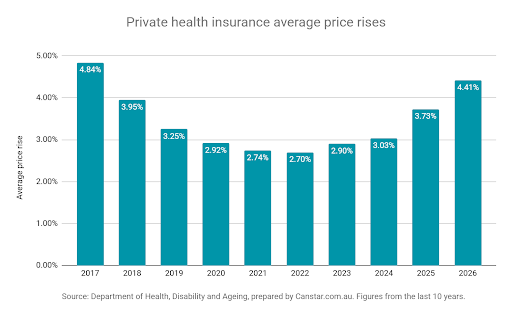

Premium pain: health insurance costs to rise by 4.41%

The government has approved an average private health insurance premium increase of 4.41%, effective 1 April, 2026. This is the largest average increase in percentage terms since 2017.

Our analysis shows an individual with an average-priced gold hospital policy could see their annual cost rise by $167 if a 4.41% increase was applied.

For families on an average-priced gold hospital policy, the impact will be even greater. A 4.41% increase will see the average annual premium rise by $330.

These scenarios are based on a policyholder earning the average wage of $104,807 and applying the relevant private health insurance rebate.

← Mobile/tablet users, scroll sideways to view full table →

| Increase to average hospital premiums if a 4.41% rise is applied | ||

|---|---|---|

| Individual | Family | |

| Gold | +$167 | +$330 |

| Silver | +$82 | +$166 |

| Bronze | +$59 | +$120 |

Source: Canstar. Note: current new customer premiums as of 9 February, 2026. Prices above are annual figures based on hospital insurance policies on Canstar’s database, excluding ‘plus’ tiers, with the govt rebate of 16.192% applied, based on the average wage. National average based on state averages weighted by proportion of hospital insured persons per APRA Quarterly Private Health Insurance (Sep 2025).

Not all policies will increase by 4.41% – some could rise by 12% or more

The approved 4.41% rise represents an industry average rather than a limit, with some insurers permitted to increase prices by more than others.

For example, AIA Health Insurance has the highest government-approved price increase at an average of 5.98%, while the lowest will be 1.98% from GMHBA Limited. (See table at end for list of insurers and their approved price hikes.)

Insurers are also able to apply price hikes differently across their policy options, with top cover such as gold hospital, typically rising the most.

Our analysis of pre- and post-price hikes from last year shows the cost of an individual gold policy rose by an average of 11.6% between March and April, when last year’s approved average was just 3.73%.

← Mobile/tablet users, scroll sideways to view full table →

| Last year’s change in average hospital premiums by cover type | |

|---|---|

| Hospital tier | 2025 increase |

| Gold | +11.6% |

| Silver | +4.8% |

| Bronze | +2.7% |

| Average | +3.73% |

Source: Canstar. Based on individual hospital insurance policies on Canstar’s database, excluding ‘plus’ tiers. Gov rebate of 16.405% in Mar-25 and 16.192% in Apr-25 applied. Averages based on state averages, weighted by % of hospital insured persons (APRA).

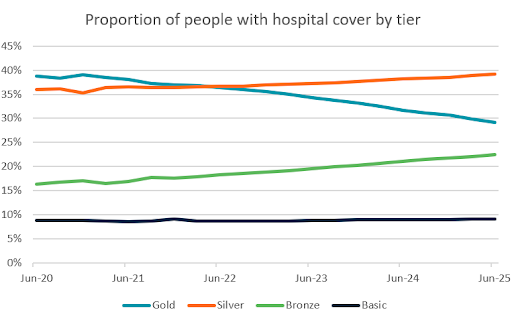

Australians likely to downgrade cover on back of the 4.41% rise

Last year’s 3.73% average increase – the largest since 2018 – didn’t drive Australians out of private health insurance, but it did lead many to downgrade their cover, a trend likely to continue after this year’s 4.41% rise.

How to save on health insurance cover

Australians facing these price hikes can explore a range of options including:

- Pre-pay the next year’s premiums at today’s prices. Many insurers will let you pre-pay the next 12 months of hospital insurance premiums at the current prices, before they increase.

- Review your level of cover and extras insurance. You might find you’re paying for a level of cover you no longer need. Just be aware of the risks that come with downgrading your cover.

- Switch to a cheaper provider offering the same level of cover.

Our analysis shows if an individual switched from the average-priced gold hospital insurance to the lowest, they could potentially save $1,387 in a year.

Note: exact savings will vary depending on a person’s location.

← Mobile/tablet users, scroll sideways to view full table →

| Min and max hospital insurance premiums – individual | |||

|---|---|---|---|

| Hospital tier | Average | Min | Difference |

| Gold | $3,790 | $2,403 | $1,387 |

| Silver | $1,854 | $1,612 | $242 |

| Bronze | $1,346 | $1,189 | $157 |

| Basic | $1,060 | $977 | $83 |

Source: Canstar. Notes: current new customer premiums as of 9 February 2026. Based on hospital insurance policies on Canstar’s database, excluding ‘plus’ tiers, with the govt rebate of 16.192% applied, based on the average wage. National average based on state averages weighted by proportion of hospital insured persons per APRA Quarterly Private Health Insurance (Sep 2025). The minimum figures are averages based on the lowest-priced policy available in each state and territory. The savings will vary depending on a person’s location. Consumers should check waiting periods and the Private Health Information Statement before deciding to switch.

Canstar’s data insights director, Sally Tindall, says, “The highest government-approved price hike since 2017 is not what the doctor ordered for households battling cost-of-living pressures.”

“This 4.41 per cent price hike will go down like foul-tasting medicine for Australians already juggling higher mortgage repayments, electricity and grocery bills.

“While the average hike is sitting at 4.41 per cent, for those with a high-level of cover, know your premium increase could be far more severe.

“If history is anything to go by, the increase for Australians with gold cover could be in the vicinity of 11 or 12 per cent.

“While there’s little good news in this announcement, know you don’t have to accept the increase without question. Switching to a comparable policy within the same tier can help mitigate or even neutralise the price hikes.

“Get on the phone to your provider to understand exactly how much your premium is going up by. Then spend 30-minutes doing a health check on your insurance. It could potentially save you hundreds.”

Compare and switch on Canstar, or call 1300 383 982 to speak with a Canstar health insurance expert.

← Mobile/tablet users, scroll sideways to view full table →

| Average approved price increases by insurer | |

|---|---|

| Private health insurer | 1 April 2026 increase |

| AIA Health Insurance | 5.98% |

| NIB Health Funds Ltd | 5.47% |

| Medibank Private Limited | 5.10% |

| Hospitals Contribution Fund of Australia Ltd | 4.96% |

| BUPA HI Pty Ltd | 4.80% |

| Health Care Insurance Ltd | 4.53% |

| Latrobe Health Services Limited | 4.53% |

| ACA Health Benefits Fund Limited | 4.48% |

| Mildura District Hospital Fund Ltd | 4.25% |

| St Luke’s Medical and Hospital Benefits Association | 4.25% |

| Reserve Bank Health Society Ltd | 4.13% |

| Peoplecare Health Limited | 4.01% |

| Australian Unity Health Limited | 3.98% |

| Health Partners Limited | 3.94% |

| Teachers Federation Health Ltd | 3.94% |

| Cessnock District Health Benefits Fund Limited* | 3.92% |

| Doctors’ Health Fund Pty Ltd | 3.67% |

| Westfund Limited | 3.26% |

| CBHS Corporate Health Pty Ltd | 3.25% |

| CBHS Health Fund Limited | 3.25% |

| Defence Health Limited | 2.99% |

| National Health Benefits Australia Pty Ltd** | 2.96% |

| Phoenix Health Fund Limited | 2.95% |

| Navy Health Ltd | 2.88% |

| Health Insurance Fund of Australia Limited | 2.60% |

| Police Health Limited | 2.53% |

| HBF Health Limited | 2.15% |

| GMHBA Limited | 1.98% |

| Industry Average | 4.41% |

Source: Department of Health, Disability and Ageing. * Trading as Hunter Health Insurance ** Trading as onemedifund

This article was reviewed by our Consumer Editor Meagan Lawrence before it was updated, as part of our fact-checking process.