Quirky Accounts To Warm The Heart

Give back to support our community and our environment with Canstar’s list of heart-warming bank accounts from customer-owned banking institutions.

“Warm ya heart” accounts

For a while now, banks have been helping customers to make regular monthly donations to community organisations using some of the interest earned or spare coins sitting in their account. Banks have long been involved in directing some of their profits to charity, but now they are personalising the process and allowing customers to donate to the causes they care about.

The main thing is that you can have a huge impact without deliberately changing where or how you spend your money. And it’s easy, since you don’t have to sign up as a regular donor to an organisation and your bank does the hard work of processing the monthly donations for you.

All interest rates, fees, or other product details listed below are current at the time of our latest update in June 2017 only. The inclusions mentioned represent a selection of what is covered, and additional conditions may apply. Please read the product disclosure statement (PDS) for any product you are considering before making a decision.

The products are listed below alphabetically by institution name. And of course, there’s a ton of other innovative products from customer-owned institutions such as mutual banks, credit unions, and building societies, which you can compare on the Canstar website:

Compare Customer-Owned Banking Institutions

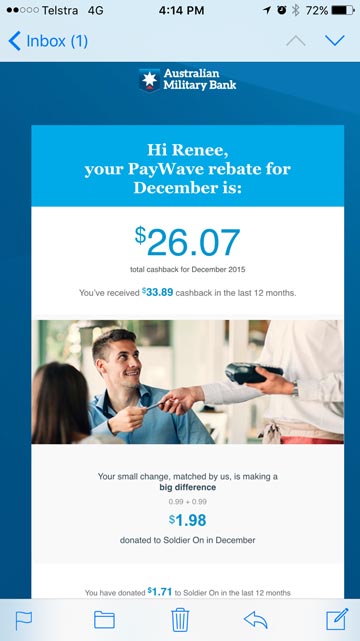

Australian Military Bank – Military Rewards Account

We discovered the Military Rewards Account when researching for the Canstar Innovation Excellence Awards in 2016. It is an everyday transaction account available to any Australian resident that both rewards members with cash back and also supports the community.

We discovered the Military Rewards Account when researching for the Canstar Innovation Excellence Awards in 2016. It is an everyday transaction account available to any Australian resident that both rewards members with cash back and also supports the community.

It uses “cents rounding” to gather the spare change less than $1.00 in the account at the end of each month and setting it aside to donate to the Defence charity of the member’s choice – which the Australian Military Bank will match cent for cent.

It uses “cents rounding” to gather the spare change less than $1.00 in the account at the end of each month and setting it aside to donate to the Defence charity of the member’s choice – which the Australian Military Bank will match cent for cent.

The member is also rewarded for their kind-heartedness with 1% cash back on all Visa payWave transactions made for amounts less than $100 using the account as of June 2017. They receive a monthly email or SMS containing the details of their total charity contributions for the month and YTD and how much they earned in cash back from payWave transactions.

All members have to do is deposit $2,000 or more each month into the account in order to receive the benefit. The account has no fee on the Visa debit card, and rediATM and NAB ATM withdrawals are fee-free.

At the time of our latest update, there are four Defence charities to choose from, or members can decide to spread their monthly donation across all four:

Source: Australian Military Bank

You can compare Australian Military Bank products, among other products, using the Canstar website.

Compare Australian Military Bank Transaction Accounts

Bendigo Bank – CommunitySaver Account

The Bendigo CommunitySaver Account was another treasure we stumbled upon during the 2016 Canstar Innovation Excellence Awards deliberations. It is a savings account designed to help customers reach their savings goals while letting them donate a portion of the interest they earn monthly on the account (from 10% up to 100%) to one of the eligible community organisations on Bendigo Bank’s list.

The Bendigo CommunitySaver Account was another treasure we stumbled upon during the 2016 Canstar Innovation Excellence Awards deliberations. It is a savings account designed to help customers reach their savings goals while letting them donate a portion of the interest they earn monthly on the account (from 10% up to 100%) to one of the eligible community organisations on Bendigo Bank’s list.

The account earns an interest rate of 1.25% p.a. as of June 2017, with no monthly account-keeping fee, free e-banking transactions, and 2 free branch withdrawals per month. Card access is not available on the account because it is a savings account, not a transaction account designed for your everyday spending.

The system is very simple. Customers don’t need to do anything special to donate a set percentage of their interest per month, just make sure they have at least a $1 minimum opening balance. Charities on Bendigo Bank’s approved list include the following:

- Bendigo Bank Community Enterprise Foundation

- Oxfam Australia

- Royal Children’s Hospital Foundation Victoria

- Royal Botanic Gardens Victoria

- Scouts Australia – Victorian Branch

- St John Ambulance – South Australia

- Emergency Services:

- Country Fire Authority Victoria

- State Emergency Services Victoria

- Tasmania Fire Services

You can compare Bendigo Bank home loans or Bendigo Bank credit cards, among other products, using the Canstar website.

Compare Bendigo Bank Savings Accounts

Beyond Bank – Community Reward Account

Beyond Bank’s Community Reward Account is a savings account that makes an annual EOFY donation to the registered charity or community organisation of their choice. The donation is calculated on a percentage of the average annual balance in all Community Reward Accounts that link to a particular organisation.

Beyond Bank’s Community Reward Account is a savings account that makes an annual EOFY donation to the registered charity or community organisation of their choice. The donation is calculated on a percentage of the average annual balance in all Community Reward Accounts that link to a particular organisation.

This account has no monthly account-keeping fee, and most transactions are free, apart from over-the-counter withdrawals – and even then, customers get 4 free over-the-counter withdrawals per month. The account is accessible through online banking, mobile banking app, SMS banking, telephone banking, Beyond Bank branches, and Bank@Post.

As of the latest update in June 2017, the account earns an interest rate of:

- $1 – $4,999: 1.00%

- $5,000 – $199,999: 1.30%

- $200,000 and over: 1.40%

If your favourite charity or community organisation is not already on Beyond Bank’s list, you can have them register for inclusion. Any not-for-profit organisation, big or small, is eligible to participate in the program.

Source: Beyond Bank

You can compare Beyond Bank home loans or Beyond Bank online and mobile banking, among other products, using the Canstar website.

Compare Beyond Bank Transaction Accounts

Heritage Bank – Community Saver Account

Heritage Bank’s Community Saver Account is an online savings account that pays a community grant of 0.50% p.a. interest on the customer’s balance to the customer’s community group of choice every 3 months as of June 2017.

Heritage Bank’s Community Saver Account is an online savings account that pays a community grant of 0.50% p.a. interest on the customer’s balance to the customer’s community group of choice every 3 months as of June 2017.

Heritage Bank has a wide range of registered community groups for customers to choose between. In fact, there’s no need to lock yourself down to just one – customers can nominate different community groups once per month.

The account has no account-keeping fee and no transaction fees, and the account is accessible via online banking, telephone banking, and SMS banking. The interest rates vary based on the balance of the account, and while the community group receives their interest earning quarterly, customers receive interest earnings monthly (as of June 2017):

- $1 – $49,999: 1.45%

- $250,000 – $749,999: 1.60%

- $750,000 and over: 1.75%

- Working Rate: 0.10% (this rate applies if no community group is nominated)

You can compare Heritage Bank home loans or Heritage Bank credit cards, among other products, using the Canstar website.

Compare Heritage Bank Savings Accounts

P&N Bank – Donation Saver Account

The P&N Donation Saver Account is a savings account that proudly supports the WA-based charities Heart Kids and WA Police Legacy. Customers earn 0.25% in interest (variable interest rate as of June 2017), received monthly, and P&N Bank makes an annual donation to one of these WA-based charities calculated on 1.25% p.a. of the account’s average annual balance.

The P&N Donation Saver Account is a savings account that proudly supports the WA-based charities Heart Kids and WA Police Legacy. Customers earn 0.25% in interest (variable interest rate as of June 2017), received monthly, and P&N Bank makes an annual donation to one of these WA-based charities calculated on 1.25% p.a. of the account’s average annual balance.

The account has no monthly account-keeping fee, free unlimited electronic transactions, and customers do not have to make any regular deposits to the account. Customers can access their funds through online banking, mobile banking app, telephone banking, and branch transactions.

You can compare P&N Bank products, among other products, using the Canstar website.

Compare P&N Bank Savings Accounts

Regional Australia Bank – Community Partnership Program

Regional Australia Bank’s Community Partnership Program allows customers to support a local community group by banking with any of 3 eligible account types:

- Community Partnership Account: A transaction account that earns interest rates of up to 0.05% on balances from $5,000 up to $50,000, and up to 0.20% on balances of more than $50,000. The monthly access fee is waived for community groups, and is also waived for other customers if the total balance of all accounts, loans, overdrafts, and term deposits with Regional Australia Bank adds up to more than $5,000 and they make no withdrawals in the month.

- eFree Account: A transaction account for young people aged 25 years old or younger (but you can keep your account open once you turn 26), with no monthly account-keeping fee, and full electronic access via cards, online banking, mobile banking app, and telephone banking.

- Youth Account: A youth banking type of transaction account for Under 18s that earns interest rates of 0.25% on all balances. This account has no monthly account-keeping fee, and full access via cards, online banking, mobile banking app, telephone banking, branch services, and the call centre.

With these 3 accounts, Regional Australia Bank donates 1% of each eligible account’s average annual balance to the community group of the customer’s choice, at no cost to the customer. Customers can choose from nearly 1,000 different community groups and causes, or they can apply for the bank to partner with a new organisation that they care about. In 2016, $627,000 was donated by Regional Australia Bank through this program.

Source: Regional Australia Bank

You can compare Regional Australia Bank products, among other products, using the Canstar website.

Compare Regional Australia Bank Transaction Accounts

What’s not to love?

Consider your options when it comes to the banks that really do give back to support our community and protect our environment.

Compare Mutual Banks with Canstar's Customer-Owned Banking Award

- “Warm ya heart” accounts

- Australian Military Bank – Military Rewards Account

- Bendigo Bank – CommunitySaver Account

- Beyond Bank – Community Reward Account

- Heritage Bank – Community Saver Account

- P&N Bank – Donation Saver Account

- Regional Australia Bank – Community Partnership Program

- What’s not to love?