Banks hike savings rates but only for those who game the fine print

The big four banks have today increased savings rates following last Tuesday’s RBA decision, but not all rates have received the full 0.25 percentage point increase.

Westpac now offers the highest ongoing savings rate, not just out of the majors, but the whole market, with a maximum rate of 5.25%, but only for those aged 18-34 who meet the bank’s conditions each month.

Looking at the big banks’ bonus saver accounts, where customers have to meet conditions to qualify for the maximum rate, all four hiked the bonus rate on these accounts, but largely left the base rate untouched.

This means anyone who doesn’t meet the monthly conditions will miss out on getting the full benefit of the RBA rise, which Canstar’s research shows is around 41% of people with a bonus saver account.

Big four banks’ bonus saver account changes

← Mobile/tablet users, scroll sideways to view full table →

| Max rate

(if monthly |

Base rate

(if conditions |

|

|---|---|---|

| CBA Goal Saver |

+0.25 to 4.50% ✓ | No change – 0.25% ✖ |

| Westpac Life | +0.25 to 4.50% ✓ | No change – 0.10% ✖ |

| Westpac Spend&Save (18 – 34) |

+0.25 to 5.25% ✓ | No change – 0.10% ✖ |

| NAB Reward Saver |

+0.25 to 4.40% ✓ | No change – 0.01% ✖ |

| ANZ Plus Growth Saver |

+0.25 to 4.50% ✓ | +0.05 to 0.10% ✖ |

| ANZ Progress Saver |

+0.20 to 3.25% ✓ | No change – 0.01% ✖ |

Source: www.canstar.com.au. Note: monthly conditions apply for maximum rates along with other terms and conditions.

Big four bank standard saver accounts

All four banks passed on the hike in full to the introductory rates on their standard saver accounts, however, these rates are only for new customers for the first four to five months.

This means existing customers on CBA’s Netbank Saver, for example, saw an increase of just 0.15%, taking their savings rate to 1.70%.

On Westpac’s eSaver account, the bank did not move the ongoing rate at all, leaving it at 1.00% for existing customers.

Big four banks’ standard saver account changes

← Mobile/tablet users, scroll sideways to view full table →

| Intro rate |

Ongoing rate |

|

|---|---|---|

| CBA Netbank Saver |

+0.25 to 4.70% for 5 mths ✓ |

+0.15 – 1.70% ✖ |

| Westpac eSaver |

+0.25 to 4.70% for 5 mths ✓ |

No change – 1.00% ✖ |

| NAB iSaver |

+0.25 to 4.70% for 4 mths ✓ |

+0.15 – 1.40% ✖ |

| ANZ Plus Flex Saver |

+0.25 to 4.50% for first $5k ✓ |

+0.25 to 1.50% above $5k ✓ |

| ANZ Online Saver |

N/A | +0.20 to 0.85% ✖ |

Source: www.canstar.com.au. Notes: conditions apply for above rates.

Term deposit rates crack 5.00%

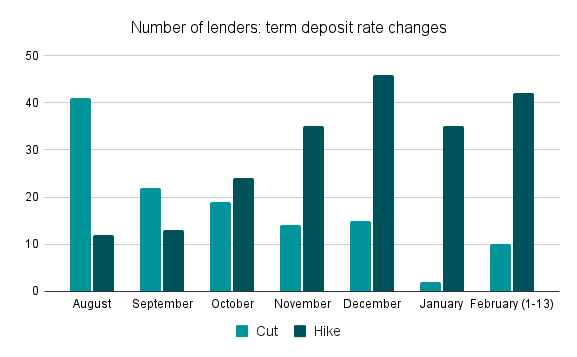

Rate tracking by Canstar shows a staggering 32 banks have hiked at least one term deposit rate since the RBA announced the increase to the cash rate last Tuesday, including Australia’s biggest bank, CBA.

The analysis shows the number of increases to term deposits so far in February has almost matched the number of lenders hiking in December.

Source: www.canstar.com.au.

As a result, the highest term deposit rate has now cracked the 5% mark again, with Judo Bank this week posting a 5-year rate of 5.00%. Other banks are likely to join them at some stage, particularly if the possibility of another hike continues to firm up.

Highest term deposit rates

← Mobile/tablet users, scroll sideways to view full table →

| Term | Bank | Highest rate |

| 6-month | ING, Macquarie |

4.60% |

| 1-year | Heartland | 4.88% |

| 2-year | Judo Bank | 4.75% |

| 3-year | Judo Bank | 4.75% |

| 4-year | Judo Bank | 4.75% |

| 5-year | Judo Bank | 5.00% |

Source: www.canstar.com.au. Note: conditions apply and interest may be paid at different intervals.

Canstar’s Data Insights Director, Sally Tindall, says, “When it comes to cash rate hikes, there’s two sides to the coin: borrowers might be feeling the pain, but savers should be reaping the benefits. The problem is, when the banks are the ones in charge of flipping it, it comes with a bias.”

“This round of savings rate hikes is a battle between who has the upper hand on the fine print: the banks or their savings customers.

“For those who meet their bank’s monthly terms and conditions every month, they could well see the benefit of a full hike. Those who don’t are likely to be missing out.

“Competition in retail deposits is nowhere near as fierce as it is in mortgages and the fact that deposits from households is at an all-time high of $1.7 trillion doesn’t help this.

“That said, banks need money from households to help fund their mortgages. The more people shop around, the more the banks will be forced to compete on savings rates.

“You don’t have to keep your nest egg with the same bank you do all your other transacting with. If you want the sharpest savings rates, you’re probably going to need to look beyond the four walls of your current bank.

“Term deposit rates have been on the rise since late last year, and have now ramped up another notch on the RBA’s U-turn back to rate hikes.

“Canstar data shows a staggering 32 banks have hiked at least one term deposit rate since the RBA announced the increase to the cash rate last Tuesday, with Judo Bank now posting a rate of 5.00 per cent, albeit for a term of five years.

“We expect other banks will start to post term deposit rates in the 5’s in the coming weeks, particularly if the possibility of another hike continues to firm up.”

Compare products, monitor your credit score, track interest rate changes, and access the deals, download the Canstar App.

This article was reviewed by our Finance Editor Jessica Pridmore before it was updated, as part of our fact-checking process.