RBA cut to fuel property market as average new loan size hits record high

KEY POINTS

- Australia’s average new owner-occupier loan size hits $678,000.

- Average Australian to see a $35k lift in borrowing capacity following three cash rate cuts.

- The value of new lending up by 2% in June quarter on back of February and May cuts.

Australia’s third RBA rate cut of the year is expected to land today, with a drop of 0.25 percentage points tipped, taking the cash rate to 3.60%.

For a borrower with a $600,000 mortgage at the start of the cuts, this move would see their minimum monthly repayments drop by a further $89.

However, with two cuts already in effect, the total drop across the February, May and August cuts would be $272.

This assumes banks pass this next cut on in full to their variable customers, which they are expected to do. Our live Rate Tracker will provide updates on each bank’s announcements from 2.30pm.

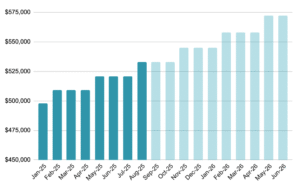

The average new loan size for owner-occupiers has hit a record high of $678,000, according to ABS data out today.

The ABS Lending Indicators for the June 2025 quarter show the average new loan size for owner-occupiers in Australia rose by approximately $18,000 between the March and June quarters, fuelled by the RBA’s February and May cash rate cuts. That’s an estimated increase of $198 a day.

NSW has the largest average new loan size for owner-occupiers at $816,000, a new record for the state, after a rise of $21,000 between the March and June quarters.

Western Australia hit a record high of $620,000, recording the biggest growth out of the states and territories in both percentage and dollar terms, with an increase of $26,000 or 4% in just one quarter.

Other states hitting record-high average new loan sizes were Victoria, Queensland and South Australia. All data is in original terms and rounded to the nearest $1,000.

← Mobile/tablet users, scroll sideways to view full table →

| Average new owner-occupier loan size |

|||

|---|---|---|---|

| Loan size |

Quarterly change |

Annual change |

|

| Australia | $678,000 – record high |

3% | 7% |

| NSW | $816,000 – record high |

3% | 6% |

| VIC | $639,000 – record high |

2% | 6% |

| QLD | $662,000 – record high |

3% | 12% |

| SA | $597,000 – record high |

1% | 10% |

| WA | $620,000 – record high |

4% | 13% |

| TAS | $481,000 | -1% | 5% |

| NT | $484,000 | -1% | 10% |

| ACT | $635,000 | 3% | 2% |

Source: ABS Lending Indicators June 2025, prepared by Canstar.com.au. Average loan size based on original terms for owner-occupier dwellings, excludes refinancing and is rounded to the nearest $1,000.

RBA’s third cash rate cut to boost average income earner’s borrowing capacity by $12k

The maximum amount property buyers can borrow from the bank for a mortgage is set to increase, following yesterday’s 0.25 percentage point cut to the cash rate by the RBA.

Canstar analysis shows that a single person earning the average full-time wage, as recorded by the ABS, could potentially borrow an additional $12,000 from the bank, as a result of the cash rate cut.

← Mobile/tablet users, scroll sideways to view full table →

| Potential increase in borrowing capacity following August cash rate cut |

|||

|---|---|---|---|

| Old borrowing capacity |

New borrowing capacity |

Increase | |

| Single person (av. wage) |

$521,000 | $533,000 | +$12,000 |

Source: Canstar.com.au. Based on an owner-occupier taking out a 30 year loan at 5.75% today or 5.50% when RBA cut takes effect. Assumes minimal expenses, no debts, no dependents, average wage based on ABS data. See full notes below.

Major banks tipping at least one further cut to come

The big four banks don’t expect the RBA to leave the cash rate at 3.60%, however, they are split on how many more rate cuts are still to come in this cycle.

CBA and ANZ expect one further cash rate cut, NAB predicts a further two cuts, while Westpac still expects three through to mid-next year.

← Mobile/tablet users, scroll sideways to view full table →

| Current big four bank cash rate forecasts |

||

|---|---|---|

| Bank | Total no. cuts to come |

Cash rate at end of cuts |

| CBA | 1 | 3.35% |

| Westpac | 3 | 2.85% |

| NAB | 2 | 3.10% |

| ANZ | 1 | 3.35% |

Should we get a total of three more cuts in this cycle, as Westpac is predicting, then a single person on the average wage could see their maximum borrowing capacity increase by an estimated $74,000 in the space of 16 months. This assumes their wage does not change in this time.

- Feb cut = +$11,000

- Feb + May cut = +$23,000

- Feb + May + Aug = +$35,000

- Feb + May + Aug + 1 more cut = +$47,000

- Feb + May + Aug + 2 more cuts = +$60,000

- Feb + May + Aug + 3 more cuts = +$74,000

Borrowing power notes below apply.

Potential impact of RBA rate cuts on borrowing capacity for person on average wage

New lending lifts in the June quarter

The total value of new housing loans has increased to $87.7 billion in the June quarter, according to the latest ABS Lending Indicator data, in seasonally adjusted terms.

The biggest rise in percentage terms for the quarter was first home buyers at a 5.7% increase, followed by upgraders (+4.4%), then investors (+1.4%).

<← Mobile/tablet users, scroll sideways to view full table →

| June quarter 2025 ABS Lending Indicators |

|||

|---|---|---|---|

| Loan type |

Value of loans |

Quarterly change |

Annual change |

| All loans | $87.7 billion | +2.0% | +7.2% |

| Owner-occupied (ex FHB) |

$39.0 billion | +4.4% | +9.8% |

| First home buyers (owner-occ) |

$16.3 billion | +5.7% | +2.2% |

| Investment | $32.9 billion | +1.4% | +6.9% |

Source: ABS Lending Indicators June 2025, prepared by Canstar.com.au. Value of new loan commitments based on seasonally adjusted figures.

Canstar’s Data Insights Director, Sally Tindall says, “The August cash rate cut will give existing borrowers more bang for their buck, with the average owner-occupier variable rate expected to drop to around 5.54 per cent.”

“For buyers, however, lower interest rates could tempt them to borrow more from the bank, and that’s not necessarily a good thing.

“The RBA’s rate cuts are helping push new loan sizes to eye-watering levels. The average new owner-occupier loan is now $678,000 – that’s $18,000 more than it was just three months ago – that’s an increase of $198 a day.

“When the cost of borrowing falls, some buyers use it to bid higher at auction, particularly in sought-after property hotspots. This is exactly what we’re seeing play out in the latest ABS data.

“Canstar research shows one 0.25 percentage point cut is likely to boost the average person’s maximum borrowing capacity by $12,000 – not a windfall in isolation, but over the last three cuts, this could translate into an increase of $35,000.

“This third cash rate cut is also likely to encourage more buyers into the market, with further confirmation the days of higher interest rates are now firmly in the rear-view mirror.

“Any boost in borrowing capacity should be taken with a healthy dose of caution. Just because the bank says you can borrow more money, doesn’t automatically make it a good idea.

“Before you take out a new mortgage, check what your repayments might look like if interest rates rose by 3 percentage points. While this kind of scenario is highly unlikely in the near future, a home loan is for up to three decades and a lot can happen in this time.”

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

30% min deposit

30% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

10% min deposit

10% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promoted products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promoted products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

This article was reviewed by our Finance Editor Jessica Pridmore before it was updated, as part of our fact-checking process.

- The RBA has delivered a long-awaited third rate cut for 2025

- NAB joins tide of fixed rate cuts while ANZ rocks boat with variable rate hike

- Home loan refinance cashback offers & deals

- Compare Fixed Rate Home Loans

- Compare some of the best variable rate home loans

- Compare some of the lowest variable home loan rates