How much does double glazing cost?

How much does double glazing cost? Canstar reviews the current price of double-glazed windows and some of their pros and cons.

How much does double glazing cost? Canstar reviews the current price of double-glazed windows and some of their pros and cons.

Key points:

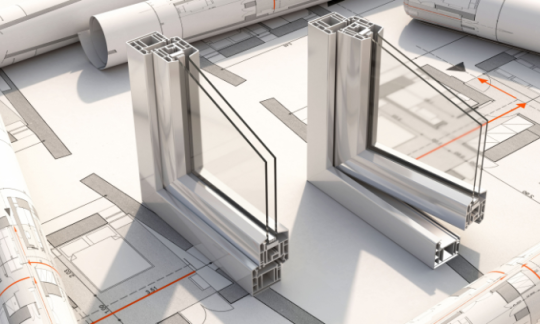

- Double-glazed windows comprise two panes of glass with an airtight space in-between.

- Double glazing can cost anywhere from $300 to $1,500 per square metre in Australia.

- While double-glazed windows can be energy efficient, there can be high upfront costs.

If you’re looking to make your home more energy-efficient, block out some external noise and, potentially, make your property more secure, you might like to know the cost of double-glazed windows? But how much does double glazing cost? We consider the current price of double-glazed windows and weigh up some of their pros and cons.

What are double-glazed windows?

Double-glazed windows comprise two panes of glass, separated by a sealed gap. The space between the panes is sometimes filled with a gas, such as argon, or left as a vacuum. Double-glazed windows provide superior insulation against temperature and noise than traditional, single-pane glazed windows.

The glass used in double-glazed windows can be laminated or UV-tinted, but is otherwise similar to the glass used in single-glazed windows. There are also triple-glazed windows, which are more commonly used in colder parts of the world. Generally speaking, double-glazed windows can be added to a property in either of two ways:

- Custom-made double-glazed windows: are produced and installed as a single unit made up of two panes of glass. This approach is commonly used for the windows and doors of new homes and extensions, when the building work is being done from scratch.

- Retrofit double glazing or secondary glazing: is when new double-glazing panels are fitted to the existing window frames of a home. For those renovating existing homes, retrofitting can be a cheaper option than purchasing new custom-made double glazing.

How much do double-glazed windows cost?

Double-glazed windows and doors are most commonly priced by the square metre. According to trade website hipages.com.au, the average cost of double glazing in Australia can be anywhere from $300 to $1,500 per square metre.

The variance in price comes down to variables such as window size, frame materials, the type of glass used and its thickness. A double-glazed window generally costs 25-35% more than a standard window.

How do costs by the three most popular frame material types break down per square metre? According to hipages, depending on the quality of your chosen framing material, double glazing costs:

- Aluminium: $300 – $1250

- uPVC: $300 – $500

- Timber: $600 – $1500

On top of these costs, you’ll likely need to factor in the cost of the glaziers needed to install the windows, which could be between $60 and $90 per hour for each glazier.

What factors can affect the cost of double-glazed windows?

It can be difficult to work out the precise cost of double glazing without taking into consideration your specific circumstances. This is because your home’s entire window configuration will need to be factored into the estimate.

For example, existing single-glazed window frames might not be able to support the thickness of double-glazed windows, and therefore be unsuitable for retrofitted double glazing. This means that new custom-made frames might be required, and this could affect the overall cost of the project.

Some of the key factors that can determine the cost of double glazing include:

- Frame material – expect to pay up to $1,500 per square metre for top-quality, timber-framed, double-glazed windows. Aluminium double-glazed windows will likely cost less.

- Glass type and specification.

- Style of window.

- Window hardware required. As a general rule, the more components a window has, the more expensive it will cost.

- Window size.

→ Renovating a home could change what insurance cover you may need:

Compare home and contents insurance providers.

What are the payment options for double-glazed windows?

How you decide to pay for the work can depend on its cost. There are several options available for would-be home renovators to consider, including drawing on savings, accessing funds through a home loan, taking out a construction loan, personal loan or green loan, or paying on a credit card.

Drawing on savings: is generally the cheapest and most straightforward way to pay for work around a home, as it will avoid interest costs and the need to apply for finance.

Drawing on a home loan: is an option if you’re replacing multiple windows, or the work is part of a more extensive renovation. If you’re ahead with your home loan repayments and have an offset account or redraw facility linked to your mortgage, you might be able to access funds without refinancing.

Taking out a construction loan: could be an option if you’re building a new home or planning a major renovation. A construction loan is a type of home loan that allows funds to be drawn down at various stages of the project. This means that you don’t pay interest on the full loan balance until the project is complete, which can be a valuable money saver.

Taking out a personal loan: could also be an option. You could take out a secured loan, or an unsecured loan. It’s worth keeping in mind, though, that interest rates are generally higher for personal loans than for home loans, and that it’s a good idea to read the lender’s terms and conditions first. You can compare personal loans with Canstar.

Taking out a green loan: can help you fund home improvements that will make your home more energy-efficient, which can save you money in the long run. Not all banks offer green loans, and those that do typically specify exactly what projects qualify. Some lenders include double glazing on their list of approved projects, as it is often considered an eco-friendly addition to a home. A recent analysis of the products on Canstar’s database found that green loans can come with interest rates well below the rates offered on regular personal loans.

Paying by credit card: may also be possible, depending on the cost of the glazing project and your ability to repay the debt quickly. There could be some potential benefits for doing this, such as extra insurance cover or rewards on your spend. But keep in mind that credit card interest rates are typically much higher than those for home or personal loans, and interest can quickly accumulate on large balances. It’s a good idea to weigh up your options and consider them carefully. If you don’t think you’ll be able to pay off the card’s balance in full each month, it may be worth seriously re-considering whether a credit card is the right option for you.

-

Additional repayments

-

Redraw facility

-

Top-up facility

-

Application fee: $0

-

Annualised fee: $0

-

Loan terms available: 1 year to 7 years

-

Additional repayments

-

Redraw facility

-

Top-up facility

-

Application fee: $0

-

Annualised fee: $0

-

Loan terms available: 3 years to 7 years

-

Additional repayments

-

Redraw facility

-

Top-up facility

-

Application fee: $0

-

Annualised fee: $0

-

Loan terms available: 5 years

Fast quote. No account required.

Won't affect your credit score. GET YOUR RATE NOW.

-

Additional repayments

-

Redraw facility

-

Top-up facility

-

Application fee: $0

-

Annualised fee: $0

-

Loan terms available: 3 years to 7 years

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promotion products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promotion products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

How to save on the cost of double-glazed windows?

While installing double-glazed windows is unlikely to be a cheap undertaking, you may be able to save money by making some savvy choices.

Think carefully about colours and window styles that can add to the cost. Choosing simple openings, aluminium rather than timber frames, and selecting awning or casement windows, are all potential ways to save.

You may be able to reduce the cost of adding double-glazed windows to your home by doing some of the work yourself, such as measuring, ordering and purchasing the materials for the window or windows, and then paying a skilled tradesperson to fit them.

But even this preliminary work is likely to require a degree of knowledge and skill. So before you jump in yourself, it could be worth thinking carefully about the risks of doing it yourself.

And, of course, regardless of which style of double-glazed window you choose, there’s the age-old method of getting bang for your buck by simply shopping around for the best-value supplier. If you obtain a number of quotes from different companies, you might be surprised at how their prices vary. Just make sure you’re comparing apples with apples, i.e. the same kinds of glass, frames, etc.

Importantly, Australia’s climate is very different to Europe’s when it comes to UV rays and the heat. So your double-glazed windows need to be tested to Australian standards. Be sure to ask your provider about this.

Related: How much do roller shutters cost?

What are the benefits of double-glazed windows?

Some of the potential benefits of adding double-glazed windows to your property include:

- Bushfire protection: fire-resistant frames and double glazing can help protect your home if it’s at risk from bushfires.

- Energy efficiency: the thermal insulation delivered by double glazing means it can help reduce your heating bills during winter, and your aircon running costs during warmer months.

- Noise reduction: double-glazed windows provide significant insulation against external noise pollution, such as from cars and planes.

- Property value increase: a 2020 study by the University of Wollongong found energy-efficient homes fetch a premium of between 5%-10% above the sale price of less energy-efficient properties of comparable value.

- Security: a double-glazed window is harder to smash than a traditional single-pane one, and therefore can be more of a deterrent to burglars.

What are the disadvantages of double-glazed windows?

Some of the potential drawbacks of installing double-glazed windows can include:

- Upfront costs: it could take five years or more for you to recoup the cost through energy savings. You also have to consider the potentially higher costs involved if your double-glazed windows need to be replaced in the future. Also weigh up how the installation could impact on other features of your windows, such as any blinds or shutters that are already installed.

- Fit of window style: this can be an issue, as it’s not always possible to find double-glazed windows that fit the style of certain properties – particularly older ones. However, retrofitting existing windows could be an option.

- Added weight: if you’re installing double-glazed windows on an existing property, the added weight of the new double glazing could be an issue, particularly on an older building. Possibly, it could cause materials around the window to warp out of shape over time.

Can double glazing save you money on energy bills?

One of the main potential benefits of double glazing is the impact it can have on your home’s energy efficiency, and the potential knock-on effect on the amount you spend on your energy bills.

A single pane of glass is not generally a good insulator. Add a second pane, though, and the difference can be significant. According to Energy.gov.au, windows can be responsible for up to 40% of a home’s heating energy loss.

However, any actual savings specific to your household will depend on factors such as the size of your home, the quality of the double glazing and the climate where you live and, of course, how much your annual energy bill is to start off with.

Cover image source: rawf8/Shutterstock.com

This article was reviewed by our Content Manager, New Zealand Bruce Pitchers before it was updated, as part of our fact-checking process.

Alasdair Duncan is Canstar's Deputy Finance Editor, specialising in home loans, property and lifestyle topics. He has written more than 500 articles for Canstar and his work is widely referenced by other publishers and media outlets, including Yahoo Finance, The New Daily, The Motley Fool and Sky News. He has featured as a guest author for property website homely.com.au.

In his more than 15 years working in the media, Alasdair has written for a broad range of publications. Before joining Canstar, he was a News Editor at Pedestrian.TV, part of Australia’s leading youth media group. His work has also appeared on ABC News, Junkee, Rolling Stone, Kotaku, the Sydney Star Observer and The Brag. He has a Bachelor of Laws (Honours) and a Bachelor of Arts with a major in Journalism from the University of Queensland.

When he is not writing about finance for Canstar, Alasdair can probably be found at the beach with his two dogs or listening to podcasts about pop music. You can follow Alasdair on LinkedIn.

- What are double-glazed windows?

- How much do double-glazed windows cost?

- What factors can affect the cost of double-glazed windows?

- What are the payment options for double-glazed windows?

- How to save on the cost of double-glazed windows?

- What are the benefits of double-glazed windows?

- What are the disadvantages of double-glazed windows?

- Can double glazing save you money on energy bills?

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.