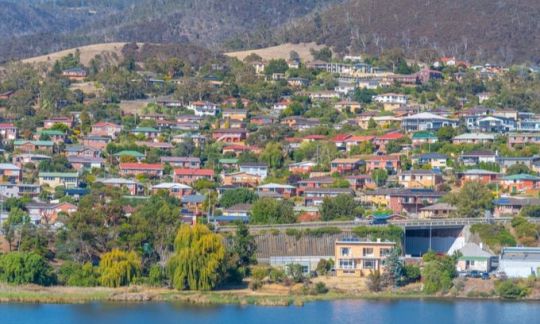

First Home Owners Grant Tasmania 2023

If you’re buying a first home in Tasmania, you may well be getting your finances in order and wondering if there are any grants that can help you – the good news is that the First Home Owner Grant in Tas is one of the most generous across all of Australia’s states and territories. It could provide the cash boost you need to get into a place of your own sooner.

Tas first home buyer grants and other support: What’s available?

Average home values across Tasmania have climbed rapidly in recent years. While this can make it more challenging for first home buyers to get into the market, a decent helping hand of financial support may be available through the First Home Owner Grant in Tassie.

How much is the First Home Owner Grant in Tas?

Until 30 June 2023, the First Home Owner Grant in Tas is a generous $30,000 but it’s only available when you buy or build a brand-new home, including if you buy off the plan.

Unlike other states, there is no price limit on the value of your first home to be eligible for the First Home Owners Grant in Tasmania. The chief condition is that you need to buy or build a new home. The Grant is not available for established homes.

First Home Owner Grant Tasmania eligibility

The First Home Owner Grant in Tasmania doesn’t just set limits on how much you pay for your first home. Eligibility also requires meeting several other conditions. For example, to be eligible you (and your partner, if applicable) must:

- be at least 18 years old, and

- at least one of you must be a permanent resident or Australian citizen.

You or your spouse/partner also must not have owned a residential property in Australia prior to 1 July 2000, or have lived for more than six months in a residential property you owned after 1 July 2000. This suggests you could still be eligible if you have owned an investment property after mid-2000 that you have never lived in yourself.

Once you have purchased your first home, you’ll need to live there for at least six months within a year of your settlement date or completion of a new build.

How to apply for the First Home Owner Grant in Tas

You can apply for the First Home Owner Grant by lodging an application through your lender or mortgage broker. Alternatively, you can lodge your own application through the State Revenue Office of Tasmania.

If you buy a newly constructed home, you can send in your application for the first home buyers grant after the sale is complete. Or, if you are building your first home, you can lodge your application after you’ve made the first progress payment, or when construction is complete.

Are first home buyers in Tas exempt from stamp duty?

The type of first home you buy in Tasmania will determine whether or not you’re eligible for savings on stamp duty.

If you buy or build a new home in Tasmania, you may be eligible for the First Home Owner Grant, but no stamp duty concessions apply.

If you buy an established home in Tassie, you may be eligible for savings on stamp duty, but as we’ve seen, you can’t claim the First Home Owner Grant. If you choose to buy an established home, as a first home buyer you can claim a 50% discount on stamp duty as long as the home is valued at $600,000 or below. This concession is due to end on 30 June 2023.

The upshot is that as part of your home buying plans, it can be worth thinking about which delivers most value to you – the First Home Owners Grant TAS or a 50% saving on stamp duty.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

10% min deposit

10% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.