So, you’ve checked your credit score and it is 855. But what does that mean? Is that a good score or could it hold you back? We take a look at a credit score of 855, and reveal what it could potentially mean for you when applying for credit.

What does a credit score of 855 mean?

According to credit rating bureau Equifax, which powers Canstar’s credit score tool, if you’ve checked your score and have a rating of 855, that means you have an Excellent credit score. Congratulations! This is the highest credit rating band and indicates that you have an exemplary credit history.

The other two credit bureaus that operate in Australia, Experian and Illion, have their own credit score scale and bands.

What does an Excellent credit score mean?

Equifax’s data shows people who score in this range are in the top 20% of Australian consumers with an Equifax credit report and are highly unlikely to experience an adverse event that will harm their credit score in the next 12 months. An Excellent credit score is between 853 and 1200.

Is a credit score of 855 good or bad?

Whether or not a credit score is ‘good’ or ‘bad’ depends on what you want to use it for and your circumstances. The higher your credit score, typically the more likely you are to be approved for credit. As you have the highest rating – Excellent – this means your application should be viewed more positively by lenders than applicants with a lower score. In this sense, an ‘Excellent’ credit score is a ‘good’ thing.

It’s important to keep in mind, though, that a credit score is only one factor lenders take into consideration when reviewing loan applications. So while having a high credit score may help, it’s no guarantee that you would be automatically approved. This is partly because the scores, and the groupings of the score into the various bands, are based on general assumptions made from financial behaviour data collected by credit bureaus.

Learn more: What do lenders look for in a borrower?

What are the benefits of having an Excellent credit score?

If you have an Excellent credit score, it’s likely that:

- there could be more products available to you to apply for. A review of Canstar’s database shows there are products specifically marked as being ideal for customers with ‘Excellent credit’. These include certain types of personal loans.

- lenders, and any company using a credit score to judge your risk, would view an Excellent credit score favourably, which could mean that it could be easier for you to be approved for a loan.

- you may well represent a desirable customer, as your credit history should show that when you borrow funds, you pay them back on time. That could mean that you have more bargaining power than other customers, so it could be worthwhile haggling with your lender for a better interest rate, loan features or other incentives.

- banks and lenders may be willing to let you borrow more money if you have a high credit score, because you have demonstrated an ability to meet your repayments on time in the past. While it may be useful to be able to borrow greater amounts depending on your plans, it’s also important to consider whether you would be able to meet the increased repayments without placing strain on your finances.

Learn more: Take advantage of a high credit score

What can you do with a credit score of 855?

If you have an Excellent credit score, it may be that your business is more highly prized by lenders than other borrowers, there are more products available for you to apply for, and that you may be more easily approved for credit. So, if you need to borrow funds, having an Excellent credit score could prove helpful. That being said, it’s only one thing a lender looks for when approving a loan.

You may also want to preserve your high credit score by continuing to follow any repayment schedules and avoiding any unnecessary credit applications.

Learn more: 10 ways you could be hurting your credit score

How can you improve a credit score of 855?

If you have an Excellent credit score, it’s likely that you’ve already done the hard work to present a pristine financial track record. However, if you do want to improve your score, the advice is the same for all Australians – maintain healthy financial habits.

Plus, It could also be a good idea to check your credit score and report from time to time, to make sure that your Excellent rating hasn’t slipped. If you notice any mistakes on your credit report when doing so, you can contact the issuing credit bureau to request a correction to your credit report.

Learn more: How to improve your credit score.

Learn more about your credit score

What is a credit score?

A credit score is a rating that shows how risky a credit bureau believes you to be when it comes to borrowing (and paying back) money. It’s a number that companies, including financial institutions, typically look at when they are deciding to do business with you, such as when assessing a loan application. Credit bureaus, including Equifax, calculate your credit score by taking into account anything recorded on your credit history.

Your credit history is a record of your financial footprint, such as how many credit cards you may have, what your repayment history is like, or if you have a home loan. It typically also includes any applications for credit, regardless of whether or not you were approved for that credit.

Check your credit score for free with Canstar.

What are the credit score bands?

Credit scores grouped into ‘bands’, based on that population-level data.

Below Average

Credit score of 0 (or below) to 459

Equifax says scores in this range belong to people who are more likely than consumers in the higher ranges to experience an adverse event such as default, bankruptcy or court judgement in the next 12 months. (Canstar’s credit score tool’s scale starts at 0, so any negative scores are expressed as 0.)

Average

Credit score of 460 to 660

If you score in this range, Equifax data shows it is likely you’ll incur an adverse event such as a default, bankruptcy or a court judgement in the next 12 months.

Good

Credit score of 661-734

Equifax’s data shows people who score in this range are more likely than consumers who score in the lower ranges to keep a clean credit report in the next 12 months, and are less likely to experience an adverse event during this period.

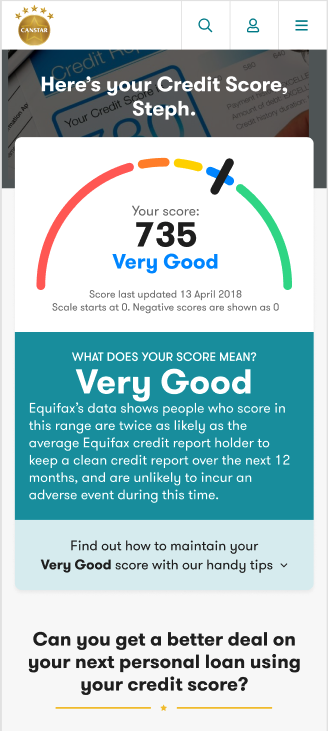

Very Good

Credit score of 735-852

Equifax’s data shows people who score in this range are twice as likely as the average Equifax credit report holder to keep a clean credit record over the next 12 months, and are unlikely to incur an adverse event during this time.

Excellent

Credit score of 853-1200

Equifax’s data shows people who score in this range are in the top 20% of Australian consumers with an Equifax credit report and are highly unlikely to experience an adverse event that will harm their credit score in the next 12 months.

Further reading

Cover image source: TierneyMJ/Shutterstock.com

This content was reviewed by Editor-in-Chief Nina Tovey as part of our fact-checking process.

Share this article