Home loan rates remain low, but experts warn Aussies to consider 'interest rate proofing'

The Reserve Bank of Australia (RBA) has kept the official cash rate steady at its November meeting. As house prices around the country continue to increase, however, there are fears that today’s ultra-low home loan rates could see Aussie borrowers pushed into mortgage stress in years to come, with one expert suggesting it may be time to start “interest rate proofing”.

At its regular monthly meeting today, the RBA announced that the official cash rate would hold steady at 0.10%, however, governor Philip Lowe indicated the rate could be raised earlier than the assumed date of 2024.

The Board said that it will not increase the cash rate until actual inflation is sustainably within the 2% to 3% target range, and that this is likely to take some time, with central forecasts suggesting it may not occur until the end of 2023.

While the RBA cash rate remains steady, recent weeks have seen Aussie lenders shake up their rates, with National Australia Bank (NAB) being “the last of the major bank dominoes to fall”, cutting its one-year fixed rate last week while raising longer-term interest rates, in line with recent moves by its competitors.

These moves suggest major lenders are keen to entice new customers with low introductory fixed rates, on the expectation that rates will rise in years to come, when many of these borrowers may well have moved from their one-year fixed rate onto a variable rate.

It’s only a matter of time until the RBA raises the cash rate, so a question arises as to how Aussie homeowners will fare when this happens.

How have house prices stacked up against interest rates?

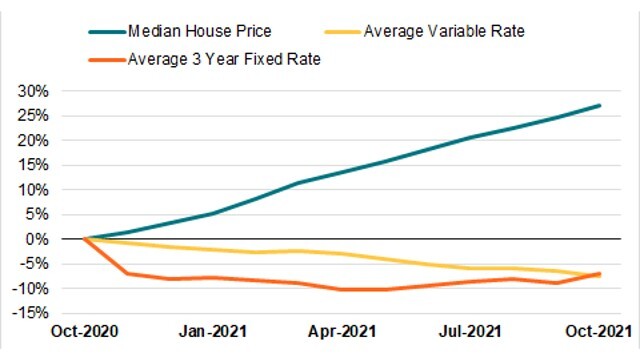

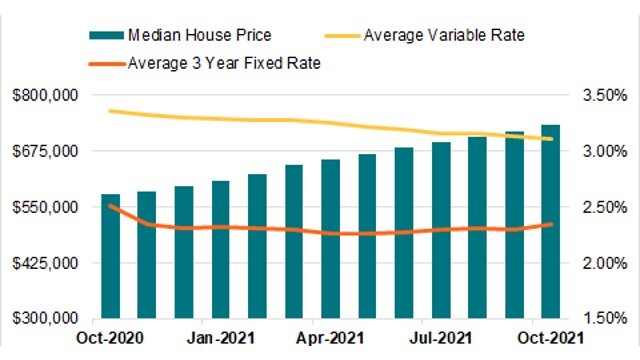

Canstar research into Australian house prices shows a staggering rise in the average house price over the past year. From October 2020 to today, prices around the country have risen on average more than 25%, with the average house price now exceeding $675,000.

Percent Difference to October 2020 Value

Source: www.canstar.com.au – 1/11/2021. Average rates based on owner-occupier loans on Canstar’s database, available for a loan amount of $500,000, at 80% LVR and with principal & interest repayments; excluding introductory variable and first home buyer-only loans. Average calculated at the end of each month. Median House Price per the Corelogic Home Value Index.

Home loan rates throughout the same period have lowered, with Canstar research showing a noticeable dip in the average variable rate on our database.

Median House Price vs Average Home Loan Rate

Source: www.canstar.com.au – 1/11/2021. Average rates based on owner-occupier loans on Canstar’s database, available for a loan amount of $500,000, at 80% LVR and with principal & interest repayments; excluding introductory variable and first home buyer-only loans. Average calculated at the end of each month. Median House Price per the Corelogic Home Value Index.

With Aussies paying more and more for houses, and mortgage rates tipped to rise, this means that the average Aussie’s repayments could go up in years to come, potentially by a significant amount.

Fears rate rises could push borrowers into mortgage stress

Canstar finance expert Steve Mickenbecker said that while the RBA has so far remained consistent in its view that it will hold the cash rate at the record low of 0.10% until 2024, there may be pressure for it to raise it earlier. He said the recent trend of lenders increasing fixed rates for terms greater than a year could suggest a possible cash rate hike as early as 2023.

Interest rates in Australia remain at historically low levels, but with house prices on the rise and Aussies paying more and more for homes, there is a potential danger that a rise in the official cash rate could push homeowners into mortgage stress in years to come.

“Canstar analysis shows that if the cash rate hiked by 0.25 percentage points and lenders passed this on in full, a residential borrower with a $1 million mortgage on the average variable rate of 3.09% would see their monthly loan repayments rise by $137 to reach $4,402,” Mr Mickenbecker said.

“For a residential borrower with a $500,000 loan on the average variable rate, a 0.25 percentage point rate rise would see their monthly repayments increase by $68 to $2,206.

“But this will be just the start of the race for rate increases, and a year down the track would surely see the cash rate increase by a full percentage point. If this happens, the borrower with a $1 million mortgage would see their monthly repayments rise by $561 to $4,826, which is quite a stretch.”

Aussies believe our hot property market needs cooling

A Canstar survey of 1,280 Australians, completed last week, found that more than half believe that our nation’s hot property market needs cooling, with 29% indicating a belief that lenders should increase interest rates, based on the assumption that doing so will reduce demand for property and cool prices.

22% argued that increasing rates is not the answer, with around a third of these respondents saying that compensating first home buyers for price increases and putting tougher restrictions on lenders could be ways to help cool the market.

Of those who felt that rate rises are not the answer, 27% indicated they would support the scrapping of negative gearing and capital gains tax discounts, while 29% said they were in favour of less red tape to encourage property development and construction, adding to the supply of housing. Around a third (33%) said they would support tougher restrictions on lending to investors.

What can borrowers do ahead of rate rises?

Mr Mickenbecker said borrowers could prepare for the eventuality of higher rates by making additional home loan repayments “before the banks ask for them”. He noted that generally speaking, borrowers on a variable rate loan will be allowed to make additional repayments on top of their standard monthly repayments, without being charged a penalty.

Many variable rate loans also include offset accounts and redraw facilities as features, meaning borrowers can put extra money away on their home loan to help lower their interest repayments, and then draw on this money again if needed.

“Low rates give a great opportunity to get the loan down and build up a buffer that can be redrawn to help with higher repayments if times get tough,” he said. “The buffer will grow faster again if borrowers also refinance into one of the very low interest rates available today.”

“Canstar currently lists 195 loans below 2%, and home owners on an average rate of 3.09% are paying way too much already,” he added. “The time to start interest rate proofing yourself is now, when rates are low.”

Interest rate moves in October 2021

The following is a snapshot of interest rate movements in October 2021, according to Canstar data.

Home loans:

- 18 lenders cut 45 variable rates by an average of 0.27%

- 10 lenders cut 33 fixed rates (1 or 2 year) by an average of 0.16%

- 27 lenders increased 343 fixed rates by an average of 0.17%

- The average variable interest rate for owner occupiers paying principal and interest is 3.10% and the lowest variable rate is 1.77% for 60% LVR or 1.88% for 80% LVR

- The average variable interest rate for investors paying principal and interest is 3.45% and the lowest rate is 1.89% for 60% LVR or 1.95% for 80% LVR

Savings accounts:

- 5 providers cut base accounts by an average of 0.09%

- 10 providers cut bonus accounts by an average of 0.09%

- 6 providers cut promo accounts by an average of 0.11%

- Bonus savings accounts: The maximum rate is 1.35% and the average rate is 0.58%. A rate of 2.50% is available from: Westpac for 18 to 29 year olds with a balance of up to $30,000, and BOQ for 14 to 24 year olds with a balance of up to $10,000

- Promotional savings accounts: The maximum rate is 1.35% (available for a 4-month period) and the average rate is 0.56%

- Ongoing savings accounts: The maximum rate is 0.90% and the average rate is 0.20%

Term deposits:

- 15 providers cut 109 rates by an average of 0.07%

- 8 providers increased 30 rates by an average of 0.18%

- The average 1-year term deposit rate is 0.47% and the maximum rate is 0.99%

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Up to $4,000 when you take out a IMB home loan. Minimum loan amounts and LVR restrictions apply. Offer available until further notice. See provider website for full details. Exclusions, terms and conditions apply.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

10% min deposit

10% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

40% min deposit

40% min deposit

Redraw facility

Redraw facility

Owner occupied

Owner occupied

40% min deposit

40% min deposit

Redraw facility

Redraw facility

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promoted products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promoted products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

Cover image source: Shuang Li/Shutterstock.com

This article was reviewed by our Sub Editor Tom Letts and Deputy Editor Sean Callery before it was updated, as part of our fact-checking process.

Alasdair Duncan is Canstar's Content Editor, specialising in home loans, property and lifestyle topics. He has written more than 500 articles for Canstar and his work is widely referenced by other publishers and media outlets, including Yahoo Finance, The New Daily, The Motley Fool and Sky News. He has featured as a guest author for property website homely.com.au.

In his more than 15 years working in the media, Alasdair has written for a broad range of publications. Before joining Canstar, he was a News Editor at Pedestrian.TV, part of Australia’s leading youth media group. His work has also appeared on ABC News, Junkee, Rolling Stone, Kotaku, the Sydney Star Observer and The Brag. He has a Bachelor of Laws (Honours) and a Bachelor of Arts with a major in Journalism from the University of Queensland.

When he is not writing about finance for Canstar, Alasdair can probably be found at the beach with his two dogs or listening to podcasts about pop music. You can follow Alasdair on LinkedIn.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Up to $4,000 when you take out a IMB home loan. Minimum loan amounts and LVR restrictions apply. Offer available until further notice. See provider website for full details. Exclusions, terms and conditions apply.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.