Your credit score is important if you want to buy your first house, need a car loan or are applying for a credit card or personal loan. Having a bad credit score can affect you for some time, limiting your borrowing potential and making you appear less creditworthy to lenders. So, what is a bad – or low – credit score, and what can you do if you have one?

What is a bad credit score?

Let’s take a look at three of the major credit bureaus that offer credit reporting services in Australia, and what they consider to be a bad or low credit score.

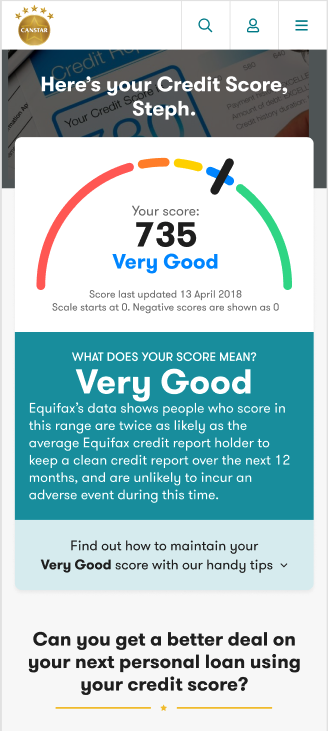

For Equifax, ‘below average’ is a score of 0 to 459. This means you are in the bottom 20% of the credit-active population and are more likely than average to have an adverse event in the next 12 months. ‘Average’ is a score of 460 to 660, and indicates an adverse event is as likely for someone in that category in the next 12 months as it is for the average of the wider population.

← Scroll to view →

Equifax credit score bands

| Below average |

Average | Good | Very good |

Excellent | |

|---|---|---|---|---|---|

| Equifax score range |

0-459 | 460-660 | 661-734 | 735-852 | 853-1,200 |

← Scroll to view →

Experian credit score bands

For Experian, a score between 0 to 549 is considered ‘below average’, and 550 to 624 is considered ‘fair’.

| Below average |

Fair | Good | Very good |

Excellent | |

|---|---|---|---|---|---|

| Experian score range |

0-549 | 550-624 | 625-699 | 700-799 | 800-1,000 |

← Scroll to view →

Illion credit score bands

For Illion, it is possible to get a ‘zero’ score, 1 to 299 is considered ‘Low’ and 300 to 499 is described as ‘Room for improvement’.

| Zero score |

A low score |

Room for improvement |

Good | Great | Excellent | |

|---|---|---|---|---|---|---|

| Illion score range |

0 | 1-299 | 300-499 | 500-699 | 700-799 | 800-1,000 |

Sources: Equifax, Experian, Illion.

What can I do if I have a low credit score?

It is important not to be discouraged if you find out you have a low credit score. There are steps you can take to improve your credit score, as well as harmful habits to avoid so you don’t damage your score further.

The length of time information stays on your credit report varies depending on what it relates to and, over time, negative items are likely to drop off. With Comprehensive Credit Reporting (CCR) in Australia, in addition to actions such as missing payments, positive behaviours – such as paying your bills on time – are listed on your credit report and may contribute to gradually improving your score over time.

There is also the possibility you might have no credit score, which can make borrowing money more difficult. If this is the case, establishing a consistent record of paying bills on time, for example, could help you to build your score from the ground up.

Everyone’s financial situation is different, and your credit score isn’t the only thing a lender will take into account when deciding whether to approve you for a loan or other type of credit. Your income, expenses and existing debt level are among the factors that may also be considered.

Can I borrow money with a low credit score?

Some lenders offer products specifically designed for individuals with poor credit who may have trouble getting approved for regular loans or credit products. If you want to know more about applying for loans when you have a poor credit rating, you can read our guides on:

Canstar Group Executive for Financial Services, Steve Mickenbecker, warns against seeking out these products if you’re already on shaky ground.

“Don’t jump from the frying pan into the fire,” he says, noting that with bad credit loans “you can expect to pay a higher interest rate than otherwise”, and that “taking on a very high rate loan could make it difficult to stay on track with your repayments and may just aggravate the problem.”

“Never miss your repayment due date.”

How can I improve my credit score?

If you want to repair or improve your credit score, keep in mind that doing so generally won’t be a quick and easy process. It may take a significant amount of time and require an extended period of financial responsibility on your part.

- Pay your bills on time

- Think carefully before applying for any new credit

- Pay down any existing loans and debts

- Consider seeking the assistance of a financial counsellor

- Check your credit report for any inaccuracies

- Hold onto credit cards you can manage

- Lower the limit on any credit cards you have.

Where can I get free financial counselling?

If you have a bad credit rating, or are even in financial hardship (which is when what you spend exceeds your income over time) you might also be interested in seeking support from a qualified professional. Free financial counselling and support is available for all Australians from the National Debt Helpline (NDH). As well as running the helpline itself (1800 007 007), NDH helps consumers find individual counsellors and organisations near to them.

Cover image source: TierneyMJ/Shutterstock.com

This content was reviewed by Editor-in-Chief Nina Tovey as part of our fact-checking process.

Share this article