So, you’ve checked your credit score and it is 665. But what does that mean? Is that a good score or could it hold you back? We take a look at a credit score of 665, and reveal what it could potentially mean for you when applying for credit.

What does a credit score of 665 mean?

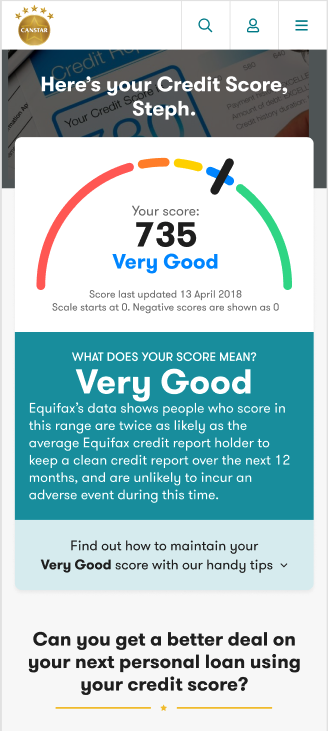

According to credit rating bureau Equifax, which powers Canstar’s credit score tool, if you’ve checked your score and have a rating of 665, that means you have a Good credit score.

The ‘Good’ credit score band sits right in the middle of Equifax’s OneScore scale – above the ‘Below Average’ ‘Average’ band, and below the ‘Very Good’ and ‘Excellent’ bands.

The other two credit bureaus that operate in Australia, Experian and Illion, have their own credit score scale and bands.

What does a Good credit score mean?

Equifax’s data shows people who score in this range are more likely than consumers who score in the lower ranges to keep a clean credit report in the next 12 months, and are less likely to experience an adverse event during this period. Credit scores of 661-734 are considered to be in the Good band.

Is a credit score of 665 good or bad?

Whether or not a credit score is ‘good’ or ‘bad’ for a person’s finances depends on what you want to use it for and your circumstances. The higher your credit score, typically the more likely you are to be approved for credit. For context, in 2022, Equifax states the average Australian credit score was 846, which is in the ‘Very Good’ band. However, a ‘Good’ score is squarely in the middle of Equfax’s OneScore bands, which means that while you may have some room for improvement when it comes to your credit history, you are rated more highly when it comes to financial risk than those scoring in the lower ranges.

It’s important to keep in mind, though, that a credit score is only one factor lenders take into consideration when reviewing loan applications, such as for credit cards, personal loans or home loans. So while having a good credit score may help, it’s no guarantee of success or otherwise. This is partly because the scores, and the groupings of the score into the various bands, are based on general assumptions made from financial behaviour data collected by credit bureaus.

And, whether or not a credit score is ‘good’ or ‘bad’ could be impacted by a number of things, such as your age. Equifax data shows that, when looking at the average credit scores of people in different age groups, younger people tend to have a lower credit score than older people. For example, in 2022, Equifax states that the average credit score of someone aged 18-24 was 665, while those aged 25-39 had an average credit score of 796 and those aged 40-54 had an average score of 868. So, if you are a younger person who has a higher-than-average score for their age group, this could potentially be viewed more positively by a lender than if you were an older person with the same credit score.

Learn more: What do lenders look for in a borrower?

What are the benefits of having a Good credit score?

If you have a Good credit score and you are a younger person, it could be possible that a lender views any application for credit in a more favourable light than those the same age with a lower credit score. Your age and score could also possibly mean that you represent a desirable customer as someone who is establishing more positive financial habits. However, a credit score is only one factor that lenders consider.

How can you improve a credit score of 665?

If you want to improve your score, there are a few things that you could try. However, the most reliable way to improve your score is to develop healthy financial habits. For example, if you miss a repayment on a loan, this could be recorded on your credit history and cause your score to fall. However, if you meet all of your repayments on time, and keep a clean credit record, it’s possible that your credit score could rise over time.

Learn more: How to improve your credit score.

It may also be a good idea to examine your credit report in detail. A credit report is what your credit score is based on. Look for such things as:

- inaccuracies in the loans that you currently have, such as mistakes in amounts or types of credit that you currently hold.

- applications that you didn’t make. This could be simply a mistake or, more troubling, a sign that someone may be using your identity to take out loans.

- opportunities to improve your credit, such as reducing the credit limit of credit cards.

- when negative credit events will expire (at which point they will be removed from your credit history).

If you notice any mistakes on your credit report, you can contact the issuing credit bureau to request a correction. However, keep in mind that there is no ‘instant fix’ that will improve your score overnight – it could take some time for the changes to take effect.

Plus, It could also be a good idea to check your credit score and report from time to time, to make sure your rating hasn’t slipped. Generally speaking, most lenders in Australia will report monthly to credit agencies.

Learn more about your credit score

What is a credit score?

A credit score is a rating that shows how risky a credit bureau believes you to be when it comes to borrowing (and paying back) money. It’s a number that companies, including financial institutions, typically look at when they are deciding to do business with you, such as when assessing a loan application. Credit bureaus, including Equifax, calculate your credit score by taking into account anything recorded on your credit history.

Your credit history is a record of your financial footprint, such as how many credit cards you may have, what your repayment history is like, or if you have a home loan. It typically also includes any applications for credit, regardless of whether or not you were approved for that credit.

Check your credit score for free with Canstar.

What are the credit score bands?

Credit scores grouped into ‘bands’, based on that population-level data.

Below Average

Credit score of 0 (or below) to 459

Equifax says scores in this range belong to people who are more likely than consumers in the higher ranges to experience an adverse event such as default, bankruptcy or court judgement in the next 12 months. (Canstar’s credit score tool’s scale starts at 0, so any negative scores are expressed as 0.)

Average

Credit score of 460 to 660

If you score in this range, Equifax data shows it is likely you’ll incur an adverse event such as a default, bankruptcy or a court judgement in the next 12 months.

Good

Credit score of 661-734

Equifax’s data shows people who score in this range are more likely than consumers who score in the lower ranges to keep a clean credit report in the next 12 months, and are less likely to experience an adverse event during this period.

Very Good

Credit score of 735-852

Equifax’s data shows people who score in this range are twice as likely as the average Equifax credit report holder to keep a clean credit record over the next 12 months, and are unlikely to incur an adverse event during this time.

Excellent

Credit score of 853-1200

Equifax’s data shows people who score in this range are in the top 20% of Australian consumers with an Equifax credit report and are highly unlikely to experience an adverse event that will harm their credit score in the next 12 months.

Further reading

Cover image source: Mironov Konstantin/Shutterstock.com

This content was reviewed by Editor-in-Chief Nina Tovey as part of our fact-checking process.

Share this article