KEY POINTS

- The colour of your car could be saving you 12% on your insurance premiums.

- White and lighter coloured cars are generally the cheapest to insure.

- Black and darker coloured vehicles can attract higher premiums, as they can be less visible to other drivers.

What is the most expensive car colour to insure?

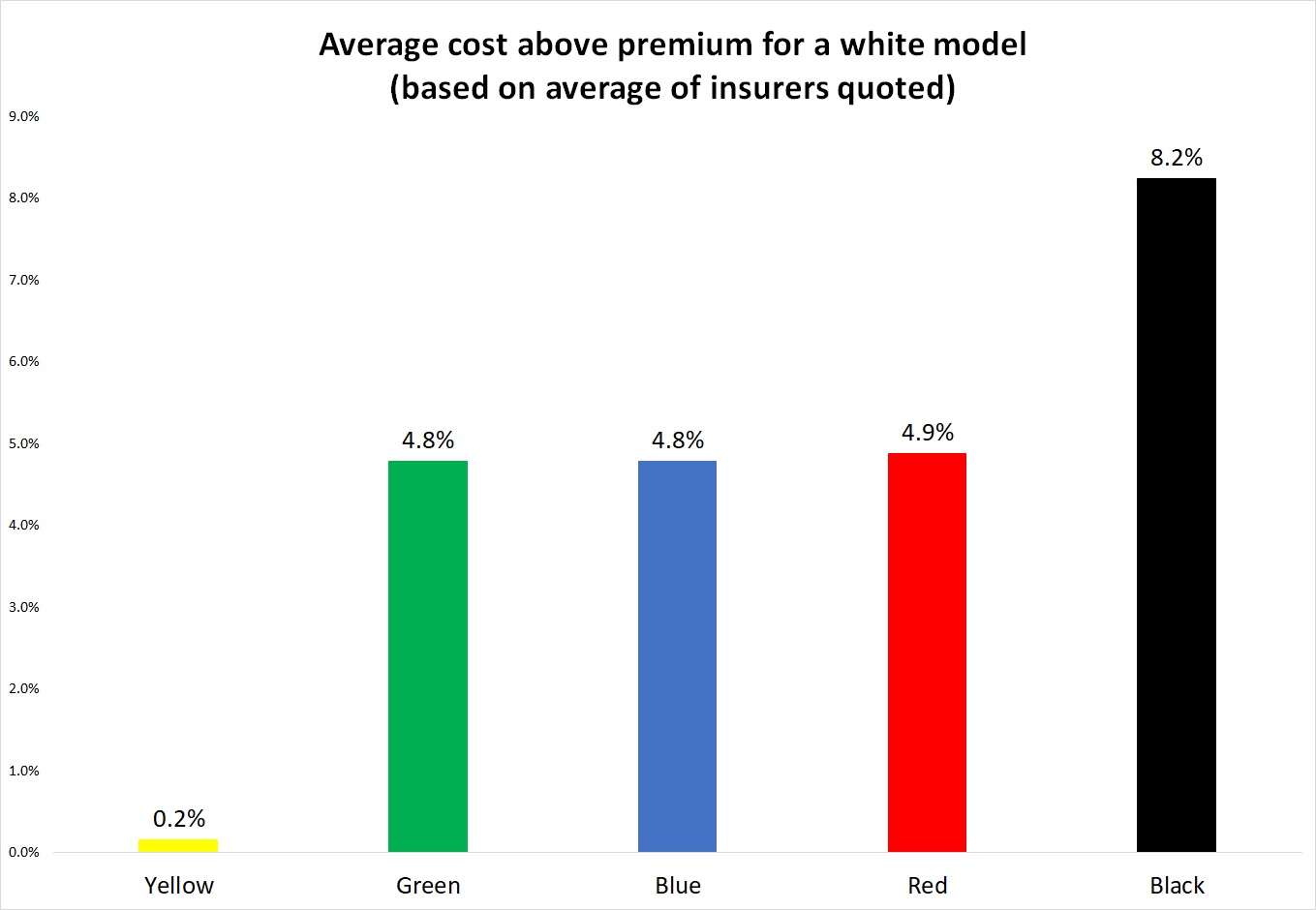

Black was found to be the most expensive colour to insure, with one insurer quoting 12% more than for the same model but in white. Black was the most expensive for all insurers as well, with the average premium being 8.2% more than the cheapest colour of white.

The data below was collected by generating quotes from three of the biggest car insurers in Australia. The figures are based on a set of standardised quoting assumptions, being for a comprehensive car insurance policy for a 40 year old male driver with a NSW address for a 2019 Mazda 3 G20 Evolve. The only factor that changed between each quote from a particular insurer was the colour of the car.

Source: canstar.com.au – based on quotes obtained from three Australian car insurers for a 40 year old male driver with a NSW address for a 2019 Mazda 3 G20 Evolve with only the car colour changed in each quote. Quotes obtained 06/08/2025.

We also found that on average, yellow is priced pretty similar to white—the average difference being only 0.2% more expensive, and on one occasion, it was actually cheaper than white by $7. Colours like green, blue and red were just under 5% more expensive than white, but the differences varied by insurer.

If you’re happy with a white-coloured vehicle, that’s the money saving option. If you want to be a bit adventurous in your choice of colour, yellow or other similar lighter colours may be an option worth considering.

Compare car insurance policies

If you’re comparing car insurance policies, the comparison table below displays some of the policies currently available on Canstar for a 30-39 year old male seeking comprehensive cover in NSW without cover for an extra driver under 25. Please note the table is sorted by Canstar Star Rating (highest to lowest) followed by provider name (alphabetical) and features links direct to the providers’ websites. Consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD), before making a purchase decision. Contact the product issuer directly for a copy of the PDS and TMD. Use Canstar’s car insurance comparison selector to view a wider range of policies. Canstar may earn a fee for referrals

Are white cars cheaper to insure?

As the above research shows, white cars are generally the cheapest to insure in terms of colour. That being said, there are other factors such as the make and model of the vehicle itself, as well as your own personal details, that will ultimately determine how much you will have to pay in car insurance premiums.

Why does the colour of your car impact your car insurance?

Over the past 30 years, technological advancements have made cars much safer to drive. Safety features such as blind-spot detection, collision warnings and lane assist can all help prevent road accidents.

However, one standard car feature has remained the same: the human behind the wheel. And out on the road, brighter cars are more visible to the human eye than darker vehicles, and therefore less likely to be involved in accidental collisions.

While there hasn’t been any recent scientific research into the risks associated with driving dark vehicles, a 2007 report from Monash University, based on 20 years of accident reports from Victoria and Western Australia, revealed an increased daytime crash risk of 10% for dark coloured cars over white ones.

It’s an increased crash risk that’s supported by the above data which suggests a link between darker vehicle colours and an increased cost of car insurance premiums. Generally speaking, if an insurer asks you about a particular detail (e.g. the colour of your vehicle) it means they take it into account when pricing your policy. It’s important to note, however, that not all car insurance providers ask about the colour of your vehicle when generating your quote.

What other factors can impact the cost of car insurance?

While car colour can affect the cost of your car insurance, other factors can have a bigger influence. These include:

- The age of listed drivers: Older and younger drivers, as well as those with less driving experience, can cost more to insure.

- Driving record and insurance history of the policyholder: Car insurance providers may penalise those with poor driving histories and drivers who have made recent car insurance claims with higher insurance premiums.

- Choice of insurance cover: Comprehensive cover is more expensive than other forms of optional car insurance such as Third Party Property Damage and Third Party Fire and Theft insurance. An agreed value policy is also likely to cost more than one that only covers the market value of the vehicle.

- Policy extras: Optional policy extras, such as roadside assistance and excess-free windscreen cover, will often push up the price of a policy.

- Where you live and park your car: Utilising secure parking options, such as a locked garage, and living in a neighbourhood with a low crime rate may see car insurance providers offer you a cheaper premium.

- The vehicle being insured: New, expensive high performance cars will generally cost more to insure than older family runarounds. The same can be said for vehicles with expensive modifications and customisations.

- Payment options: It usually costs more to pay your car insurance premiums monthly, instead of annually. Some providers may even offer you a discount for paying your premiums in a lump sum annually.