Westpac cuts range of fixed home loan rates for investor customers

Westpac has reduced interest rates across a range of its home loans for investors, in a bid to increase its share of that market. In some cases, the new package rates are lower than the bank is offering for owner-occupiers.

Westpac cut a range of fixed investment home loan rates on Wednesday, across standard and package rates.

The bank’s largest cuts to package loans with principal and interest repayments and a 20% deposit were a sizable 0.50 percentage points off its one-year, four-year and five-year loan terms.

That cut brings the five-year Premier Advantage Investment Fixed loan down to 3.19% (comparison rate 4.12%), for instance, which is the lowest fixed package rate for investors on Canstar’s home loan database. Westpac’s owner-occupier customers paying the same type of repayments over the same term are paying 3.49% (comparison rate 3.92%).

Canstar finance expert Steve Mickenbecker said it was worth keeping in mind that while the new rates are pretty competitive, the comparison rates are much higher.

Comparison rates are a percentage rate designed to represent a closer estimate of the total cost of a loan per year, taking into account costs such as upfront and ongoing fees as well as the advertised interest rate.

“Incorporating the $395 package fee, and with a higher rate attaching when the loan moves to variable interest after the fixed rate period, investors will have to be on their toes at the end of that period to assure a competitive rate,” Mr Mickenbecker said.

Westpac chasing investor market

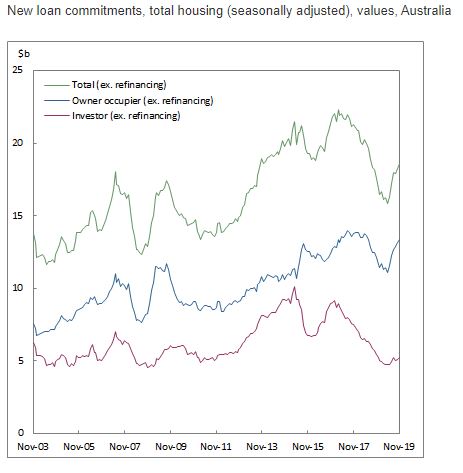

Mr Mickenbecker said Westpac was clearly working to lift its share of the investment market, which has remained sluggish despite recent growth in lending to owner-occupiers.

And the bank might be onto something, because the latest numbers on household lending from the Australian Bureau of Statistics show some early signs investors may be returning to the market.

The number of new loan commitments for investors rose by 2.2% in November. It’s still subdued overall, though, with the total value still noticeably below what it was back in 2015.

Westpac’s new investment home loan rates

The tables below summarise the changes Westpac made to its fixed investment package home loan rates for new and existing customers on Wednesday, 22 January.

| Westpac Fixed Rate Investment Property Loan with Principal & Interest Repayments: Premier Advantage Package | ||||

| Product Name | Old Rate | Change | New Rate | Comparison Rate* |

| Premier Advantage Investment Fixed P&I 1 yr 80% | 3.69% | -0.50% | 3.19% | 4.40% |

| Premier Advantage Investment Fixed P&I 2 yrs 80% | 3.28% | -0.19% | 3.09% | 4.30% |

| Premier Advantage Investment Fixed P&I 3 yrs 80% | 3.28% | -0.19% | 3.09% | 4.22% |

| Premier Advantage Investment Fixed P&I 4 yrs 80% | 3.69% | -0.50% | 3.19% | 4.18% |

| Premier Advantage Investment Fixed P&I 5 yrs 80% | 3.69% | -0.50% | 3.19% | 4.12% |

| *Comparison rates calculated based on a $150,000 loan amount over a total loan term of 25 years. Read the Comparison Rate Warning. | ||||

| Westpac Fixed Rate Investment Property Loan with Interest Only Repayments: Premier Advantage Package | ||||

| Old Rate | Change | New Rate | Comparison Rate* | |

| Premier Advantage Investment Fixed IO 1 yr 80% | 3.79% | -0.40% | 3.39% | 4.64% |

| Premier Advantage Investment Fixed IO 2 yrs 80% | 3.49% | -0.20% | 3.29% | 4.54% |

| Premier Advantage Investment Fixed IO 3 yrs 80% | 3.49% | -0.20% | 3.29% | 4.46% |

| Premier Advantage Investment Fixed IO 4 yrs 80% | 3.79% | -0.40% | 3.39% | 4.41% |

| Premier Advantage Investment Fixed IO 5 yrs 80% | 3.79% | -0.40% | 3.39% | 4.35% |

| *Comparison rates calculated based on a $150,000 loan amount over a total loan term of 25 years. Read the Comparison Rate Warning. | ||||

Follow Canstar on Facebook and X for regular financial updates.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.