Australian economy: COVID-19 vs The Great Depression

Welcome to the Great Depression of 2020 – but it’s not as bad as it could be. That seems to be the message Australian Treasurer Josh Frydenberg delivered to the nation today.

“The COVID-19 pandemic is a once-in-a-century shock,” Mr Frydenberg’s Economic and Fiscal Update, covering to the end of June 2021, states. “The COVID-19 pandemic has caused severe contractions in economic activity. As a result, the world is experiencing its most severe economic crisis since the Great Depression.

“Australia has outperformed most other countries in both health and economic outcomes through this crisis. However, the outbreak of COVID-19 globally and the resulting containment measures are having profound impacts on Australia’s economy.”

→ Budget Update: When do the government COVID relief and support packages expire?

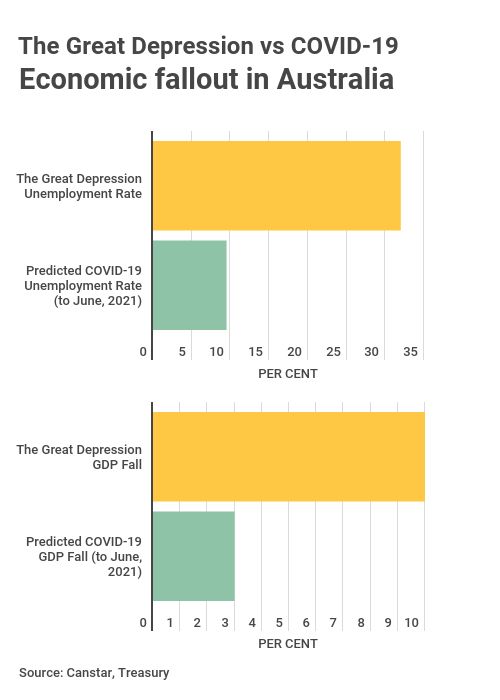

During the Great Depression, Australia’s unemployment rate rose to as much as 32% in mid-1932, according to statistics from the Parliament of New South Wales. GDP, the value of goods and services the country was able to produce and an important marker of economic health, fell by almost 10% in 1930-31.

However, the figures in Treasury’s Update predicts the official unemployment rate will peak at around 9.25% by the end of 2020 (although Mr Frydenberg has stated that “real” unemployment could be as high as 13.3% before recovery). GDP is predicted to fall less than 3%.

The update included these insights into the economic effects of the pandemic in Australia:

- $289 billion in economic support paid, which is 14.6% of Gross Domestic Product (GDP)

- Estimated Deficits:

- 2019-20: $85.8 billion

- 2020-21: $184.5 billion

Australia is experiencing a health & economic shock like no other in the last 100 years.

While our economy has taken a big hit & we confront major challenges, we will get through this as a nation. pic.twitter.com/jJ3YKI2qWd

— Josh Frydenberg (@JoshFrydenberg) July 23, 2020

Mr Frydenberg presented a range of figures, graphs and tables to the nation today, too, which paint a picture of Australia’s economic performance during the coronavirus pandemic, and what is predicted to happen in the near future. Below are some highlights:

What difference did government support make to predicted economic outcomes?

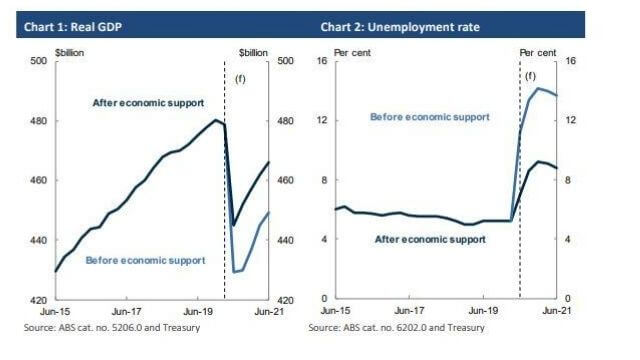

Mr Frydenberg said support packages were helping to soften the blow of the economic fallout from the pandemic. He said this was particularly evident in the unemployment rate and “Real GDP” – GDP after it has been adjusted for inflation, which is generally thought to give a more realistic picture of the movement in an economy’s capacity to produce goods and services.

The chart below shows what he means – the light blue line is what was projected to have happened if the government had not stepped in with support measures. The darker line shows what is predicted to happen now as a result of the support: the economy should be able to produce more goods and services, which keeps more people employed.

“Fiscal measures are also estimated to have lowered the peak of the measured unemployment rate by around 5 percentage points, preventing the loss of around 700,000 jobs,” the Update stated.

Source: Budget.gov.au

What will happen to jobs during the next phase of the COVID-19 pandemic?

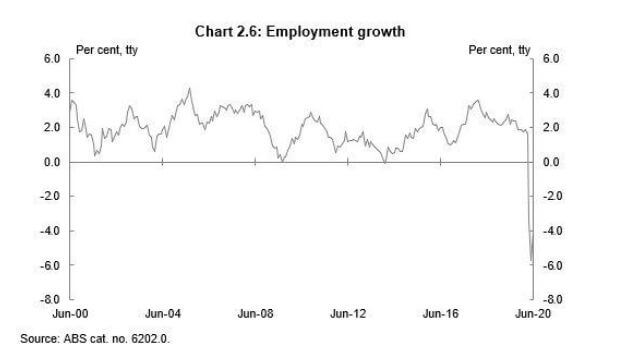

Based on a number of assumptions the Government based its findings on, the Update included a mixed forecast about employment. The Update notes there are expected to be more job losses, with the unemployment rate expected peaking around 9.25% in the December quarter.

But, it also states that it is expected that the job landscape could improve somewhat from where it sits now. However, there is a catch – the improvement will be increased hours for existing employees, rather than the creation of new jobs due to businesses hiring new staff.

“Further increases in the unemployment rate are likely to be driven by rising labour force participation as those who dropped out of the labour market at the start of the crisis begin to look for work again as the economy opens up. The unemployment rate is expected to gradually decline from the start of 2021 to be around 8.75% in the June quarter 2021.”

The below graph shows employment growth to date, over the last 20 years, with a steep drop-off in 2020 already visible.

How will household incomes and wealth be impacted? What about property prices?

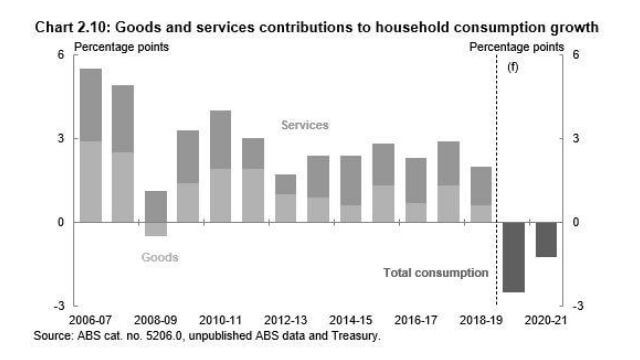

The Update stated that the government expected people to be spending less and saving more due to the decreased chances to go out and spend money (measured in “consumption growth”) as well as the economic support package payments. However, it also predicts that Australians will become poorer overall, due to a predicted fall in how much their assets are worth, including their home.

The Update also included specific predictions on key aspects of the Australian economy:

- Household budgets: “While household income is expected to hold up in the near term, there have been significant falls in household wealth… The support to household incomes, combined with the weakness in consumption, is expected to result in a sharp increase in the household saving ratio in the June quarter 2020. The household saving ratio is expected to reach a near record high in the June quarter to be around double that seen during the GFC, before moderating as labour market conditions improve.”

- The stock market: “Australia’s ASX200 has recovered some of its losses since the onset of the crisis, but it remains substantially below the highs reached in late February.”

- Property prices: “The outlook for the established housing market remains uncertain with prices falling in June for a second consecutive month despite transaction activity starting to recover alongside the easing of restrictions… Dwelling investment (the amount spent on homes in Australia – buying, building or major renovations) is forecast to fall by 16% in 2020-21.”

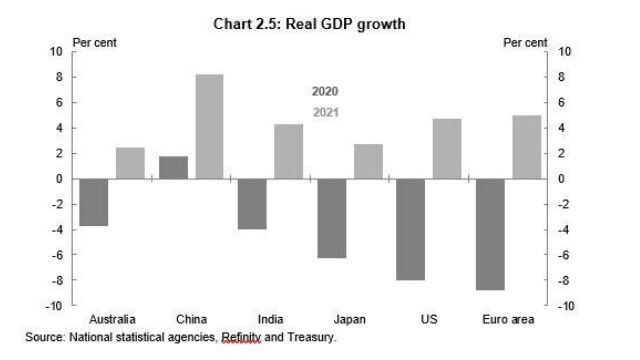

Prediction: How might Australia fare compared to other nations?

Mr Frydenberg said that while Australians are facing some fallout from COVID-19, we are doing relatively well in comparison to some other nations. The Update states that while it’s hard to predict when the world will recover from the crisis, it’s likely to take some time.

“Uncertainty surrounding the COVID-19 pandemic and the global recession may dampen economic sentiment more than expected, leading to weaker than expected global economic activity,” the Update stated. “The extent of any longer‑lasting effects from the pandemic is also uncertain, including as a result of persistently high unemployment, business failures or broader changes in the structure of the economy both domestically and globally. This economic scarring may suppress the pace of recovery.”

Follow Canstar on Facebook and X for regular financial updates.

A journalist for more than two decades, Amanda Horswill has reported on a galaxy of subjects, including property, lifestyle, hyper-local news, data journalism, the Arts and careers.

She’s served as the Editor of Brisbane News, Deputy Features Editor for The Sunday Mail, Deputy Editor – Digital at Quest Community News, and a host of other senior positions at News Corp, prior to joining Australia’s biggest financial comparison website, Canstar.

Amanda is fascinated with the ever-changing world of finance. A passionate believer in the motto “knowledge is power”, she strives to translate the news into practical information that will help readers make informed decisions about their future. While at Canstar, her work has been regularly referenced by publishers such as the Sydney Morning Herald , The Age, The New Daily and Yahoo Finance.

Amanda holds a Bachelor of Arts (Journalism, Media Studies and Production, and Public Relations) and a Graduate Certificate in Editing and Publishing, from the University of Southern Queensland.

Follow her on LinkedIn and Canstar on Facebook. Meet the Canstar Editorial Team.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

40% min deposit

40% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.