Afterpay launches savings and transaction accounts: Will your cash be safe?

Australians with an Afterpay buy now pay later account can now do their everyday banking and saving with the fintech too. We take a look at how Afterpay’s savings rate stacks up against what’s currently on offer from traditional banks, and whether your money will be safe.

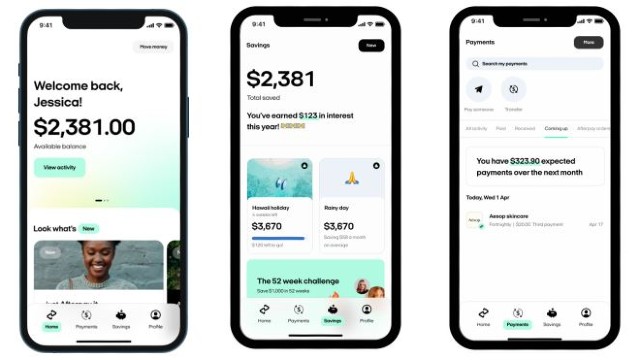

Afterpay has launched ‘Money by Afterpay’, a mobile finance app targeted primarily at Gen Zers and Millennials. The Money app offers savings and transaction accounts, thanks to Afterpay’s partnership with Westpac.

What is Money by Afterpay?

Money by Afterpay is a mobile app with transaction and savings accounts backed by Westpac. Through the app, you can view and manage your spending and savings, as well as your buy now pay later orders. The app is now available on the App Store for iOS devices, and Afterpay says an Android version is “expected in 2022”.

To open a savings or transaction account using the Money app, you’ll need to also have an Afterpay buy now pay later account with up to date payments.

The savings account

The savings account (called a ‘savings goal’ in the Money app) currently offers an interest rate of 0.75% on balances up to $50,000, with no strings attached to earn this rate. Customers can open up to 15 different savings goals and the $50,000 balance cap is combined across all savings goals. To open an account, you also need to also have an Afterpay transaction account.

The accounts are issued by Westpac, as it has a deposit licence and Afterpay doesn’t. Interestingly, Canstar’s database shows the most an adult banking directly with Westpac could generally earn on a savings account would be just 0.30% at the time of writing. However, 18-29 year-olds who meet certain eligibility criteria could earn up to 2.5% interest on their savings in a Westpac Life account, on balances up to $30,000.

How does the Afterpay savings account compare?

Looking at Canstar’s database, about 35% of savings accounts are similar to Afterpay’s, in that they do not have conditions that need to be met in order to earn an ongoing bonus rate or promotional rate.

The top savings account rate with no conditions to earn ongoing interest on Canstar’s database is currently Macquarie Bank’s Savings Account, at 0.95%. It’s followed by Volt at 0.90%, Qudos Bank at 0.50%, MOVE Bank at 0.40%, and Australian Unity, Great Southern Bank and Citi, which are all at 0.35%.

The highest savings account rate without an age limit overall on Canstar’s database is available from Virgin Money, where customers could earn up to 1.50% on its Boost Saver account. But this rate comes with other strings attached. The rate is made up of a 0.10% ongoing rate, a 1.10% bonus rate and a three-month 0.30% promotional rate. To get the bonus rate each month, you’ll need to deposit $2,000 into your linked Virgin Money transaction account and make at least five debit card purchases, direct debits or BPAY payments.

The transaction account

Afterpay customers can open a transaction account (called a ‘daily account’) in the Money app. The account comes with a physical debit Mastercard and you can also add it to your Apple Wallet and to Apple Pay. Other digital wallets such as Google Pay and Samsung Pay are not yet supported.

The account has no monthly fees or set-up fees and there is no minimum balance required to open an account. Of the transaction accounts on Canstar’s database, 68% of them also do not charge an account-keeping fee. Some of those that do charge fees will waive this if a certain deposit amount is made per month.

Other features of the Money app include the ability to categorise your transactions so you can see where you are spending your money. You can also use the ‘roundups’ feature to round up your debit card transactions to the nearest dollar, and transfer the difference to a savings goal.

The Money app also comes with a ‘Retro’ feature, which allows eligible customers to retrospectively turn debit card purchases into buy now pay later orders (up to $200). Afterpay will give you 100% of the original cost and you’ll then need to pay it off in four installments or pay a late fee, as with any other Afterpay purchase.

Just as Westpac is the issuer of the savings account, the major bank is also the licensed card issuer for Afterpay’s transaction account.

Is it safe to bank with Afterpay?

Money that a customer stores in Afterpay’s savings and transaction accounts will be secured and protected by a Federal Government guarantee of up to $250,000, thanks to Westpac’s licence as an authorised deposit-taking institution (ADI), while the customer side will effectively be managed by Afterpay. If you have other accounts with Westpac, these will also count towards the $250,000 limit.

Afterpay’s venture into banking is made possible by Westpac’s 10X bank-as-a-service platform, launched in November 2019, that essentially opens a back door for fintechs to provide full banking services, but with the added security of a major bank brand, as well as its banking licence and systems.

While Westpac will be the regulated deposit account and card issuer, Afterpay obtained an Australian Financial Services Licence (AFSL) earlier this year from the Australian Securities and Investments Commission (ASIC), enabling it to provide general financial product advice and distribute basic deposit products and debit cards, which it is now doing with the launch of its new app.

According to the Australian Financial Review, Afterpay hopes the launch of the transaction accounts will drive more spending on its buy now pay later offering, with plans to add investment and superannuation options down the track.

As we’ve reported previously, access to customers’ transaction data could give Afterpay further insights into their customers, such as whether a person is creditworthy, and whether there are any other financial products they can sell to them in the future.

This story was originally published on 21 July, 2021 by Ellie McLachlan and has been updated.

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

This article was reviewed by our Sub Editor Tom Letts before it was updated, as part of our fact-checking process.

Try our Savings Accounts comparison tool to instantly compare Canstar expert rated options.