RBA hike would relegate rates under 5% to the history books

Home loan rates under 5% are set to disappear if the Reserve Bank lifts the cash rate tomorrow to 3.85%.

A hike in February would mark the RBA’s first rate increase in more than two years, as it moves to rein in inflation.

Canstar analysis of a 0.25 percentage point rate increase, passed on in full, would mean:

- 5.77% would be the new average variable rate for owner-occupiers

- 6.02% would be the new average variable rate for investors

- 4 lenders would offer a variable rate under 5.25%, down from the 42 currently

- Fixed and variable rates under 5% would no longer exist.

Impact of a rate hike in February

A hike of 0.25 percentage points would see an owner-occupier with a $600,000 mortgage and 25 years remaining would see their minimum monthly repayments rise by $90, assuming banks pass it on.

← Mobile/tablet users, scroll sideways to view full table →

| Impact of an RBA hike in February on minimum monthly repayments | ||

|---|---|---|

| Loan size | 0.25%-point hike | New repayment |

| $500,000 | +$75 | $3,151 |

| $600,000 | +$90 | $3,782 |

| $700,000 | +$105 | $4,412 |

| $800,000 | +$120 | $5,042 |

| $900,000 | +$135 | $5,673 |

| $1 million | +$150 | $6,303 |

Source: Canstar. Notes: based on an owner-occupier paying principal and interest with 25 years remaining in Feb 2026 at the RBA average existing customer variable rate. Calculations assume banks pass on each hike in full to existing variable customers the month after.

Fixed rates continue to rise signalling lenders are preparing for a rate hike

Our rate tracking shows a total of 60 lenders have hiked at least one fixed rate since the last cash rate decision on December 9. This compares to only 2 lenders that have cut fixed rates in this time.

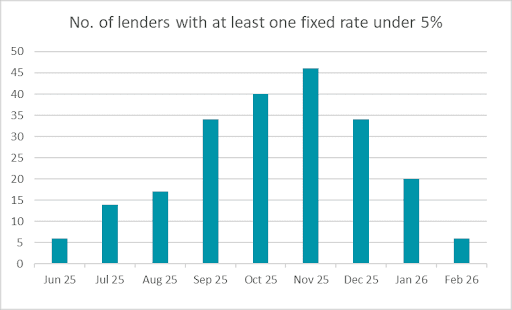

There are now just 6 lenders offering a fixed rate below 5%, down from 46 three months ago.

Big four banks all expect a rate hike in February

CBA, Westpac, NAB and ANZ are all tipping a 0.25 percentage point rate hike next week, while NAB is predicting a second hike in May.

← Mobile/tablet users, scroll sideways to view full table →

| Current big four bank cash rate forecasts | ||

|---|---|---|

| Bank | Forecast | Cash rate at end of 2026 |

| CBA | 1 x 0.25 in Feb | 3.85% |

| Westpac | 1 x 0.25 in Feb | 3.85% |

| NAB | 2 x 0.25 in Feb, May | 4.10% |

| ANZ | 1 x 0.25 in Feb | 3.85% |

60 lenders have hiked fixed rates since the December RBA meeting

Canstar’s data insights director, Sally Tindall says, “If the RBA hikes tomorrow, home loan rates under 5 per cent are likely to be relegated to the history books.”

“There are now just six lenders offering fixed rates under 5 per cent. A February hike would almost certainly close the door on the last remaining options.

“Canstar research shows 60 lenders have hiked fixed rates since the December RBA Board meeting when the Governor effectively put the country on notice a rate hike was on the cards.

“Since then, inflation has fallen off the tracks. Last week’s CPI figures saw trimmed mean inflation land at an annual rate of 3.4 per cent in the December quarter. This result overshot the central bank’s revised forecast of 3.2 per cent, and looks close to ridiculous next to the RBA’s previous estimate of 2.6 per cent, which was set back in August.

“We’re now four years into the battle with high inflation and while great progress was made initially, the RBA is fast running out of time to get the job done.

“For a typical owner-occupier with a $600,000 mortgage, a February hike would add around $90 a month to repayments.

“While plenty of borrowers will be able to cop this on the chin, it comes on the back of an uptick in the cost of essentials such as food and the end of the electricity rebates. It could be the tipping point for those households already running on tight budgets.

“If you’ve got a mortgage, don’t just accept a rate hike unchallenged. Instead, neutralise the rise by asking your bank for a cut instead.

“If you haven’t hit them up in the last six months, then it’s time to do it again, particularly if you’re paying an above-average variable rate, which at this point, as an owner-occupier, is above 5.52 per cent.

“A 10-minute phone call could be enough to duck the rate pain.”

← Mobile/tablet users, scroll sideways to view full table →

| Lowest fixed rates on Canstar.com.au | ||

|---|---|---|

| Term | Lender | Lowest rate from |

| 1-year | The Mac | 5.09% |

| 2-year | BankVic, Regional Australia Bank | 4.98% |

| 3-year | BankVic | 4.98% |

| 4-year | Hume Bank | 5.29% |

| 5-year | Hume Bank | 5.39% |

Source: Canstar – 02/02/2026. Rates based on owner occupier fixed rate loans. LVR requirements apply.

This article was reviewed by our Finance Editor Jessica Pridmore before it was updated, as part of our fact-checking process.