What moves the stock market?

Every night on the news we hear about the market going up or down. But even though movements in the market tend to be closely followed by many in the finance industry as well as a large cohort of investors, it’s not always clear what causes these shifts. Understanding some of the key factors that move the market can potentially help investors improve their investing success by being able to determine which moves are important and which are just noise.

The mechanics of the market

A critical thing to remember when trying to understand a market price of a share is that it usually represents the price of the last transaction. The buyers and sellers in that market are in it for many different reasons and with varying views of the future. Therefore, we get a standoff of prices that is referred to as market depth. Here’s a simplified hypothetical example:

AAA Stock

Last trade: $10.50

| Buyers | Sellers | ||

|---|---|---|---|

| Volume | Offer Price | Volume | Offer Price |

| 3 | $9.50 | 2 | $10.50 |

| 20 | $9 | 18 | $11 |

| 50 | $9.00 | 5 | $11.50 |

| 30 | $8 | 30 | $12 |

| 45 | $7.00 | 1 | $12.50 |

In this example, AAA shares last traded at $10.50 and someone is still trying to sell their shares at this price. However, as you can see above there aren’t enough buyers at that price to clear all of the shares that are available. If a new buyer entered the market and wanted to buy 10 shares at $11, then they could get two at $10.50 and the remaining eight at $11, leaving ten still on market at $11. This would also move the market price to $11, as this was the price at which the last trade was made.

To understand what moves the markets, the next step is asking ‘why’? Given the market price just reflects the buyers and sellers who have matched transactions, to understand why the price is moving requires us to understand why those buyers and sellers are in the market to begin with.

Here are a few examples of various sorts of investors in the market and how they can move the market.

Fundamental investors

These are the investors who have crunched the numbers on a stock and have determined a price point they’re willing to buy at or sell at. Effectively, they will come in and out of the market on the basis of the fundamentals of the company, such as its profit announcements, balance sheets and the like. These could be professional stock pickers or everyday investors. Given the popularity of this style of investing among individuals, it could be assumed that these investors make up most of the market.

However, increasingly robots, institutional investors and passive money have been the cause of the shifting prices. In fact, it is estimated that 70% to 80% of shares traded on U.S. stock exchanges come from automatic trading systems.

Related article: Explainer: What is Value Investing?

Robots

So, what are robots? It’s a tough question to answer without underrepresenting or overrepresenting elements of the industry.

Effectively, when people talk about robots, computers, algorithms or machine-led trading in the market, they’re talking about trading decisions made by computers based on specific rules determined by investors. Let me give a simple example. I might create a rule that says if a company’s share price goes down 20% or more within a week, buy that stock. Once it has gained 5% back, sell it. This then allows the computer to go about buying and selling stocks on my behalf.

Being a computer, there is no emotion behind the trade. The computer doesn’t have any concern for the company it invests in or the market overall. This can lead to large spikes in volatility when the market starts to move.

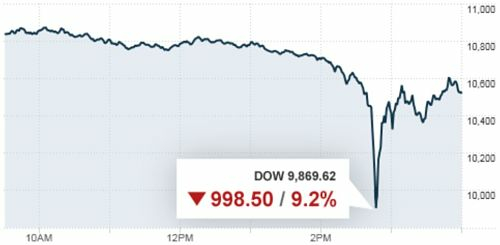

The Flash Crash

At 2.32pm on a Thursday afternoon in May of 2010, the US stock market crashed almost 10% in just minutes. By 3.08pm, most of that loss had been regained and the markets were trading as usual once again. Known as the Flash Crash, it saw the second worst one-day drop in the US history and it all happened within 36 minutes.

Effectively, an initial price drop triggered sell orders from computers, which drove the price down further and triggered more computers to sell and so on. On the way back up, the opposite happened and before long, the market was back to a reasonable level.

While this is an extreme example, it illustrates how it’s not necessarily company results, economic data or political environments that are moving prices on a day-to-day basis.

Institutional investors

While robots make somewhat objective decisions (or at least intentional decisions) on stock prices, institutional investors and passive money can move prices by necessity rather than decision.

Firstly, an example with institutional investors. Some institutions may have an investment mandate which requires them to invest in A-rated stocks only. They may have a large position in a company that currently has an A+ or A1 rating, but after its most recent earnings report, the relevant ratings agency (think Standard and Poor’s or Moody’s) re-grades them to a B level. In order to be compliant with its mandate, the fund is now required to sell all of their holdings in that company, regardless of what the price is or whether it is sold at a profit or loss. These sorts of rule-based restrictions on funds can have a material impact on the price of certain assets, given the relative size of the holdings compared to the smaller orders on market.

Exchange traded funds

Secondly, with the rise of ETFs came a rise in orders on the market that are agnostic to price and company as they look to replicate an index. For example, if I were to buy $100k worth of an ASX200 ETF, then in order to replicate the index, the fund manager would in turn need to buy some of each of the stocks that make up the ASX200. For example, if CBA made up 7.8% of the index, the ETF would need to buy $7,800 worth of CBA shares at whatever price is available on the market.

This actually leads to another force in moving prices: stocks falling out of indices. Each quarter, Standard and Poor’s reviews which companies are included in the ASX200 list. If a company drops out of the ASX200, then the ETF money invested in that stock is required to sell out their positions. Again, not because they’ve made a decision about that company, simply because that company no longer meets the rules of their fund.

Some of the critics of passive investing, by way of ETFs, make the point that this sort of indiscriminate buying and selling undermines the market’s role, which is to find the fair value of companies. Regardless of whether that is a good or bad thing, the fact remains that it’s a growing force in the market.

Related article: Active vs. Passive Investing – What’s the Difference?

What it all means

Knowing about these forces is a good place to start if you’re trying to understand what moves the markets. Of course, there are many more potential reasons behind changes in stock prices, and when multiple reasons combine (sometimes with opposing forces), the market can end up not making much sense at all. Some of these are subjective, some are objective, some are seen and reported on, and others are hidden from market view. In the end, it comes down to forming a view on what factors might affect the price of the asset you’re looking at and making an assessment of their impact.

→ Looking for more ways to create wealth? Learn more about Online Share Trading, Exchange Traded Funds and Cryptocurrency.

You can also compare health insurance, credit cards and life insurance and home loans with Canstar.

This article was reviewed by our Content Producer Marissa Hayden before it was updated, as part of our fact-checking process.

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.