Editors note: Diners Club is exiting the Australian market as of 2024

- Diners Club advised Australian cardholders that they will no longer be able to use their cards after 31 January 2024.

- Member benefits such as travel insurance and airport lounge access will not apply from this date.

- All personal Diners Club accounts in Australia will be closed as of 30 July 2024.

- Cardholders with a Qantas Frequent Flyer Diners Club card will automatically have any outstanding points transferred into the Qantas Frequent Flyer accounts.

- Cardholders collecting Diners Club Reward Points will need to use or transfer them by 30 July 2024 to avoid forfeiting them.

What are American Express and Diners Club?

Diners Club and American Express (AMEX) are responsible for creating the charge cards concept in the 1950s that developed into credit cards. They are both payment systems, but unlike Visa and Mastercard, issue their cards directly to the consumer, finance payments and process the transfers.

In contrast, Visa and Mastercard provide the system of payment, but don’t actually issue any cards themselves. Consumers often apply for a Visa or Mastercard through their bank or other financial institution.

Diners Club

Diners Club is a charge card company. It was created in 1950 when its founder went to pay for dinner in a New York restaurant and realised he left his money in another suit. To avoid future embarrassment of being caught without cash, he created the concept of the multi-purpose charge card. In Australia, Diners Club is part of the Citi group.

AMEX

American Express is a global financial services company that mainly offers premium and rewards credit cards, although it still does offer a few charge cards and low-cost credit cards. AMEX began as a freight forwarding company in 1850, and switched gears in 1958 when it introduced its first charge card.

Charge card vs. credit card

While similar to credit cards, a charge card has ‘flexible spending power’ and no interest, however you are required to pay the entire card balance in full at the end of every month (or fees apply). On the other hand, a credit card has a set credit limit, charges interest on unpaid balances, and requires minimum monthly repayments on balances.

Diners Club mainly offers personal, business and corporate charge cards. Most AMEX cards are credit card accounts, but the company does still offer a small selection of charge cards, such as the American Express Platinum Card.

AMEX vs. Diners Club: differences, pros and cons

Both AMEX and Diners Club tend to aim for the higher end of the card market, offering premium rewards and perks to members. If you’re weighing up whether to get a rewards credit or charge card, and are considering AMEX or Diners Club, these two primarily differ in four areas:

- rewards program offer

- merchant fees/card surcharges

- accepted locations

- interest and fees

Rewards programs

Both AMEX and Diners Club offer punchy reward schemes, rewards points, transfers and member perks. With an emphasis on travel and experiences, both card providers allow customers to redeem points for travel, such as to book flights, accommodation and car hire, as well as complimentary access to their airport lounges, travel insurance, and the ability to transfer rewards points to their airline partner programs. Member perks focus on special entertainment experiences (such as VIP-only and pre-sale tickets) and dining.

The Diners Club Rewards program lets customers earn points for all eligible spending, with no limit on how many points can be earned and no expiry. At the time of writing, cardholders can earn at least 1 Rewards Point per $1 spent (not including bonus points), depending on the specific Diners Club card chosen.

The American Express Rewards program is similar, where customers can even earn up to 5 points per $1 spent on some cards at the time of writing, for example, the American Express Essential Rewards Credit Card. In Australia, AMEX has partnered with Qantas and Virgin Velocity to offer specific benefits and perks. However, AMEX’s most lucrative member rewards seem to be attached to their premium charge card products, such as an annual travel credit, global airport lounge access, and complimentary travel insurance.

While tempting, a significant potential downside to these rewards programs could be higher payment surcharges, and as such, fewer businesses accepting payment by these providers (or passing it onto customers at the till).

→ Related: Top Credit Cards on Canstar’s Database for Earning Qantas Frequent Flyer Points

Credit Card merchant fees/card surcharges

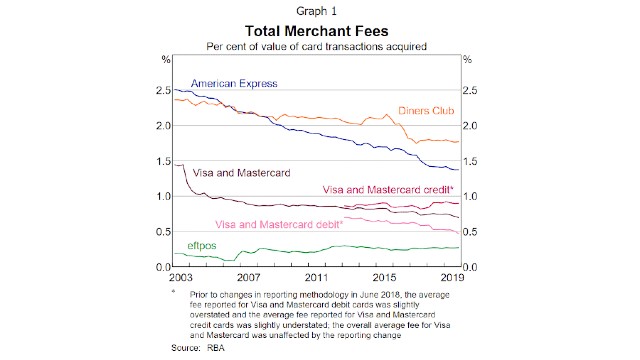

Merchant fees are paid by businesses to the financial institution or card network for allowing customers to use their cards to make purchases. In 2020, the Reserve Bank of Australia (RBA) reported that the average merchant fee for Visa and Mastercard credit card transactions was 0.9%. American Express and Diners Club are the most expensive card systems, with average merchant fees of around 1.4% and 1.8% of the transaction value, respectively. The RBA reports that AMEX and Diners Club have significantly reduced their fees over the past few years to remain competitive with the other schemes.

Accepted locations

Due to the higher merchant fees, not as many Australian businesses accept Diners Club and AMEX payments as they do Visa and Mastercard, but this may be changing as fees become more competitive.

Diners Club Australia is part of Citi, and has formed a partnership with Mastercard. Members now have the option to get an extra World Mastercard companion card for wider acceptance at more than 33 million locations online and in more than 210 countries (for a higher annual fee).

While AMEX doesn’t publish a list of its worldwide locations, it does claim that more than 100,000 new merchants signed on between 2018 and 2019 across Australia and New Zealand, which appears to be more than a standard Diners Club card, currently listing just under 65,000 merchants in its Australian network.

Interest & fees

Diners Club charge cards don’t charge interest, as all balances must be paid in full at the end of every month. However, there are fees to look out for in addition to the annual membership fee, such as an additional card fee ($50), a rewards program fee ($55, plus a rewards operation fee of $22), and liquidated damages (late fees) where the amount owing hasn’t been paid within 14 days of a statement issue date.

AMEX has a range of cards available, from low-rate to rewards and premium credit cards. Its low-rate product has no annual fee and a competitive interest rate, at 8.99% per annum on purchases at the time of writing. However, most of its other credit cards have some sort of annual fee and an interest rate set at or around 20.74% per annum. The American Express Platinum charge card doesn’t charge interest, however it has an annual fee of $1,450 and requires a minimum household income of $100,000.

AMEX vs Diners Club: Which is better?

Whether AMEX or Diners Club is a better option for you will depend on your personal circumstances. Both AMEX and Diners Club offer premium rewards programs, so it may be beneficial to consider your purpose, needs and spending habits.

Explore further: Canstar’s Outstanding Value Credit Card Awards

A Diners Club charge card has no credit limit and typically doesn’t charge interest, so if a user were able to pay off their balance in full every month they might be able to cut down on the fees they pay. On the other hand, AMEX primarily offers credit cards that seem to be accepted at more Australian locations than Diners Club alone, based on information on the two providers’ websites. One downside of credit cards, particularly rewards credit cards, is their relatively high interest rates, so even though you may not be required to pay off your balance in full each month as with a charge card, doing so could help reduce your costs.

So, if you’re in it for the rewards and perks, it may be beneficial to research and compare the Australian merchants accepting Diners Club and/or Amex as well as their specific rewards partners to align with your spending and flying preferences.

Alternatively, you may want to consider your wider financial circumstances in deciding whether a rewards-oriented credit or charge card is the right option for you in the first place, given the high potential costs these types of products can incur compared to other forms of borrowing.

- 0% p.a. for 26 months on balance transfers plus $0 annual fee in first year.* 3% balance transfer fee applies.

Australian Credit Licence 234527. See provider for TMD

- 0% BT for 24 months*. 3% BT fee applies. New customers only, must be approved by March 31 2026.

Australian Credit Licence 392145. See provider for TMD

- 0% p.a. for 24 months on balance transfers.

- Free overseas travel insurance. No FX fees.

- 3% BT Fee. Ltd time, other fees, T&Cs apply.

Australian Credit Licence 234945. See provider for TMD

- Fill your shopping trolley with a $250 Coles gift card when you apply for a new Coles Rewards Mastercard by 17 March 2026. T&Cs apply.

Australian Credit Licence 230686. See provider for TMD

- $0 annual fee 1st year (normally $96) & earn up to $500 in Latitude Rewards in yr 1. Min spend on eligible purchases applies. New approved customers by 30 April 2026

Australian Credit Licence 392145. See provider for TMD

- 0% p.a. for 10 months on balance transfers (1% fee)

- Award winning no annual fee rewards credit card

- Complimentary FIRST membership valued at $129/year

Australian Credit Licence 230686. See provider for TMD

- $300 credit back. Spend $1.5K+ p/m on general purchases in 1st 4 months. T&Cs, mthly credit card fee $10.95 & other charges apply, new customers approved by 31Mar26

Australian Credit Licence 392145. See provider for TMD

Australian Credit Licence 291313. See provider for TMD

Australian Credit Licence 234945. See provider for TMD

Australian Credit Licence 234945. See provider for TMD

Australian Credit Licence 240573. See provider for TMD

Australian Credit Licence 229823. See provider for TMD

Cover image source: Serge Cornu/Shutterstock.com