New Reserve Bank credit card data shows personal credit card spending increased in November 2023.

Spending on personal credit cards in the lead-up to Christmas grew compared to the same period last year with the number and value of purchases in November 2023 rising, according to newly released credit and charge card data from the Reserve Bank.

The number of new purchases on personal credit cards in November rose by 3.58% year on year to reach 285.9 million. At the same time, the value of those purchases increased by $978.7 million or 3.81% annually to hit $26.66 billion in November.

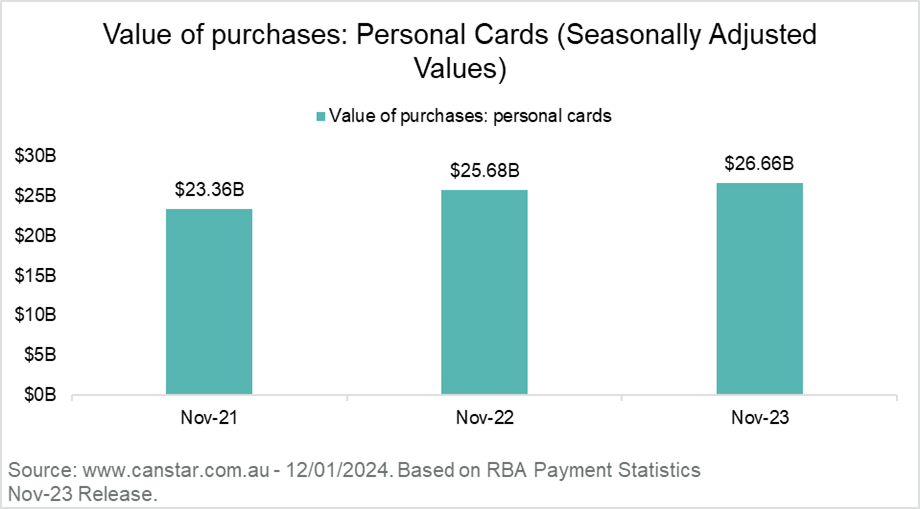

Credit card spending in November continues to climb each year as Aussie shoppers take advantage of the traditional Black Friday US sales event. The value of purchases has increased by 14.11% since November 2021 when a total of $23.36 billion in purchases were put on plastic.

The spending trend continues despite 13 Reserve Bank cash rate rises hitting mortgage holders since May 2022. Rate hikes are doing little to curb spending and may be the cause for growing credit card debt in 2024, warns Canstar.

Already debt on personal credit cards accruing interest in November is at $17.29 billion with the average balance accruing interest per card sitting at $3,603. It would take someone almost 25 years to repay the average balance accruing interest if they were only making minimum repayments and repaying their debt with an average purchase rate of 17.10%.

Finance expert at Canstar, Steve Mickenbecker says, “Australia’s love affair with American culture has seen credit cards being put to heavy use during the Black Friday sales this past November.”

“Home loan borrowers will be hoping that the Reserve Bank views the higher spending as a change of pattern and not as an economy running out of control.

“While debt accruing interest is down very modestly over the year to November, the overall balances on credit cards is up by $681 million for the period. Hopefully, Aussie card holders’ New Year’s resolutions included paying off credit cards fast during 2024 and the increase doesn’t find its way into long-term debt.

“Australians who have put Christmas 2023 on their credit card can get a leg up with the grind of repaying debt by moving their debt to a zero interest balance transfer card. Used properly, these cards mean that the full monthly payment goes towards knocking off debt, not paying the bank interest.

“Low rate cards can help but a bigger balance on the monthly credit card statement has to be a wake-up call to pare back on spending. January is a great time of year to set up a household budget.”

Top five longest 0% balance transfer offers on Canstar.com.au

← Mobile/tablet users, scroll sideways to view full table →

| Top 5 Longest 0% Balance Transfer Credit Cards | ||||||||

|---|---|---|---|---|---|---|---|---|

| Provider | Card Name | Balance Transfer Duration (Months) | Balance Transfer Revert Rate | Balance Transfer Fee | Purchase Rate | Annual Fee | Minimum Credit Limit | |

|

St.George | Rainbow Vertigo Visa/ Vertigo Visa – Balance Transfer Offer | 32 | 21.49% | – | 13.99% | $55 | $500 | |

| Bankwest | Zero Mastercard/ Zero Platinum Mastercard | 28 | 14.99% | 3.00% | 14.99% | $0 | $1,000/ $6,000 | |

| Westpac | Low Rate Card – Balance Transfer Option | 28 | 21.49% | – | 13.74% | $59 | $500 | |

| NAB | Low Rate Card | 28 | 21.74% | 2.00% | 12.49% | $59* | $1,000 | |

| ANZ | Low Rate – Balance Transfer Offer | 28 | 21.99% | 2.00% | 13.74% | $58* | $1,000 | |

Source: www.canstar.com.au – 12/01/2024. Based on personal, unsecured credit cards with a 0% balance transfer offer on Canstar’s database. Top 5 selected based on the longest balance transfer period. Table sorted in descending order by balance transfer period, followed by ascending order by balance transfer revert rate.

*$0 in the first year.

Summary of Reserve Bank Personal Credit Card stats for November 2023

← Mobile/tablet users, scroll sideways to view full table →

| Personal Credit Card Statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Nov-22 | Oct-23 | Nov-23 | Highest/ Lowest Since | Difference | % Change | |||

| MoM | YoY | MoM | YoY | |||||

| No. of Accounts (Original) | 12.4 million | 12.6 million | 12.6 million | Highest since Mar-2021 | 9,024 | 180,651 | 0.07% | 1.45% |

| Balances Accruing Interest (Original) | $17.30 billion | $17.40 billion | $17.29 billion | Lowest since Sep-2023 | -$115.4 million | -$18.8 million | -0.66% | -0.11% |

| Average Balance Accruing Interest^ (Original) | $3,659 | $3,629 | $3,603 | – | -$27 | -$56 | -0.73% | -1.54% |

| Total Balances | $33.44 billion | $33.95 billion | $34.12 billion | Highest since Dec-2020 | $168.1 million | $681.4 million | 0.50% | 2.04% |

| No. of Purchases | 276.0 million | 285.5 million | 285.9 million | Highest since Sep-2023 | 364,149 | 9.9 million | 0.13% | 3.58% |

| Value of Purchases | $25.68 billion | $26.39 billion | $26.66 billion | Highest since Sep-2023 | $268.0 million | $978.7 million | 1.02% | 3.81% |

| No. of Cash Advances | 1.11 million | 1.06 million | 1.04 million | Lowest since Sep-2021 | -29,180 | -73,789 | -2.74% | -6.65% |

| Value of Cash Advances | $399.8 million | $392.2 million | $382.7 million | Lowest since Apr-2022 | -$9.5 million | -$17.0 million | -2.42% | -4.26% |

Prepared by www.canstar.com.au. Data source: RBA Credit and Charge Card Statistics, Nov-2023. All values are in seasonally adjusted terms unless otherwise stated, in which case statements about trends should be made with caution.

^Assumes 38% of personal credit card accounts are revolving a balance and therefore accruing interest, based on the Canstar 2022 Customer Satisfaction Survey (n=4936).

If you’re thinking about switching, you can compare credit cards with Canstar to find a deal that might be suitable for you.

- 0% p.a. for 26 months on balance transfers plus $0 annual fee in first year.* 3% balance transfer fee applies.

Australian Credit Licence 234527. See provider for TMD

- 0% BT for 24 months*. 3% BT fee applies. New customers only, must be approved by March 31 2026.

Australian Credit Licence 392145. See provider for TMD

- 0% p.a. for 24 months on balance transfers.

- Free overseas travel insurance. No FX fees.

- 3% BT Fee. Ltd time, other fees, T&Cs apply.

Australian Credit Licence 234945. See provider for TMD

- Fill your shopping trolley with a $250 Coles gift card when you apply for a new Coles Rewards Mastercard by 17 March 2026. T&Cs apply.

Australian Credit Licence 230686. See provider for TMD

- $0 annual fee 1st year (normally $96) & earn up to $500 in Latitude Rewards in yr 1. Min spend on eligible purchases applies. New approved customers by 30 April 2026

Australian Credit Licence 392145. See provider for TMD

- 0% p.a. for 10 months on balance transfers (1% fee)

- Award winning no annual fee rewards credit card

- Complimentary FIRST membership valued at $129/year

Australian Credit Licence 230686. See provider for TMD

- $300 credit back. Spend $1.5K+ p/m on general purchases in 1st 4 months. T&Cs, mthly credit card fee $10.95 & other charges apply, new customers approved by 31Mar26

Australian Credit Licence 392145. See provider for TMD

Australian Credit Licence 291313. See provider for TMD

Australian Credit Licence 234945. See provider for TMD

Australian Credit Licence 234945. See provider for TMD

Australian Credit Licence 240573. See provider for TMD

Australian Credit Licence 229823. See provider for TMD

Cover image source: kitzcorner/Shutterstock.com