House hunting tips: 19 property research moves to make before you buy

Cutting corners to secure a property in this current real estate storm is not on the cards for Canstar’s Digital Editor Amanda Horswill. Instead, she adheres to “a rather extreme” list of property checks. She tells all…

Why I think researching a property is important

Almost a quarter of a century ago, as bright-eyed and bushy tailed (aka extremely naive) first home buyers, my now-husband Jason and I purchased our very first home. It was a three-bedroom, single storey brick house in the leafy western suburbs of Brisbane and it cost just $126,000. After denuding it of its ‘80s grey paint and matching matte tiles, we sold it for a tidy (tiny) profit. And we were hooked.

Last year – around the same time COVID-19 was starting to sweep the world – we sold for the eighth time. Each property taught us more about how to spot a “good” house – good enough to live in for a while, renovate and then sell (yes, that’s a lot of packing boxes). But we have also learned that there is no perfect property. Unless you build from scratch, you are essentially buying someone else’s idea of their perfect home. Knowing which imperfections are important and which to ignore before we buy has meant the difference between selling for a profit and doing in our dough.

The magic formula is actually pretty simple – take the current value of the house and its predicted growth over a certain number of years, and weigh that up against the cost to rectify any shortcomings. Research is the key. Yes, falling in love with a property is important, as, after all, you (may) have to live there. But, there’s also something to be said for knowing a property’s shortcomings and how much they could potentially cost to fix. We think of it as a property pre-nup.

In hindsight, our first home wasn’t such a good buy: It faced Brisbane’s full west (hot) afternoon sun, was not far from the hum of high-tension power lines, and had a cut-and-fill block that turned into our own local Niagara Falls at the mere suggestion of a cloud. If we had followed the rather extreme list of property checks we use now, we would never have even attended the open home.

And I have to warn you – unfortunately, this list is also definitely why we are finding it so hard to find a home to buy right now. The market is nuts in my neck of the woods. Open homes are all-out elbowing-down-the-hall, can’t-wait-to-gazump-you battle fields, with front-door steps piled with enough visitor shoes to rival all of David Jones’ shoe counters in Australia. Recently, there have been reports of people buying houses sight unseen and with no finance clause, nor building inspection. This hurry-at-all-costs-and-buy mentality, in my humble opinion, has the potential to bite people in the hip pocket down the track. The market is so hot in some places that properties with significant defects – which would never have sold in quieter times – have been dumped onto the market and are selling like hotcakes.

Building up a solid profile of a property before you get serious about negotiating price is, in my opinion, a vital financial protection strategy for anyone considering making what is probably the most expensive investment in their lifetime.

Here is a list of some of the property research we conduct before even considering if a home is worthy of taking a mortgage or home loan out on.

Before you go to the property

In our experience, you can typically tell if it’s worth the effort of physically seeing the property just by doing a few simple online searches. As house hunters and buyers, if we like what we see, we go deeper. Here are my personal tips you might choose to consider.

1. Real estate ‘for sale’ listing

Don’t just examine the listing on Domain.com.au or realestate.com.au, but also the agent’s own listing on their website. Sometimes there is extra information or photos on the various ‘official’ listings. Examine the map, the photos and the physical description carefully, and cross-reference with the floorplan (as sometimes the photos are shot with wide lenses and can be deceiving). Check for things like the bedroom sizes (usually 3m x 3m is the smallest size of a bedroom, for example); logical placement of rooms, doors and hallways; and that the house suits the way you want to live. Maybe a small kitchen is ok if you’re not keen on cooking, but it could be a dealbreaker for some. Living areas upstairs might be good for the view, but what about carting shopping up the stairs or when you want to have a barbecue by the pool?

Pro tip: One lesson we learned the hard way is to never take the information presented to you by someone selling property at face value. An example of this is when the photos do not match up to the floorplan of a multi-storey property, which could indicate issues with what can be called ‘livable space’. Let’s say that there are photos of four bedrooms in a real estate listing, but the floorplan only shows three bedrooms and a downstairs ‘storage space’. This could indicate that the downstairs area is not of a sufficient ceiling height to be called a living space. Unless you physically raise the house or lower the floor, you may not even be able to renovate it – as we discovered with one purchase. We have also seen situations where bedrooms are called just that when they should not have been.

2. Google the address

It’s amazing what you might find with just a simple search engine search. Sites such as onthehouse.com.au, propertyvalue.com.au and the like can help build a profile of the house. You can usually find out if the property is a rental (and how much it rented for), when it was last up for sale, previous photos (if, for example, it was renovated, or if beautiful floorboards might be lurking under the peach plush pile carpet), and what previous owners may have paid for it. Some sites will also offer a ‘value estimate’. Keep in mind that some of these types of real estate websites may not be primary sources, so take the recommendations with a grain of salt.

3. Google Maps

Take a look in map view to get an idea of the lie of the land; then swap to satellite view and take note of things like the home’s position on the block and where the fences are. You can also typically see variables like where creeks, main roads and powerlines are likely to impact properties. You may even discover things like a suspicious undeveloped strip of land bordering the property and traversing several blocks, which may just turn out to be a future road reserve (true story).

4. Google Street View

Walk the street without leaving the comfort of your couch. Check out how the house looks, and have a (discreet) stickybeak at the neighbours. Are there lots of cars parked in the street, perhaps indicating traffic issues? Where is the sun shining – are there shadows over the house from neighbouring properties? Is there a ‘reduce speed’ or ‘local traffic only’ sign, indicating it might be a commuter ‘rat run’/shortcut? Use Street View by dragging the little yellow figure in the bottom right-hand corner onto the map in your browser or app to check out the surrounding streets too. It’s also possible in some cases to step back in time by clicking the clock icon under the Street View address (usually on the top left-hand side of the screen). This can tell you about any changes made to the property, and the properties around it, even details such as if there are big trucks parked on the street over successive years, indicating a possible source of noise. In the below example, the real estate listing shows only a quaint house, but Google Street View reveals a side driveway with several townhouses in its backyard.

5. Property report

Some lenders, if you have pre-approval, and some brokers, offer a service where they will generate a property report on a home that you are thinking of purchasing. This can be helpful, as it will typically list similar properties that have sold in recent times, and other important information. Sometimes, the agent selling the property could provide this to you; however, it could be a good idea to get it from a more neutral and impartial source.

Government searches

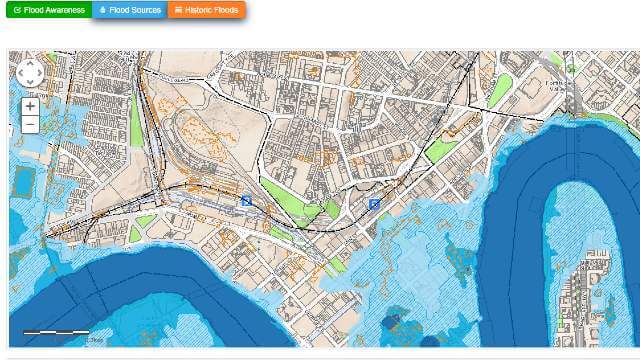

6. Flood maps and other ‘risk’ maps

Living in Brisbane, flooding is a major concern. Brisbane City Council (BBC) has a Flood Awareness Map that shows where floods have covered the land. There are maps available in other jurisdictions that could help a buyer work out risks associated with a property, such as flooding, aircraft noise and traffic noise. Check with your local council and state or territory government.

7. Zoning/City Plan

These maps are very helpful to try and predict what a place might look like in decades to come, and will tell you a lot about how far you can go when renovating. For example, Brisbane has a number of areas where very small lot developments are allowed, and other areas where character homes must be protected. Similar requirements apply across other states and territories.

8. Title search

If there’s an easement or encumbrance on the property, a title search may show it up (but not in all cases). Sometimes the real estate agent will have a copy of the title that they can show you. It could also be possible to buy one from your state or territory’s Lands office (if you are really serious about buying the property). This is also typically done in conveyancing searches, but that is after you’ve entered a contract and can sometimes be too late, especially if there is something that could impact the value of the property that you should have considered in the price you offered to the buyer.

9. Development application search

- If you are buying an apartment or a new home in a housing estate: It can be a good idea to check out the local council’s property development portal to see if you can find the original development plans. This could include things like local objections, any changes requested by council to a development, orientation (to tell you how the light will fall on a property) and car parking arrangements.

- For new developments: This type of search could tell you invaluable information, such as where major drainage work has had to be done, if there was any contamination on the site that had to be cleaned up, or if there are any covenants on the property. There could also be noise and shadow reports

- Detached houses: In some jurisdictions, detached houses – even if they are new or newly renovated – may not have plans lodged with council (depending on the development rules of the area). However, it will tell you about the area, such as if there are any planned developments and the zoning of the area.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Up to $3,000 when you take out a IMB home loan. Minimum loan amounts and LVR restrictions apply. Offer available until further notice. See provider website for full details. Exclusions, terms and conditions apply.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promoted products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promoted products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

10. Services and utilities

It can also be a useful exercise to find out where the services are on a block (if you are buying a detached house). This could help to reveal any potential drainage problems or if the placement of services could hamper renovation plans. For example, if the house has a big backyard, and one of the selling points is that you could renovate the property to expand it, you’ll need to know if there are any sewer pipes running through the area where you’d build. If there are, it could cost extra money to build over the top of them, as this type of construction typically requires special planning permission and fees.

Personally, we use Dial Before You Dig, a website where you can request these reports sent to you (it’s free, but you do have to set up an account). There are some companies who do these types of searches for a one-off fee (and may also do a title search for you, too). Or, you could go to the websites of the utility providers in the area because they often have plans available that will show a specific street or property, detailing the approximate location of services.

Law, order etc

11. Crime maps

Most police departments will have a ‘crime map’, where crime reports are displayed on a map of an area. For example, we discovered that one particular street was a hotspot for break-ins, car theft, drug offences and robbery with violence, all possible reasons why so many houses were for sale on that street.

12. Crime watch

There may also be websites and social media pages dedicated to law and order in a specific area. They could be run by the police or by citizens. Be careful here, too, as social media can become an echo chamber where tales of woe are amplified. For example, we fell in love with a local area which had great cafes and transport. But, the local Facebook page contained harrowing stories of home invasions, car damage, vandalism and the like, complete with security camera footage. It seemed that the entire neighbourhood was rough, but we were able to narrow it down to a few distinct streets, near a popular shortcut to a fast food restaurant from a train station.

13. Accommodation websites

Accommodation websites are particularly helpful if you are considering buying in a tourism region, where they may be apartments or houses rented out via AirBnB and other organisations. It’s not necessarily a bad thing, it’s just something to consider. It could also be handy to find out if someone is running the house next door as a hostel, for example. If you are buying in a unit complex, it could pay to find out if there are some apartments in a holiday rental pool.

14. Public transport

Is the area serviced well by public transport? Is the bus stop near enough/too close? Will bus noise be an issue? Can you walk to the train/ferry? Does the school bus stop nearby, or will you have to drive the kids to school? You can check this online via your jurisdiction’s public transport journey planner.

15. Social media

Join the local Facebook pages, including the buy-and-sell pages. If anything, it could give you an idea of services people recommend in the area, to give you clues about development troubles or other brewing local issues. Instagram feeds from locals can also give you insights into how facilities in the area are used (and may help you to fall in love with the place, or not).

Still love it? When you are reach to check out the actual property IRL

16. The casual drive-by(s)

We drive by at different times of the day and night. For example, my super-zealous partner was worried about whether the main bedroom of a particular house would cop headlights all night. He drove past after dusk one evening, and was rewarded with a definitive answer – yes.

17. The casual walk-by(s)

You can get a lot of information by walking through the area. Do it during the day and at night (but not too late), maybe a few times. Then, you’ll be able to see if the next door neighbour is actually running a nightclub in his backyard, or if that building at the back fence of the property is actually a shed used by a part-time car restorer for spray painting cars at all hours of the night.

18. Park and listen

If possible to do so (without getting arrested of course), drive to the property and park nearby. Wind down the windows, sit and observe. Listen for neighbourhood noises and note the traffic (both foot and car traffic). An interesting exercise is to count how many neighbours come to their windows to check out the strange people sitting in their car just watching. Sign of a safe haven or a street of busybodies? If you do this in the early morning, can you hear any jackhammers drilling nearby, hinting at a possible major construction site just out of your view?

19. Official open home/private inspections

If possible, go there at least twice, and try to stay as long as possible and listen to the realtor. Take off your rose-coloured glasses. Remember, the house will be polished to an inch of its life, and could possibly have been professionally styled and finished with hired furniture. Try to imagine it without the furniture, and how your family would live in it.

This is by no means an exhaustive list of the type of research that could be done on properties before someone decides to buy them. And it does not even touch on the many property defect checks that we do (but that’s a whole other story). There are other searches that should be performed during the contract phase, such as a building and pest inspection and legal searches. If you are worried about a property, and whether or not you should make an offer, it could be a good idea to seek out suitably qualified professionals to help you. Some people are engaging buyer’s agents and consultants to assist them with finding their forever home. But, keep in mind that there is a cost involved and be sure to read all the terms and conditions of any contracts before signing on the dotted line (sometimes, buyers agents’ contacts, for example, will insist that you pay them a fee even if you find a house yourself).

And even if you decide not to follow this exhaustive list of checks, I beg you, please, consider conducting at least a professional building and pest inspection. In my personal opinion, yes, they cost money, but a little spent in the short term could save your bacon in the long run.

Happy hunting!

This article was reviewed by our Sub Editor Jacqueline Belesky before it was updated, as part of our fact-checking process.

A journalist for more than two decades, Amanda Horswill has reported on a galaxy of subjects, including property, lifestyle, hyper-local news, data journalism, the Arts and careers.

She’s served as the Editor of Brisbane News, Deputy Features Editor for The Sunday Mail, Deputy Editor – Digital at Quest Community News, and a host of other senior positions at News Corp, prior to joining Canstar.

Amanda is fascinated with the ever-changing world of finance. A passionate believer in the motto “knowledge is power”, she strives to translate the news into practical information that will help readers make informed decisions about their future. While at Canstar, her work was regularly referenced by publishers such as the Sydney Morning Herald , The Age, The New Daily and Yahoo Finance.

Amanda holds a Bachelor of Arts (Journalism, Media Studies and Production, and Public Relations) and a Graduate Certificate in Editing and Publishing, from the University of Southern Queensland.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

30% min deposit

30% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.