What is a property price bubble?

From backyard barbecues to uptown boardrooms, property prices are a perennial topic of conversation in Australia.

Watching the real estate market seems to be a national sport, with spectators taking in the drama of recent years, watching prices waver between giddying heights and prolonged falls to varying degrees in different locations.

The term “property bubble” is used frequently in these conversations, often twinned with phrases such as “slow recovery” and “correction”. That could be partly because right now, over in the US, there are fears its property market has been in a bubble and is about to burst, echoing the catastrophe that was the Global Financial Crisis of 2008. There is talk, too, about a property bubble and correction impacting Australia, but experts are divided about whether or not that is actually the case.

The media speculated this week about whether or not the low interest rate environment was about to start a boom-bust cycle, otherwise known as a property bubble. Reports point to a speech made by Reserve Bank of Australia governor Philip Lowe. In the speech, Dr Lowe talked about assets – property – lifting in price after two successive cash rate cuts led to a number of banks lowering the interest rates they were offering on their home loans. “I think later on we will have problems because of that”, he was quoted as saying.

what-is-a-property-bubble? ">What is a property bubble?

Price “bubbles” can happen in any market.

“A bubble is when an asset price appreciates rapidly over a short period of time and reaches levels that aren’t supported by underlying demand,” CoreLogic property research analyst Cameron Kusher told Canstar.

“Subsequently, the bubble will burst and prices will revert to fair value.”

what-causes-a-property-bubble? ">What causes a property bubble?

A property bubble occurs when, over a short amount of time, the number of people wanting to buy a house is greater than those who want to sell, forcing prices up quickly. As other homeowners and investors see all that heat in the market, some jump into the real estate pool, buying with the hope that prices will rise, while others sell up to cash in on what they see as enticing gains. The higher prices go and the speedier that rise is, the bigger the bubble becomes.

But then, as more people put their house on the market, the precarious balance between supply and demand can tip. When there are more houses on the market than there are buyers, prices typically begin to fall. Suddenly, there can be more houses for sale than buyers, or the prices can be driven higher than those buyers can pay.

The big bubble begins to wobble.

This can lead some owners and investors to panic, believing that they need to sell up in order to head off any larger losses, so they put their property on the market. Buyers can see that there are more properties from which to choose and start bargaining for a cheaper price, and the cycle speeds up in a downward spiral of declining home values.

Mr Kusher said the term can strike fear in the hearts of owners and investors because the aftermath of a housing bubble burst can be “nasty”.

has-a-property-bubble-ever-popped-in-australia? ">Has a property bubble ever popped in Australia?

Experts are divided on this question.

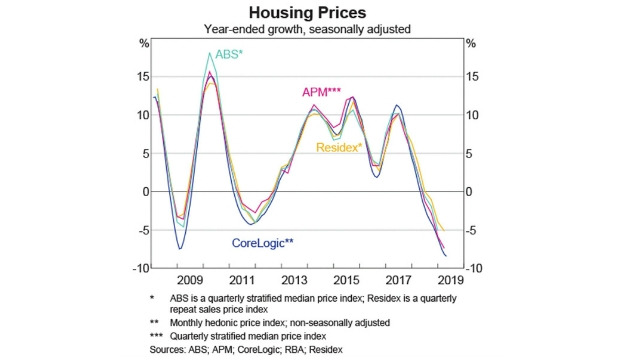

The Reserve Bank of Australia (RBA) released a graph in June 2019 (below) showing annual changes in Australian housing prices over the past 10 years, as reported by the Australian Bureau of Statistics, Australian Property Monitors, Residex and CoreLogic. It charts a series of steep climbs and falls, with a period of more moderate growth in between.

The most recent climb began in 2016, with the fall starting in 2017 and continuing this year into negative growth territory. However, there is evidence – at least in some markets – that the rate of this price fall could be slowing, and in other places, house prices are growing.

Mr Kusher said that while Australia has had a period of rapid price growth and rapid price falls, it was “difficult to say that a bubble has ever burst”.

“The closest would be what we’ve seen over recent years. However, that was really driven by changed credit conditions rather than a lack of underlying demand,” he said.

where-has-there-been-a-property-bubble? ">Where has there been a property bubble?

Most economists do agree that the US experienced a property bubble, which subsequently and dramatically popped in the mid-2000s.

Over the preceding few years, a dip in the stock market had meant investors flocked to the real estate market, which drove up prices, creating the start of a bubble. A number of lenders lowered their standards, offering home loans to people who couldn’t really afford them, creating “subprime mortgages”, as more people entered the market. Prices continued to rise.

In his book “The Great Housing Bubble: Why Did House Prices Fall”, US author Lawrence Roberts writes that what happened next spelled disaster for many unsuspecting investors and home owners.

“Most homeowners did not care why residential real estate prices rose; they assumed prices always rose, and they should simply enjoy their good fortune. It was not until prices began to fall that people were left searching for answers,” he wrote.

Eventually, the stock market recovered and home loan interest rates began to rise. Investors moved from property to stock investments, which meant housing price growth slowed. Loan costs went up due to higher interest rates, which took the wind out of the sails of the market.

Some people, due to low lending standards, were trapped in loans they couldn’t repay, and so mortgage default rates went up. The number of distressed sales (urgent house sales by people in financial trouble) -and mortgagee sales (sales of houses that have been repossessed by banks) which usually result in the vendor taking a lower-than-expected price – went up, and property prices really began to fall. Some speculative investors saw this and tried to sell up, sending prices even lower. The media, at the time, declared that the property bubble had burst.

The fallout was drastic. Some property owners were then left with properties worth less than their loans were worth, which meant their lenders also lost money. Some banks went out of business.

This, in turn, created a banking crisis, which then went on to hit the stock market, which crashed in 2008. That set off the Global Financial Crisis.

how-can-i-protect-myself-against-a-property-bubble? ">How can I protect myself against a property bubble?

Anticipating a property bubble is a difficult feat.

The Federal Government’s MoneySmart website states that while buying and renting out an investment property “is a popular form on long-term investment in Australia”, it’s important to “remember that property values can fluctuate over time”.

The site also recommends that when it comes to making investment decisions and choosing experts such as property developers, lawyers and mortgage brokers, it’s typically best to do your own research, take your time and try to avoid being pressured to rush into a decision.

In general, home owners, sellers, buyers and investors who keep an eye on the market, stay educated about the state of the economy and act with a cool head are more likely to see a potential bubble forming. They would also be more likely to be able to make a judgement about when to buy – or sell – depending on the property cycle, and how much to spend.

A journalist for more than two decades, Amanda Horswill has reported on a galaxy of subjects, including property, lifestyle, hyper-local news, data journalism, the Arts and careers.

She’s served as the Editor of Brisbane News, Deputy Features Editor for The Sunday Mail, Deputy Editor – Digital at Quest Community News, and a host of other senior positions at News Corp, prior to joining Australia’s biggest financial comparison website, Canstar.

Amanda is fascinated with the ever-changing world of finance. A passionate believer in the motto “knowledge is power”, she strives to translate the news into practical information that will help readers make informed decisions about their future. While at Canstar, her work has been regularly referenced by publishers such as the Sydney Morning Herald , The Age, The New Daily and Yahoo Finance.

Amanda holds a Bachelor of Arts (Journalism, Media Studies and Production, and Public Relations) and a Graduate Certificate in Editing and Publishing, from the University of Southern Queensland.

Follow her on LinkedIn and Canstar on Facebook. Meet the Canstar Editorial Team.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

40% min deposit

40% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.