First Home Loan Deposit Scheme (New Homes): Applications open for extra places

Applications are now open for the First Home Loan Deposit Scheme (New Homes) grant program, which could potentially save a buyer thousands in home loan fees. The extra 10,000 scheme places have been reserved exclusively for those wanting to build a home, or buy a newly constructed home. We take a look at how it works, who can apply and what properties can be purchased.

This week, the majority of the scheme’s approved banks opened applications for people wanting to reserve a FHLDS (New Homes) spot. Under the scheme, the government will partially guarantee 10,000 home loan deposits for eligible borrowers who have saved up as little as 5% of a property’s value as a deposit, and who want to build or buy a new home.

Typically, if a borrower has a deposit worth less than 20% of the purchase price, the bank insists they take out Lender’s Mortgage Insurance (LMI) as part of the loan contract. A recent exception has been from selected lenders who are offering LMI discounts.

LMI can often add thousands of dollars to the cost of the loan. The government’s guarantee is in lieu of that insurance.

This round of extra FHLDS places, announced in the 2020-21 Federal Budget, are hoped to provide stimulus to the construction industry to help weather COVID-19’s economic fallout.

According to the agency responsible for administering the FHLDS, the National Housing Finance and Investment Corporation (NHFIC), the scheme extension covers buyers who want to buy:

- a new house that has never been lived in

- a house and land package that’s yet to be built (or is in the process of being built)

- an “off the plan” property (such as a unit that is being, or will soon be, constructed)

- a block of land and then build a house on it

The FHLDS is only available for loans from selected lenders:

Applications opened on 3 November for 20 lenders, including: Australian Military Bank, Defence Bank, P&N Bank, Australian Mutual Bank, G&C Mutual, People’s Choice, Bank Australia, Gateway Bank, QBank, Bank of Us, Indigenous Business Australia, Qld Country Bank, Bendigo Bank, The Mutual, Regional Australia Bank, Commonwealth Bank, MyState, WAW Credit Union, Community First and National Australia Bank.

Applications open from 9 November for: Auswide Bank, Bank First, Beyond Bank, Credit Union Australia, Mortgageport, Police Bank and Teachers Mutual Bank.

The cut-off date for applications is 30 June, 2021.

According to the NHFIC, to be eligible, applicants must:

- satisfy all FHLDS qualification requirements

- enter into an eligible building contract before the 90 day pre-approval home loan period expires

- sign a building contract with a licensed or registered builder

- have a building contract which specifies “a fixed price for the construction of the dwelling”

The scheme was launched on 1 January, 2020, when 10,000 places were released. A further 10,000 places were released on 1 July. This round is in addition to the existing places available in this financial year.

The FHLDS has proven popular with first home buyers with most of the places reserved under the scheme just weeks after being released.

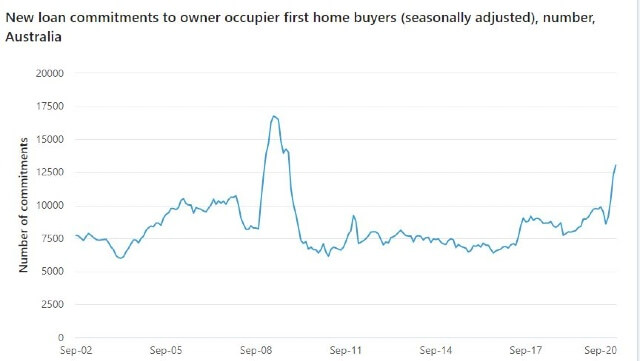

Australian Bureau of Statistics figures show that overall, the number of owner-occupied home loans for first home buyers has risen rapidly this year.

The ABS stats show that in September 2020, first home buyer loans jumped 6% (seasonally adjusted), which was more than a third of all owner occupier commitments (excluding refinancing, in original terms).

As a comparison, the ABS recorded 8,961 owner-occupier first home buyer loan commitments in September last year, compared with 13,040 in the same month this year.

The value of all Australian owner occupier home loan commitments also rose 6% in September, to $17.3 billion. This followed a 19.2% rise in August.

“Approximately half of the rise in (all of) September’s owner occupier housing loan commitments was for the construction of new dwellings, which rose 25.3%,” said ABS Head of Finance and Wealth Amanda Seneviratne.

“Owner occupier housing loan commitments are at historically high levels, consistent with low interest rates and government incentives. For example, it is likely that the HomeBuilder grant is contributing to increased demand for construction loans.”

A journalist for more than two decades, Amanda Horswill has reported on a galaxy of subjects, including property, lifestyle, hyper-local news, data journalism, the Arts and careers.

She’s served as the Editor of Brisbane News, Deputy Features Editor for The Sunday Mail, Deputy Editor – Digital at Quest Community News, and a host of other senior positions at News Corp, prior to joining Australia’s biggest financial comparison website, Canstar.

Amanda is fascinated with the ever-changing world of finance. A passionate believer in the motto “knowledge is power”, she strives to translate the news into practical information that will help readers make informed decisions about their future. While at Canstar, her work has been regularly referenced by publishers such as the Sydney Morning Herald , The Age, The New Daily and Yahoo Finance.

Amanda holds a Bachelor of Arts (Journalism, Media Studies and Production, and Public Relations) and a Graduate Certificate in Editing and Publishing, from the University of Southern Queensland.

Follow her on LinkedIn and Canstar on Facebook. Meet the Canstar Editorial Team.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.