Credit Cards - Page 9

Are there deals on the cards? We explore how American Express Connect works

If you have an American Express card, you may want to know more about the Amex member benefits and offers hub.

How to earn Cathay Pacific frequent flyer points

If you often fly with Cathay Pacific, or a partnering airline such as Qantas, or use an eligible rewards credit card with American Express, you might be interested in finding out more about Cathay Pacific’s frequent flyer program. We look at how you can earn and redeem points with Cathy Pacific, the rewards available and whether loyalty programs are generally worth it for consumers. How to earn frequent flyer points with Cathay Pacific Cathay Pacific is a Hong Kong-based airline that offers a frequent flyer program called the Marco Polo Club which allows members to earn club points and reach different … Continued

How to earn, buy and spend Etihad Guest Miles

Do you regularly fly with Etihad or partnering airlines such as Virgin Australia? If so, you might be curious to find out about Etihad’s frequent flyer program, what it offers and whether loyalty programs generally are worth it for consumers. What is Etihad Guest? Etihad’s frequent flyer rewards program is called Etihad Guest. It allows members to earn Etihad Guest Miles, which can then be used to pay for flights, upgrades, hotels and a variety of products from the Etihad Reward Shop. Etihad Guest is free to join and, at the time of writing, the airline is offering new members 500 bonus miles … Continued

Commonwealth Bank customers to get cash for shopping at Coles, Caltex, Myer & more

Australia’s largest bank just launched a new rewards scheme that allows customers to earn cash back when they pay for groceries at Coles or fuel up at Caltex. Most Commonwealth Bank (CBA) customers that hold one of the bank’s eligible debit cards or credit Mastercards will be able to receive personalised shopping rewards based on their spending history, places they like to shop and similar stores with CommBank Rewards. This is available in the latest version of the CommBank app from today – Monday, 16 December. Customers will be able to see and activate reward offers tailored to them in … Continued

Keeping your card data under wraps: Top tips for shopping safely online

Australian consumers and retailers are embracing the convenience of online payments, with Reserve Bank of Australia statistics showing that e-commerce in Australia grew by 27% in 2018 – almost double the 14% growth figure of 2017. Unsurprisingly, the NAB Online Retail Sales Index shows that our biggest months for online shopping are November and December, which last year continued to grow at about 9% year-on-year. Big online events such as Black Friday, this year on 29 November, and Cyber Monday, on 2 December, have become fixtures of the Australian retail calendar in recent years, adding to the already busy online … Continued

The hidden price of your Afterpay habit

New figures show that consistent spending via buy now pay later schemes could require the same repayments as if you had bought a small car with a personal loan or bought a round-the-world-cruise with a credit card. Buy now, pay later (BNPL) services are hot news right now, with a recent media report recommending caution for would-be home buyers, and the Reserve Bank of Australia announcing it would investigate how the services charge retailers. BNPL companies, such as Afterpay, Zip Money and Humm, operate like the name suggests – consumers can buy a product immediately using the BNPL company’s money … Continued

Canstar reveals its latest 5-Star credit cards

We've announced the winners of our latest credit Star Ratings - take a look to see if your card is giving you Outstanding Value.

Everyday Banking Award Winners in 2019: Which institutions came out on top?

Canstar has revealed the financial institutions that provide the strongest combination of everyday products and services for customers in its 2019 Everyday Banking Award. Canstar’s researchers assessed and rated 116 transaction accounts and 183 credit cards from 14 banks and 34 customer-owned institutions on the Canstar database, to determine the providers offering a strong combination of competitive transaction accounts and credit cards for customers. While product excellence was the main focus for Canstar Research in these Award calculations, the team also assessed institutions based on the strength of their online banking platforms and their coverage of ATMs and branches throughout Australia. … Continued

Home loan interest rates are falling: Are credit card rates going down too?

The answer is: it will probably depend on what type of credit card you have. Interest rates on a range of bank products – including home loans, savings accounts and term deposits – have been dropping overall since the Reserve Bank cut the official cash rate in June and again in July. Home loan interest rates, for instance, have fallen to their lowest point in 26 years according to Canstar’s database, with some currently available for less than 3%. Research from Canstar shows that while some credit card interest rates have been tracking down, this has not been the case … Continued

Which credit card provider has the most satisfied customers in Australia?

Do you trust your credit card provider to protect your card from fraud? Do you trust it to act in your best interest? A recent Canstar survey found Australian consumers, on average, have more faith in their credit card provider’s ability to protect their card from fraud than they do in its willingness to act in their best interests or provide support in times of hardship. Interestingly, younger people had higher-than average levels of faith in the latter. The survey of nearly 4,000 credit cardholders, of whom about 1,700 had a rewards card, also asked respondents to grade their overall … Continued

How Do I Apply for a Credit Card?

Canstar explains how to apply for a credit card, and what the process involves.

Westpac hikes credit card interest rates ahead of possible RBA rate cut

One of Australia’s largest lenders has hiked interest rates across a number of its credit cards by 0.25 percentage points. Westpac has made changes, effective from today, to purchase rates and cash advance rates across its suite of credit cards, including the Altitude Black, Altitude Platinum, Low Fee, Low Fee Platinum and Low Rate Card, but excluding its Lite Card. The bank’s subsidiaries – St. George Bank, Bank of Melbourne and BankSA – increased rates across a number of their credit cards in early April. Westpac’s higher interest rates come into effect shortly before the Reserve Bank’s next monetary policy meeting on 7 … Continued

Credit cards: ANZ cuts rewards, Westpac banks hike interest rates

ANZ has reduced the number of frequent flyer points its credit card customers can earn, while three Westpac-owned banks will lift a range of credit card interest rates. Changes to minimum spend and points earned will apply to ANZ Rewards, ANZ Rewards Platinum, ANZ Rewards Black, ANZ Frequent Flyer, ANZ Frequent Flyer Platinum and ANZ Frequent Flyer Black credit cards from 1 April. St. George Bank, Bank of Melbourne and BankSA will increase the purchase rates and cash advance rates across a number of their credit cards from 9 April. This includes the banks’ Amplify Signature, Amplify Platinum and Amplify … Continued

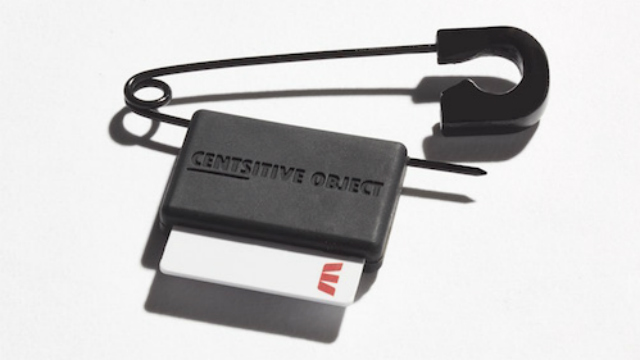

Westpac expands wearable payment range, security concerns flagged

Imagine your next shopping trip involves sticking out your sleeve or waving your gym towel or keys to pay for something. This is what Westpac is now offering customers who bank with them. Westpac has today launched a new range of wearable technology amid an industry-wide drive to find new and more convenient ways for people to tap-and-pay, otherwise known as contactless payments. But one privacy expert has cautioned consumers to weigh up what this extra convenience means for their data security. Westpac’s ‘Centsitive Objects’ wearable payments range comes in five new accessory designs, including a safety pin, iron-on patch … Continued

Sharing your #shopping on social media can damage your health and your wallet

Some young people are getting into credit card debt to achieve the ideal lives they see portrayed on social media. Posting images on social media when we buy new clothes, eat out or purchase the latest gadget may seem harmless enough. But this consumption-oriented sharing may be undermining both our bank balance and our mental well-being. Our research has found that this sort of social media engagement is linked in some people to greater anxiety, lower self-esteem and an increased likelihood of excessive spending. Around 40% of the world’s population uses social media, with young people spending the greatest amount … Continued

Commonwealth Bank drops American Express companion cards

The Commonwealth Bank will no longer issue its range of rewards-based American Express (Amex) companion cards from 1 November 2018. The Commonwealth Bank stated on its website applications for its Amex cards would be open until 1 September but all CommBank Amex cards, including Commbank Awards, Platinum Awards or Diamond Awards American Express, would be discontinued from 1 November. A Commonwealth Bank spokesperson said some card benefits would still be available to Commbank Mastercard and Visa cardholders, and impacted customers would be contacted by the bank to help them manage the change. “We know our Awards cardholders value the benefits available on … Continued

Westpac launches new bundled Amex credit card offer

From today, Australians can bundle Westpac’s Altitude Platinum (Visa) and Altitude Black (Mastercard) rewards credit cards with an Amex card, issued directly by American Express. Announced by Westpac and American Express late last year, the deal for American Express to issue the Westpac-branded cards allows Westpac to offer higher rewards point earn rates than it would be able to afford if it self-issued – given the Reserve Bank’s ‘interchange fee’ regulations introduced in July 2017. It was these fresh regulations which caused a number of major banks to discontinue their range of Amex companion cards. In late January, the new American Express-issued, Westpac-branded … Continued

Outstanding Value Mastercard Credit Cards

As a major, global credit card company, there are many Mastercard products available in the market. This article reveals some of the outstanding value (5-Star rated) Mastercard credit cards on Canstar’s database, based on Canstar’s unique ratings methodology that compares both cost and features across credit card products. Mastercard is not technically a direct provider of credit cards – it is a third party payment processor that offers its credit card functionality to a huge number of providers across hundreds of countries throughout the world. There are hundreds of Mastercard products to choose from across a range of different categories, including: Rewards cards … Continued

Christmas shopping: don't be ripped off by retailers

The Government has warned shoppers to beware of excessive card surcharges and dodgy refund policies in the lead-up to Christmas.

Westpac drops American Express companion cards, announces exclusive offer

Becoming the third of the Big 4 banks to cut its range of rewards-based American Express (Amex) companion cards, Westpac has announced its customers will be able to apply for two new Amex cards in early 2018 which won’t be subject to the Reserve Bank’s (RBA) interchange restrictions. Joining NAB and ANZ, Westpac’s announcement to drop its American Express (Amex) companion cards falls in line with other banks’ reactions to the RBA’s cap on interchange fees that primarily affect Amex companion cards issued by banks. Since the RBA announced it would apply a cap to all surcharges, restricting credit card interchange fees to … Continued

Important Information

For those that love the detail

This advice is general and has not taken into account your objectives, financial situation or needs. Consider whether this advice is right for you.