Cooling inflation tempers case for a hike, but final decision hangs on next CPI

Inflation cooled in November, taking some pressure off the RBA to increase the cash rate, however, a hike is by no means off the cards.

ABS data released today shows headline inflation dropped from an annual rate of 3.8% in October to 3.4% in November, while trimmed mean inflation dropped from an annual rate of 3.3% in October to 3.2% this month.

← Mobile/tablet users, scroll sideways to view full table →

| Consumer Price Index (annual movement) | ||

|---|---|---|

| Month | Headline CPI% | Trimmed mean % |

| April 2025 | 2.4 | 3.1 |

| May 2025 | 2.1 | 3.0 |

| June 2025 | 1.9 | 2.8 |

| July 2025 | 3.0 | 3.0 |

| August 2025 | 3.2 | 3.0 |

| September 2025 | 3.6 | 3.2 |

| October 2025 | 3.8 | 3.3 |

| November 2025 | 3.4 | 3.2 |

Source: ABS Monthly Consumer Price Index.

Next RBA decision is in 27 days – what will the Board do?

Today’s monthly CPI results show inflation is now moving back in the right direction, however, it is still noticeably outside of the RBA’s target band and a long way from the mid-point of 2.5%.

This result today reduces the urgency for a cash rate hike, however, much will depend on data still to come before the RBA meets on 2 – 3 February, including the next round of more robust quarterly inflation figures on 28 January.

Key data still to come before the RBA’s first meeting of 2026:

- 12 January – Monthly Household Spending Indicator, ABS (December)

- 22 January – Labour Force, ABS (December)

- 28 January – CPI, ABS (December and December quarter).

If the RBA decides to lift the cash rate as soon as February and banks pass on the increase in full, many variable rate borrowers would see higher repayments flow through in the weeks that follow.

For an owner-occupier with a $600,000 debt and 25 years remaining, a 0.25 percentage point hike would increase the minimum monthly repayment by $90.

← Mobile/tablet users, scroll sideways to view full table →

| Impact of 0.25%-pt cash rate hike to monthly repayments | ||

|---|---|---|

| New monthly repayments | Increase to monthly repayments | |

| $600,000 | $3,778 | +$90 |

| $750,000 | $4,722 | +$112 |

| $1 million | $6,296 | +$150 |

Source: Canstar.com.au, assumes borrower is on RBA’s average rate for existing variable borrowers of 5.51% in January 2026, with 25 years remaining. Cash rate hike of 0.25%-pts is in February and assumed banks pass on in full the following month.

Banks already factoring in rate rise to fixed

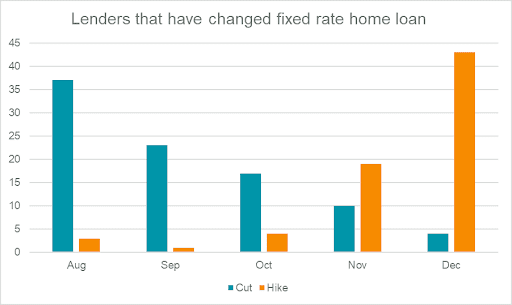

Canstar rate tracking shows 43 banks increased at least one fixed rate in the month of December, while four cut.

Three of the big four banks – Westpac, NAB and ANZ – were among the lenders hiking fixed rates in December, along with Macquarie, ING and Suncorp.

Lenders that have changed fixed rate home loans

Source: Canstar. Notes: excludes introductory rate and green loan rate changes.

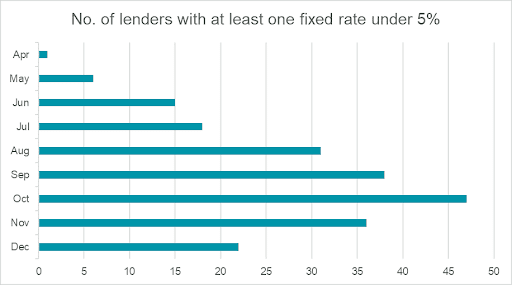

Fixed rates under 5% alive but on the slide

Canstar rate tracking shows there are now just 22 lenders offering a fixed rate below 5% – a dramatic drop from 36 at the end of November.

Source: Canstar. Lenders counted at the end of each month.

Lowest rates on Canstar.com.au

← Mobile/tablet users, scroll sideways to view full table →

| Lender | Lowest rate from | |

|---|---|---|

| Variable | Horizon, G&C Mutual, Unity Bank (first home buyers) | 4.99% |

| 1-year | Pacific Mortgage Group, Geelong Bank | 4.99% |

| 2-years | Illawarra Credit Union, Community First | 4.94% |

| 3-years | G&C Mutual, Unity Bank | 4.85% |

| 4-years | Teachers Mutual Group, Freedom Lend | 5.24% |

| 5-years | Teachers Mutual Group, Freedom Lend | 5.24% |

Source: Canstar. Rates based on owner occupier loans. Excludes green only loans. LVR requirements apply.

What does the RBA have in store for 2026?

Canstar’s data insights director, Sally Tindall says, “Today’s inflation figures have reduced the chance of a rate hike in February, however, we’re not in the clear just yet.

“Inflation is now moving back in the right direction. That’s a small win for the RBA but the reality is trimmed mean inflation has been at or above 3 per cent for five consecutive months. What this tells us is that the current cash rate setting might not be high enough to bring inflation back down to its target of 2.5 per cent.

“Much will be riding on the next round of quarterly inflation figures due out six days before the RBA’s next cash rate call.

“The Governor has already made it clear the Board will be putting a lot more weight on the quarterly results for now.

“The possibility of a rate hike is still very much a live one and borrowers should take the time to get ahead of the game while they can.

“Work out what your repayments would look like if the cash rate rises and make sure your budget can handle it.

“The good news is, as unpalatable as rate hikes are to borrowers, many are already paying extra on their mortgage, having left their repayments the same following the three 2025 rate cuts.

“It’s also worth doing a check to make sure your interest rate is competitive. For owner-occupiers that’s around or below 5.25 per cent – a stretch target if you’re with a big bank, but not if you’re willing to play the field more widely.

“Canstar data shows there are 43 lenders offering variable rates below this threshold, but only one big four bank, Westpac, in this list.

“A rate cut now, whether that’s from haggling or switching lenders could put you ahead of what the RBA serves up in the first half of 2026.”

← Mobile/tablet users, scroll sideways to view full table →

| Current big four bank cash rate forecasts | ||

|---|---|---|

| Bank | Next move | Cash rate at end 2026 |

| CBA | 1x hike in Feb | 3.85% |

| Westpac | – | 3.60% |

| NAB | 2x hikes in Feb, May | 4.10% |

| ANZ | – | 3.60% |

This article was reviewed by our Consumer Editor Meagan Lawrence and PR Lead, Banking Laine Gordon before it was updated, as part of our fact-checking process.