How you can stop living from pay cheque to pay cheque

Struggling to make ends meet? In this edited extract from her book, Ditch the Debt and Get Rich, Effie Zahos shares her tips to break the cycle of living from pay to pay.

Do you find yourself counting down the days to payday? Chances are you’re not alone. Rising interest rates, higher rents and the increased cost of living have seen many household budgets stretched.

It may feel like it’s an impossible task to stop living from pay to pay but the good news is that it can be done. The not-so-good news is that it won’t necessarily be easy and will involve making some sacrifices.

Here’s your blueprint to help you put a strategy in place so that you can work towards being in a stronger financial position and stop living from pay to pay.

Create a bare-bones budget

If you want to escape the vicious cycle of living from pay to pay, the first thing you need to do is create a bare-bones budget. This is different from a normal budget because it only includes the expenses you need to survive – the ones that mean you’ll have a roof over your head, (home-cooked) meals on the table and the lights on – and not the things that would fall under nice-to-have or luxuries. Here is a guide to what you should and shouldn’t include.

What you should include

- Mortgage repayments/rent

- Electricity and gas bills

- Groceries

- Insurance premiums (car, home and contents, life, income protection)

- Minimum debt repayments

- Medication

- Childcare/school fees

- Mobile phone plan

- Internet plan

- Petrol, public transport

- Savings towards an emergency fund

What you shouldn’t include

- Dining out/takeaway

- Entertainment services such as Netflix or Foxtel

- Non-essential clothing

- Holidays

- Recreational activities/hobbies

- Non-essential household items

- Personal care such as manicures and cosmetics

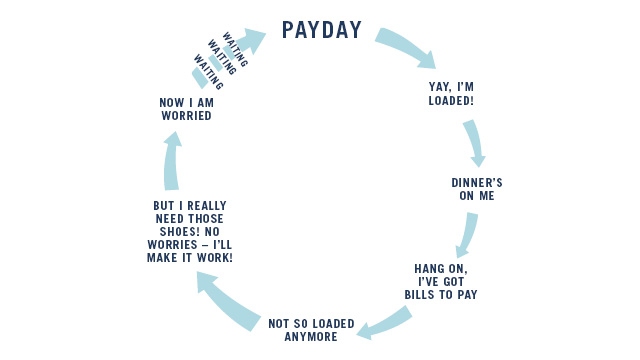

Payday circle of life

Can you cut any of your costs?

When you have all your expenses listed, it’s a good idea to go through them individually to see if there are ways to trim the costs.

If you have a mortgage, this is a great place to start as chances are it would be one of your biggest regular expenses. If you can score a cheaper rate, not only will your repayments be lower but you can save big bucks over the life of the loan.

For example, let’s assume you have a $500,000 loan over 30 years and are paying 6.16%pa. By switching to a loan with a lower rate of 4.95%, your repayments would be $380 a month less, saving you $4,560 a year.

Keep in mind that cheapest doesn’t always mean best, so consider the features as well as the price. It’s also a good idea to call your existing lender to ask if they can match the rate to save you the hassle of switching.

If you’re renting, you can also look for ways to reduce that expense: is it possible to move to a different location where the rent is cheaper or to a smaller place or share house? It doesn’t have to be forever – it can be a temporary solution.

It is also a good time to shop around for better deals on some of your other regular bills such as electricity and gas, mobile and internet plans as well as insurance. You might be surprised by how much you could save on these as well.

Do you need to make more money?

Hopefully, you’ll find you have enough money coming in to cover the expenses listed in your bare-bones budget but, if not, you may need to explore ways to make more money.

Looking for a new job that pays more is the obvious solution to boost money coming in but that is easier said than done and it may take a while to find something appropriate. While you’re waiting to land a new job, look for alternative ways to bring in extra cash.

This could include selling unwanted items, getting a second casual job or picking up a side hustle.

Live on your bare-bones budget temporarily

Even if you feel that you could possibly add in a few nice-to-haves, I would suggest living on your bare-bones budget for a few months – at the very least until you have built up a decent emergency fund.

Having money set aside for a rainy day is vital if you want to stop living pay to pay, which is why I have included it as one of the items in the ‘what you should include’ list. So, any money ‘left over’ after meeting all your other necessary expenses should be directed to your emergency fund at this stage.

Once you have reached your emergency fund goal, you can revisit your budget and start adding some ‘fun’ stuff back in, such as the occasional takeaway meal or a Netflix subscription. It’s a good idea to reintroduce these little luxuries gradually so that you don’t end up struggling to make ends meet again. And make sure you update your budget accordingly.

Tips to help you manage your money

There are a few little tricks to help you better manage your money and stick to your budget.

Put your money into buckets

One way to easily manage your money is to break down your expenses into smaller buckets rather than having them all lumped into one. For example, you may have one for school fees, one for groceries, one for bills, one for splurges and so on. How many buckets you have is completely up to you but be sure to name them.

The idea is that when you get paid, you transfer the designated amount into each bucket. This is the modern-day equivalent of the envelope system where you put cash for different expenses into an envelope.

Plan for your irregular expenses

One way that people often get caught out is not setting aside enough money to cover bills that aren’t fortnightly or monthly but rather quarterly, such as electricity and gas, or annually, such as car registration and rates. So that you don’t find yourself scrambling for cash to pay these bills, you could use something called ‘bill smoothing’. This involves estimating what that big expense will be and then breaking it down into fortnightly or monthly amounts. For example, if you think your electricity bill will be $1,500 for the year then you put away $125 a month or $58 a fortnight to make sure you have enough when the bill arrives.

Don’t spend money you don’t have

It might sound obvious but given that there are 12.5 million personal credit card accounts in Australia and buy now, pay later schemes such as Afterpay remain popular, not spending money we don’t have appears to be easier said than done for many.

So, keep your credit card at home, cancel any buy now, pay later arrangements, and use cash to pay for things whenever possible.

Keep track of your spending

It’s important to stay on top of your spending so bad habits don’t creep in again. This could be as simple as regularly taking a look at your accounts online but there are also helpful apps that track your spending.

This is an edited extract from Ditch the Debt and Get Rich (Are Media Books, RRP $29.99) republished with permission.

Cover image source: Just Life/Shutterstock.com

This article was reviewed by our Editorial Campaigns Manager Maria Bekiaris before it was updated, as part of our fact-checking process.