speak to an expert quantity surveyor, to help you calculate and claim your tax depreciation deductions.

PhotoMavenStock/Shutterstock.com

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

About Tuan Duong

Tuan is the Principal and Founder of Duo Tax Quantity Surveyors. His passion is to educate property investors in the power of tax depreciation and the benefits it can offer in helping them minimise their tax liability.

Tuan is the Principal and Founder of Duo Tax Quantity Surveyors. His passion is to educate property investors in the power of tax depreciation and the benefits it can offer in helping them minimise their tax liability.

Tuan is also a professional member of the Australian Institute of Quantity Surveyors and is a Registered Tax Agent, authorised to offer advice on all matters related to depreciation.

This article was reviewed by our Sub Editor Tom Letts and Sub Editor Jacqueline Belesky before it was updated, as part of our fact-checking process.

Redraw freely – Access your additional payments.

Unlimited additional repayments free of charge.

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.