Neobank 86 400 launches home loans, ditches paperwork

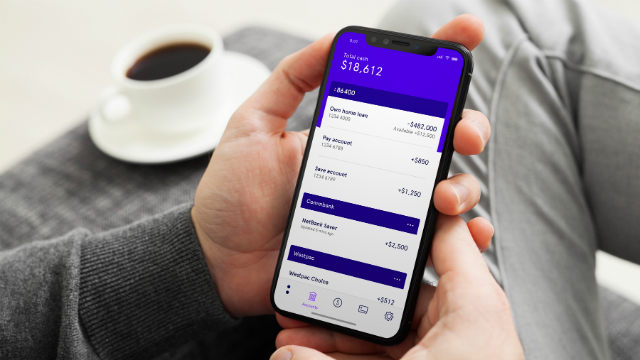

A neobank has launched a new suite of home loans that it promises will virtually do away with paperwork. 86 400 says you’ll only have to sign one physical paper document during the application process, but you can only get the loan through brokers.

Neobank 86 400 launched its home loans this week, offering rates as low as 2.88% (comparison rate 3.31%). And while that’s not the lowest rate currently listed on Canstar’s database – Reduce Home Loans’ 2.69% (2.71% comparison rate) holds that title at the time of writing – the bank has come out swinging, promising to slash application times and almost all paperwork.

The loans, which include owner-occupier and investor products, are only accessible exclusively via a select number of mortgage brokers at present.

86 400 CEO Robert Bell said the response had been “fantastic” to yesterday’s launch with “selected accredited mortgage brokers”.

“We’re excited to continue to grow our network of brokers and onboard homebuyers in the coming months through our careful and considered rollout,” Mr Bell said.

How does the 86 400 home loan application process work?

86 400 Home Loan Lead Melissa Christy said the bank’s application process was almost completely virtual, and could be completed on a smartphone. She said the only physical document required in the process was the contract of sale.

“We have made the process transparent, easy to understand and quick so consumers can focus on finding their dream home rather than drowning in paperwork and unknowns,” Ms Christy said.

She said the bank’s purpose-built portal would allow loan applicants to “pull relevant information from their accounts to pre-populate the application”. This includes details such as income details and expenses, and Ms Christy said this feature could help the broker and the borrower complete the loan process faster than would otherwise be the case. Applicants can link their non-86 400 bank accounts to the portal, allowing information from those accounts to be pulled into the application.

A bank spokesperson said the process is as follows:

- Once applicants have met with their broker, the applicant electronically supplies their income and expenses.

- This data is categorised, verified by the applicants and populated electronically into their application. This happens in minutes and saves the applicant the lengthy process of having to manually pull this information or provide paper documents.

- Applicants also go through identity verification on their mobile phones, and sign most of their loan documents electronically.

“By using smart technology we are able to get a very accurate picture of an applicant’s financial position and save time and effort for both the applicant and the broker along the way,” the spokesperson said.

The launch of the home loan products comes two months after the bank released its transaction and savings account offerings.

86 400 is not the first bank to offer digital home loan applications, but it does have the honour of being the first neobank to do so publicly. However, neobank Xinja’s website states that that bank has already offered home loans to “a limited number of friends and family”, and said it would “be rolling out to the public in 2020”.

What home loan interest rates is 86 400 offering owner-occupiers?

| 86 400 Owner-occupier home loans – Variable rates | ||

| Repayment type | Advertised rate (p.a.) | Comparison rate (p.a.) |

| Principal and Interest | 3.09% | 3.36% |

| Interest only | 3.69% | 3.56% |

| Source: 86400.com.au, current as of 12/11/2019 | ||

| 86 400 Owner-occupier home loans – Fixed rates, principal and interest | ||

| Fixed term length | Advertised rate (p.a.) | Comparison rate (p.a.) |

| 1 year | 3.29% | 3.38% |

| 2 years | 2.88% | 3.33% |

| 3 years | 2.88% | 3.31% |

| 5 years | 3.39% | 3.48% |

| Source: 86400.com.au, current as of 12/11/2019. | ||

| 86 400 Owner-occupier home loans – Fixed rates, interest-only | ||

| Fixed term length | Advertised rate (p.a.) | Comparison rate (p.a.) |

| 1 year | 3.69% | 3.41% |

| 2 years | 3.59% | 3.44% |

| 3 years | 3.59% | 3.47% |

| 5 years | 3.79% | 3.60% |

| Source: 86400.com.au, current as of 12/11/2019. | ||

What home loan interest rates is 86 400 offering investors?

| 86 400 Investor home loans – Variable rates | ||

| Repayment type | Advertised rate (p.a.) | Comparison rate (p.a.) |

| Principal and Interest | 3.44% pa | 3.71% pa |

| Interest-only | 3.79% pa | 3.82% pa |

| Source: 86400.com.au, current as of 12/11/2019 | ||

| 86 400 Investor home loans – Fixed rates, principal and interest | ||

| Fixed term length | Advertised rate (p.a.) | Comparison rate (p.a.) |

| 1 year | 3.59% | 3.72% |

| 2 years | 3.18% | 3.66% |

| 3 years | 3.18% | 3.64% |

| 5 years | 3.59% | 3.77% |

| Source: 86400.com.au, current as of 12/11/2019. | ||

| 86 400 Investor home loans – Fixed rates, interest-only | ||

| Fixed term length | Advertised rate (p.a.) | Comparison rate (p.a.) |

| 1 year | 3.74% | 3.73% |

| 2 years | 3.38% | 3.69% |

| 3 years | 3.38% | 3.68% |

| 5 years | 3.69% | 3.78% |

| Source: 86400.com.au, current as of 12/11/2019. | ||

How much does it cost to take out a home loan with 86 400?

The minimum initial cost of taking out a loan with 86 400 is typically $250, plus any added valuation fees, lender’s mortgage insurance and government charges that may apply. For fixed-rate loans, there’s also an option to pay a “rate lock fee” of $500, which will hold the agreed interest rate on the loan for a period of 90 days.

86 400 details its fees as follows:

- Loan advance fee: $250

- Valuation fee: free if the valuation costs under $300, total fee minus $300 if over $300

- Annual fee: $250 (per year, for up to five loans)

The bank’s “key facts sheet” states that other loan set-up fees, such as lender’s mortgage insurance and government charges such as registration fees and stamp duty, have not been included in this list of fees, adding that these will be determined after a would-be borrower has completed their application.

What does the bank name “86 400” mean?

The bank name 86 400 represents the number of seconds in a day. The company says it chose that name because it wanted people to know it is “helping Australians feel in control of their money, every second of every minute of every day”.

The bank was granted a full banking licence on 18 July as an “authorised deposit-taking institution”, which means deposits of up to $250,000 per customer are guaranteed by the Australian Government’s Financial Claims Scheme.

A journalist for more than two decades, Amanda Horswill has reported on a galaxy of subjects, including property, lifestyle, hyper-local news, data journalism, the Arts and careers.

She’s served as the Editor of Brisbane News, Deputy Features Editor for The Sunday Mail, Deputy Editor – Digital at Quest Community News, and a host of other senior positions at News Corp, prior to joining Canstar.

Amanda is fascinated with the ever-changing world of finance. A passionate believer in the motto “knowledge is power”, she strives to translate the news into practical information that will help readers make informed decisions about their future. While at Canstar, her work was regularly referenced by publishers such as the Sydney Morning Herald , The Age, The New Daily and Yahoo Finance.

Amanda holds a Bachelor of Arts (Journalism, Media Studies and Production, and Public Relations) and a Graduate Certificate in Editing and Publishing, from the University of Southern Queensland.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

10% min deposit

10% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.