Gen Y, don’t be the first generation to give up on the dream of home ownership

A day doesn’t pass without media analysis of the housing affordability problem. Get a group of 20-somethings together and it is one of the typical points of conversation. The culinary musings of “Australia’s demographer” have delivered smashed avocado as the national metaphor for housing affordability.

Politicians are competing for the silver bullet of how to solve this problem. The May Federal Budget brought in some measures addressing housing affordability. Since then, the Victoria and New South Wales State Budgets have made some strides with changes to Stamp Duty for first time buyers. But sadly there’s still no silver bullet.

I wonder if we can pause just for a minute. Gen Y didn’t cause the problem, but they are living with it.

The more things change …

My turn to muse on life in a bygone era, an era before my time and very different to our world. 1950 Australia.

In 1950 Australia, only an elite had ever heard of avocado – it was way before the best menus discovered the half avocado filled with prawns and seafood sauce. No internet, no TV, no Netflix. No computers in the era of long division. Mobile was a public phone and a bent penny. No designer clothes – a good percentage of the population had spent a large part of the prior decade in uniform.

… the more they stay the same

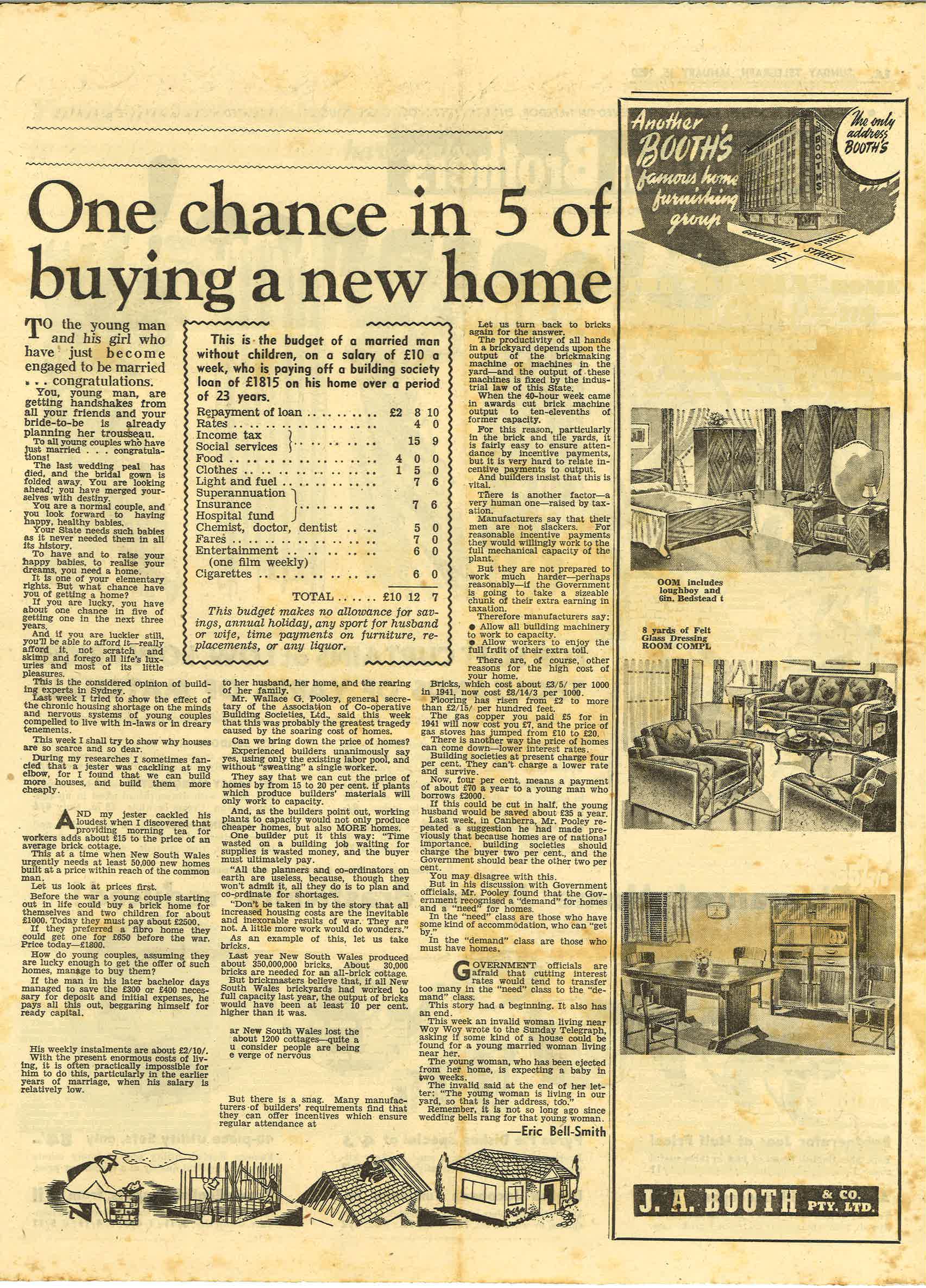

Source: Sunday Telegraph, 1950

But there was one thing about life in 1950 that has lived on to our millennial world. Housing affordability was a problem.

Back in 1950! Millennials, we are talking about the time when your grandparents were aspiring to own their own home. Our headline is from January 15, 1950 in an old newspaper that fell into my hands.

Every subsequent generation has held the same fear … that “they will never be able to afford their own home”. Gen Y’ers are the latest, and not without good cause, after the last couple of years of price rises in Sydney and Melbourne. But their grandparents also lived through an unprecedented inflation in housing costs in the period that straddled World War II.

Just to show how similar the challenge was, here’s how the two eras stacked up:

| 1950 | 2017 | |

|---|---|---|

| Housing Market | Post-war, post-rationing housing demand pushed housing prices up, with more buyers trying to buy fewer houses. | Housing prices have risen in capital cities (but this may be slowing), with investors and home buyers competing for the same properties. |

| House Prices | House prices: Brick houses cost £2,500 (compared to £1,000 in 1930s).

Fibro houses costs £1,800 (compared to £650 in 1930s). |

House prices: Nationally $585,000.

Capitals: Sydney $805,000, Melbourne $605,000, Canberra $586,500, Darwin $490,000, Brisbane $480,000, Perth $475,000 Adelaide $439,000, Hobart $355,000 (median house prices, April 2017) |

| Average Weekly Wage | £10/week | $1,575.60/week (ABS) |

| Average House Deposit | £300 – £400 (30 – 40 weeks’ worth of the average weekly wage) | 10% = $58,500 (37 weeks’ worth of average weekly wage)**

20% = $117,000 (74.3 weeks’ worth of average weekly wage)** |

| Average Loan Size | £1,815 | $324,300 (ABS) |

| Weekly Repayment | £2 10s/week | $406.68/week* |

| Repayment Loan Term | 20 – 30 years | 25 – 30 years |

| Interest Rates | 4% p.a. | 4.49% p.a. on average (but you can find many rates under 4% p.a. if you compare home loans) |

| Source: 1950 data comes from Sunday Telegraph; 2017 data comes from www.canstar.com.au and ABS.

*Average weekly repayment for 2017 is based on average loan size above, average standard variable interest rate of 4.49% p.a. on Canstar’s database as of 15 May 2017, and loan term of 25 years. **Average house deposit is based on national average house price listed in table. |

||

To aggravate the problem in 1950, there was a banking system concentrated to a handful or two of banks, with inflexible rules for loan qualification and a regulated market where credit for home loans was rationed. No brokers, no mortgage originators, no credit unions lending for housing. No low deposits. No options.

Compare this with today’s choices. There are 2,483 products from 94 different lenders rated by Canstar for the 2017 Home Loans Star Ratings. You can compare your options using the Canstar website:

My advice to Gen Y?

Hold onto the dream

Don’t be the first generation to let go of the great Australian dream of home ownership.

Past generations have looked back on their doubts and wondered why they were so worried. Make sure that you are one of the Gen Y’ers that will be thinking this way in 20 years’ time.

Back to the class of 1950

Home ownership statistics from the ABS show that 80% of Australians aged 75 or older owned their own home outright in 2011-2012.

But don’t just believe this Baby Boomer. Here are some tips for Millennials buying homes, from Canstar’s own Gen Y staff members who have already gone down the path to home ownership.

Try our First Home Buyers comparison tool to instantly compare Canstar expert rated options.