First Home Buyer Survey 2024

First home buyers saving less than half what they did a year ago

First home buyers are saving less than half of what they were a year ago as the cost of living crisis hampers their efforts to gather a deposit for their first home, new research from Canstar has found.

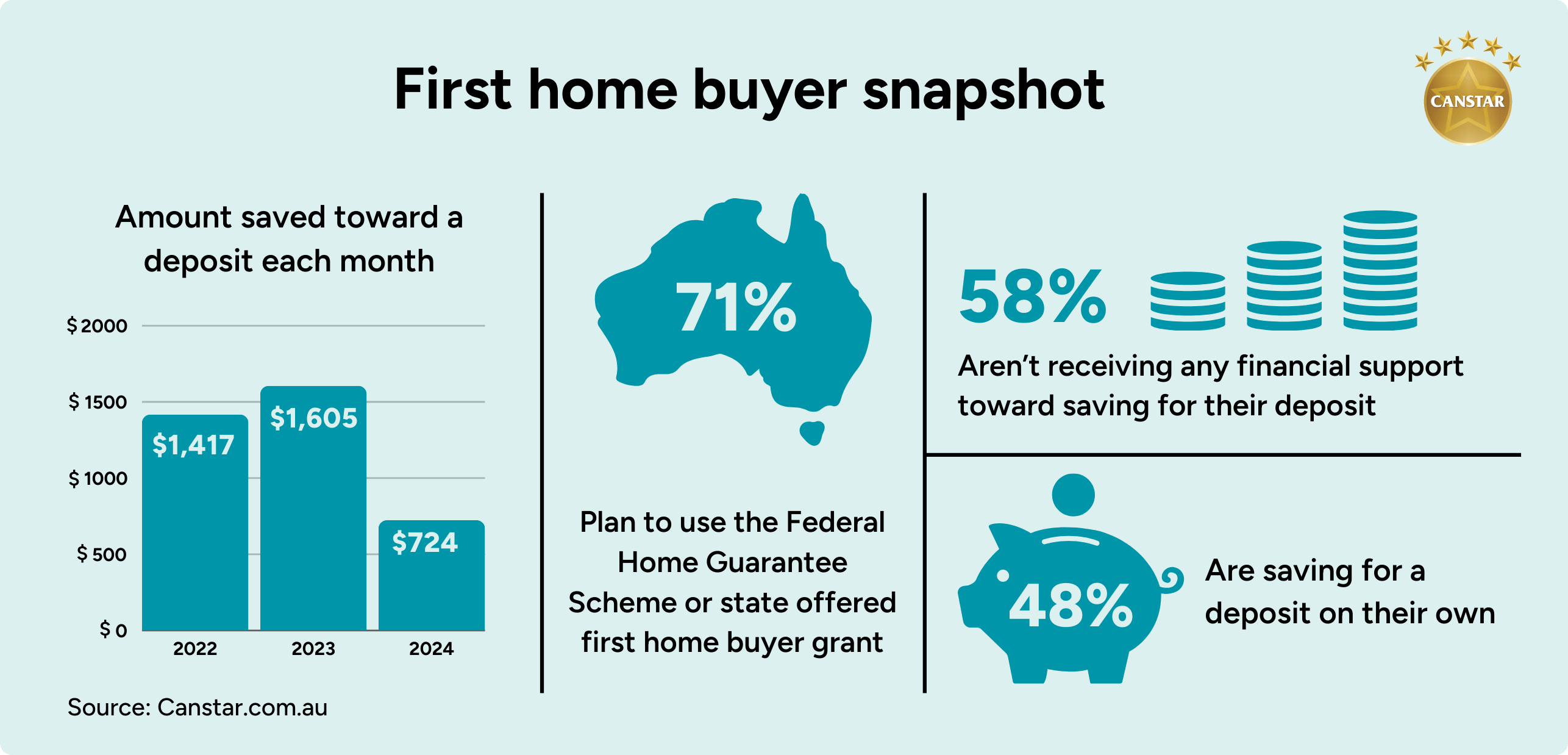

The Canstar 2024 First Home Buyer Survey of almost 1,000 (974) Australians saving for their first home, revealed they are setting aside, on average, $724 a month toward the purchase of their first property.

This figure is less than half of what first home buyers were saving in 2023, which, when surveyed, was $1,605 and just over half (51%) of what they were saving in 2022, which was $1,417.

This is unsurprising with the latest ABS quarterly CPI data showing the last year has seen sharp rises to the cost of essentials such as rent (6.7% p.a.), insurances (14.0% p.a.) and food and non-alcoholic beverages (3.3% p.a.), putting additional pressure on already squeezed first home buyer budgets.

A single person saving $724 a month towards a deposit for an average priced unit, would take an estimated 10 years to achieve a 10% deposit, assuming property prices rise at 3.49% p.a. (the 5-year average price increase for units) and the funds were in a high-interest savings account. This is almost four years longer than if they were saving $1,605 a month^.

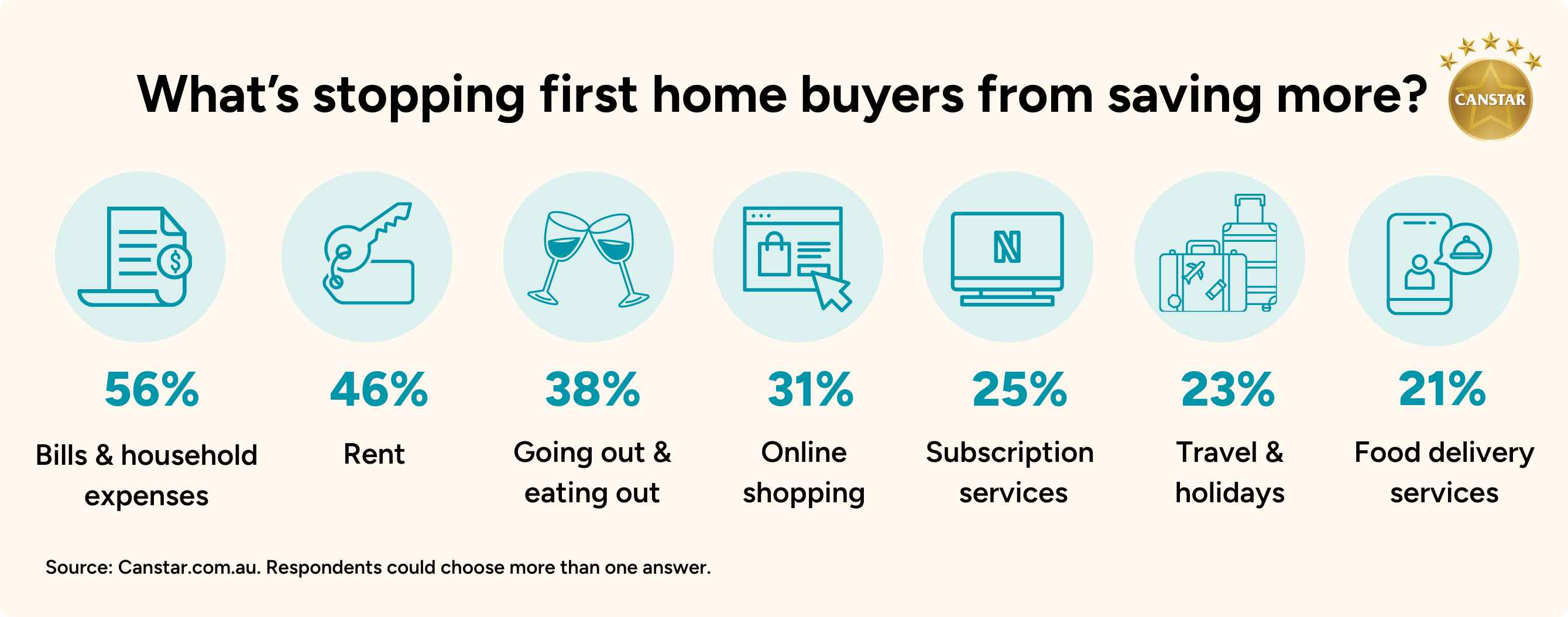

What’s stopping first home buyers from saving more?

The rising cost of living is hampering first home buyers’ ability to save for a deposit. Canstar’s survey revealed the two main reasons for not saving more were ‘bills/household expenses’ (56%) and rent (46%).

However, discretionary expenses were next including: ‘going out or eating out’ (38%), online shopping (31%), subscription services (25%), travel and holidays (23%), and food delivery services (21%).

Many first home buyers doing it alone

Surprisingly, almost half (48%) of those saving for their first home, are planning to purchase by themselves, while more than half (58%) said they were not receiving any financial support from family such as a cash gift, rent-free accommodation or as a guarantor on their loan to avoid lenders mortgage insurance (LMI).

That said, 71%, say they are planning on using the federal government’s Home Guarantee scheme, or state-based grants and concessions.

Three ways buyers can get themselves in the property market sooner

1. Make cheap bills a necessity

Canstar research shows a single person could save up to $310 a month by shopping smarter when it comes to groceries, internet, phone, streaming services and car insurance. This would be achieved by choosing to buy supermarket-branded products, switching to comparable but more affordable internet and mobile phone plans, cutting out just one streaming service, and switching car insurers.

An extra $310 a month towards their deposit, on top of the existing $724, they could see their time taken to save for a deposit drop by three years and seven months, to just six years and five months.

2. Use a government scheme – or an alternative lender

Many first home buyers with small deposits plan to either ask their parents to be a guarantor on their loan or apply for the federal government’s First Home Guarantee Scheme to avoid paying LMI.

However, some parents aren’t in a position to go guarantor, while the federal government’s scheme has tight qualifying criteria, including an income cap of $125,000, a property price cap of up to $900,000 depending on where you buy, and just 35,000 places available each year.

First home buyers can still go it alone. Canstar.com.au shows over 60 lenders offering owner occupier loans with a deposit of as little as 5%, and while many banks will charge these customers higher rates for having a small deposit, some also offer highly competitive interest rates under 6%.

Compare first home buyer home loans

While purchasing without the help of the federal government’s scheme is likely to have fewer restrictions on what buyers can do with the property, such as having the option to turn it into an investment property, borrowers with small deposits will have to pay LMI, which can run into the tens of thousands of dollars.

For example, a first home buyer purchasing a median-priced apartment today at $668,234 (CoreLogic, national average figure) with a 5% deposit could be charged an estimated $26,678 in LMI costs. With a 10% deposit, it would be $14,794, based on estimates from Helia.

Buying with a deposit of less than 20% also comes with risks, including a larger loan size and can often attract a higher interest rate, which will impact your monthly repayments.

3. Reframe the objective – buy smaller, further away, or invest

Canstar’s survey of first home buyers revealed 64% are aiming to purchase a house, while just 13% are aiming to buy a unit, and 10% a townhouse/duplex, with the remaining looking at off the plan or vacant land options.

The difference between a median house price ($847,827) and a median unit price ($668,234) is more than $200,000, and will require 30% more in savings for the same 20% deposit, based on CoreLogic property price data for October 2024.

If buyers are truly focused on entering the property market, taking the time to assess the additional months – if not years – that will be required to achieve a deposit for a house, instead of a unit, may make them reconsider their plans.

Additionally, Canstar’s survey revealed just 16% of potential first home buyers are planning to buy their first home as an investor.

For many first home buyers, the government incentives provided to owner-occupiers are enough to stop them from considering an investment property. However, the rental return on an investment property can significantly boost a first home buyer’s borrowing capacity, and help them meet their mortgage repayments, particularly if they have the opportunity to live in their family home rent-free.

Canstar’s recent Deposit Stars report revealed there are a number of properties available for purchase with just a $50,000 or $100,000 deposit, that are forecast to offer growing rental yield.

Canstar Data Insights Director, Sally Tindall says, “It’s hugely concerning but by no means surprising first home buyers are saving less than half of what they were just 12 months ago.”

“The rising cost of everyday essentials impacts us all, but it’s making it especially difficult for first home buyers trying to get ahead.

“Add on top of this rising property prices, rising rates and rising rents and it’s incredible to think 10,000 first home buyers are making it into the market each month.

“Shopping smarter, switching essential services to cheaper options more regularly and putting your nest egg in a high interest rate savings account can help speed up the time it will take you to save for a deposit, however, for some people that’s not going to move the needle nearly enough.

“If that ever-elusive first rung of the property ladder keeps slipping out of reach, it could be time to look for a different way up.

“Consider shifting the goal posts closer by looking for a smaller property, looking further afield or taking that first step as an investor.

“Some first home buyers aren’t willing to consider an investment property as their first purchase as it can exclude them from stamp duty concessions and lenders mortgage insurance waivers.

“However, if you can’t get a foothold into the market as an owner-occupier, it’s worth considering it as an alternative, particularly if you can live rent free in the family home.”

To compare home loans from over 80 lenders, visit www.canstar.com.au.

For further information:

Belinda Williamson

Group Manager, Corporate Affairs

Ph: 0418 641 637

Belinda.williamson@canstar.com.au

Notes to Editors

^Assumes unit price of $668,234, in line with CoreLogic HVI published 1 November 2024. Rate of property price increase based on average price increase of national unit prices over the last five years. Time to save based on a single person earning the national average income of $100,292 at a tax rate of 30%, with tax paid at the end of every 12 month period. Starting interest rate of 5% changes in line with Westpac’s cash rate forecast, with the change flowing through the month after the change.

Calculations for potential savings based on a single person in NSW. Grocery costs saved based on an average percent saving of 38.8% from purchasing home-branded products. Average percent savings based on comparing the home-brand price to the cheapest branded price of a selection of products from Woolworths and Coles. Internet and mobile plans switched from average plan to cheapest at similar service. Streaming service costs saved by removing one service. Car insurance cost saved based on comprehensive car insurance policies rated in Canstar’s 2024 Car Insurance Star Ratings (June 2024). Annual premiums include quotes for both new and used cars for a range of scenarios, with a state-specific target excess ranging from $800 to $1,000. Average premiums include 5-Star rated products.