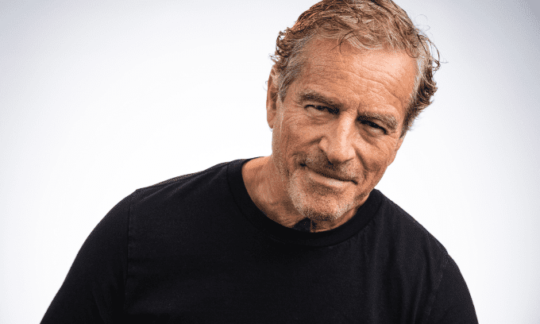

Mark Bouris forecasts when rates will fall and shares his tips for borrowers

Canstar’s Effie Zahos caught up with Mark Bouris to get his thoughts on what’s next for rates and his tips for borrowers.

Not too long ago I had an excellent chat with Mark Bouris on his podcast, The Mentor, about the challenges many Aussies are facing given rates have increased significantly over the past 16 months and the cost of living has soared.

I thought it would be great to get Mark’s thoughts on the Reserve Bank’s September cash rate decision, when he thinks rates will move next and his tips for borrowers doing it tough. Here are his insights.

What are your thoughts on today’s interest rate decision?

Well, today’s decision not to put rates up is no surprise to me, nor is it a surprise to the money market. The money market was predicting a 0% chance of a rate rise and a very large chance (86%) of keeping rates where they were. And that makes sense because if you look at any of the data, there’s no data out there at this stage to suggest the need to increase rates. So, I’m not surprised one iota.

So what is your forecast for the cash rate moving forward – when do you think the RBA will start reducing the cash rate?

Well, my prediction for the cash rate moving forward is that the RBA will leave rates on hold for a good six to seven months waiting to see what the net effect is on the economy, especially on gross domestic product (GDP), inflation and the labour market.

The RBA board has outlined where they would like those numbers to be before they start thinking about reducing the cash rate. They definitely don’t want GDP to be negative. As for inflation, they want to see it between 2% and 3% on a quarterly basis or at least starting to trend towards that number. And, they’ve made it clear that unemployment needs to get closer to 4.5%.

So when those three numbers are where the RBA wants (or in the case of GDP doesn’t want) them to be that’s when we may see interest rates coming down. Until that point, the RBA is going to leave them where they are.

There are still a significant number of loans that will roll off fixed rates before the end of the year. What are your tips for people whose low fixed rate is coming to an end?

If you’re rolling off a low fixed rate, talk to your lender and try to negotiate a better variable rate. So, if the variable rate they are offering is around 6% tell them you are going to refinance unless they give you something starting with a five or in the low fives. Banks would rather discount your variable rate against their advertised rate instead of trying to find a new customer. If you can’t negotiate a deal with your bank then you should try to refinance your loan with another lender.

You’ve gone on record saying that people will be forced to sell their homes. How do people know when that is an option that should be exercised?

You should try to explore all your options before making the decision to sell. If your income currently is not sufficient to service your debt make sure you go out and see if you can get another job or get some more income somehow. That might mean asking for a pay rise or getting a second job. Just try to get some more money coming in.

Always have a crack at that first but if that doesn’t work you may consider selling. From my point of view, and keep in mind this is not financial advice, the best time to sell your home is when you know there’s still some equity left.

If you’re completely underwater and you’re making your mortgage payments by borrowing money on credit cards or borrowing money from family because you don’t have enough money coming on to meet your repayments, then you should consider selling even if there’s no equity left in your property. It can help take the pressure off and you can start all over again.

If you’re not under that pressure, but you can see the pressure coming for some reason, then the best time to sell may be now because house prices are pretty strong. It means you’re going to get your equity back which is very important. If you sell now, you can put the money into a high-paying account and wait for things to turn around. I think there’s going to be a lot of people selling in September, October and November this year.

This article was reviewed by our Editorial Campaigns Manager Maria Bekiaris before it was updated, as part of our fact-checking process.

- What are your thoughts on today’s interest rate decision?

- So what is your forecast for the cash rate moving forward – when do you think the RBA will start reducing the cash rate?

- There are still a significant number of loans that will roll off fixed rates before the end of the year. What are your tips for people whose low fixed rate is coming to an end?

- You’ve gone on record saying that people will be forced to sell their homes. How do people know when that is an option that should be exercised?

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

50% min deposit

50% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.