What Are Bonds And How Do They Work?

The chances are you’ve come across the term ‘bonds’ before but perhaps you’re unsure of what a bond is and why they exist.

You might have gone as far as googling ‘bonds’ or ‘How to buy bonds?’ but alas the search results only returned images of fresh-faced Aussies in their underwear and ads for men’s trunks – not quite what you were after. From there, bonds remained a mystery. Well, that’s about to change because we are going to break it down for you with an introduction to the world of bonds.

What is a bond?

A bond is a debt instrument, a form of lending. The easiest way to think of a bond is to liken it to an interest-only loan. When you purchase a bond you are essentially loaning money to an entity, typically a corporation or government, to fund projects or activities. In exchange for your loan, the bond issuer will pay you regular interest until the end of the loan period, after which you will receive your initial loan back.

Bonds can be a tool used in your investment portfolio to create balance and diversification and a way to strengthen your portfolio’s risk return profile. This is because in a volatile market, bonds can remain fairly stable with less volatility.

Here are a couple of terms to get you started:

Face value: This is the nominal value of the bond, typically $100. Face value is the term used to describe the principal amount lent to the bond issuer which they commit to repay to investors when the bond matures. You may also hear it referred to as the par value.

Coupon rate: The annual interest paid to the investor and is calculated as a percentage of the face value. Coupon payments can be made quarterly, semi-annually or annually.

Maturity date: This is the date the bonds effectively expires and final payments are made to investors. These payments include the initial loan and the final coupon.

An example of how investment bonds work

Now that you have the key terms down pat and an idea of what a bond is, here is an example of a bond in action.

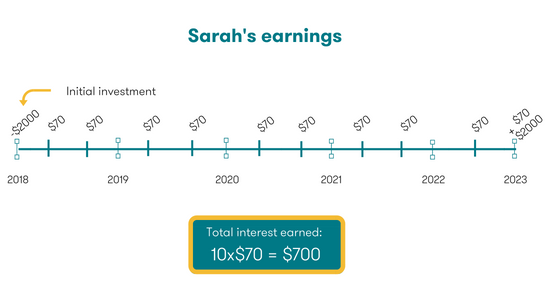

Due to their current success, Barbara’s Bakery is looking to finance the opening of several new stores. They decide to issue bonds, which will have a face value of $100, a 7% coupon rate paid semi-annually and a maturity date of five years. Sarah decides to invest $2,000 into this bond, which equates to 20 parcels valued at $100. She will then receive $70 twice a year for five years. When the bond reaches its maturity date the bond issuer, Barbara’s Bakery will repay Sarah the face value plus the final coupon. The below illustrates Sarah’s earnings:

why-are-bonds-known-as-fixed-income-investments?">Why are bonds known as fixed-income investments?

Due to the fixed-rate nature of a bond and the generally lower level of risk they carry, bonds are considered a defensive asset. Where the risk does lie, is in the chance of the bond issuer defaulting on the loan and not being able to pay it back. Therefore, the level of risk varies depending on the type of bond and the company that is issuing it. Let’s compare three different bonds as an example:

- Barbara’s Bakery

- BHP

- Australian Government Bond

As the bakery is a small, less established company, a bond with them will be riskier than it would be for BHP, a well-established corporation. Of the three, the Australian Government Bond is considered the least risky, as it has the full backing of the government, the chances of defaulting are low. But keep in mind the lower the risk the less interest you are likely to earn.

Related article: What is an asset class?

How are bonds valued and how do you buy bonds?

Generally, there are two ways to purchase bonds. When a bond is first issued you can purchase it directly from the company, afterwards, they are listed on the secondary market where investors can buy and sell their bonds.

View all Canstar rated Online Share Trading products. View Disclosures.

Let’s just take a second to recap, remember when we discussed face value? The face value of a bond, typically $100, remains fixed for the lifetime of the asset. The face value is also equal to the price of a bond when first issued i.e. when you buy a bond directly from a company. However, once a bond is listed on the secondary market the value of the bond fluctuates due to changes in market conditions, particularly changes in interest rates. When interest rates rise, the market value of the bond falls. The reason for this is if a bond has a coupon rate of 5% but the interest rate rises to 7%, the coupon rate on the bond will now be less attractive to investors and they will be willing to pay less for it.

The coupon rate more often than not is based on a percentage of the face value, therefore it too remains fixed. So, where you will see a difference in the market value of a bond is in the market price. For example, if interest rates rise, the value of a bond may fall below its face value, perhaps leaving the market price at $92. However, when the bond reaches its maturity date, investors will still receive the face value of the bond – typically $100. Therefore, if you had bought in at that time you’d make an additional profit on that investment.

Related article: 4 Ways To Buy Bonds

how-to-invest-in-government-bonds-in-australia">How to invest in government bonds in Australia

If you are considering purchasing a bond, ensure you thoroughly read and understand the prospectus set by the bond issuers first. The prospectus will outline all the key features of a bond and risks that investors need to be aware of. If you would like further information on the risks involved and whether investing in bonds is right for your portfolio, you should contact a financial adviser.

To learn more about bonds, check out this resource from the ASX.

Cover image source: Andrii Yalanskyi/Shutterstock.com

This article was reviewed by our Content Producer Isabella Shoard and Sub Editor Tom Letts before it was updated, as part of our fact-checking process.

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.