How can bankruptcy affect your credit score and ability to get a loan? And how long will it stay on your credit report? Canstar reports.

Being declared bankrupt can trigger many emotions, and there are consequences that will impact you immediately and longer term. In this article, we cover how bankruptcy can impact your credit score, how long it will stay on your credit report and how it can impact your ability to borrow money in future.

-

- What is bankruptcy?

- What are the consequences of bankruptcy?

- How does bankruptcy affect your credit score?

- How long does bankruptcy stay on your credit report?

- Can you improve your credit score after bankruptcy?

- Can bankruptcy affect your ability to get a loan?

- What do you need to disclose if you apply for a loan after bankruptcy?

- Where can you get financial and legal support with bankruptcy?

What is bankruptcy?

Bankruptcy is a legal process where you’re declared unable to pay your debts. It can release you from most debts, provide financial relief and allow you to make a new start, according to the Australian Financial Security Authority (AFSA), the government agency which regulates Australia’s personal insolvency system. Bankruptcy information and procedures in Australia rely largely on the Bankruptcy Act, which explains the legal requirements for debt agreements and personal insolvency agreements. For the recent reporting year of 2019–20, there were 12,450 bankruptcies in Australia, based on AFSA data.

What are the consequences of bankruptcy?

According to AFSA, bankruptcy can affect:

- your income, employment and business

- your ability to travel overseas

- your ability to get credit in the future

- your assets, such as your home if you own one

- some, but not all, of your debts

If you declare or are declared bankrupt, a trustee (either a person or an entity) will manage your bankruptcy, and they will seek to ensure fair and reasonable outcomes for you and your creditors. The trustee may be able to claim and sell your assets and possessions, using the proceeds to repay money you owe. While a vehicle can be kept if its value is up to an indexed amount ($8,100 at the time of writing), a trustee can claim any houses or property you own as assets as part of proceedings.

How does bankruptcy affect your credit score?

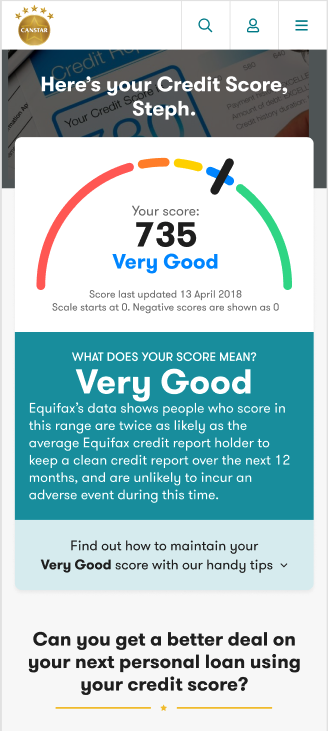

A credit score or credit rating is a number calculated by a credit bureau or credit reporting agency. It represents how trustworthy your reputation is as a borrower, and is a factor lenders may use to decide whether or not you are eligible for a credit product, plus what interest rate to charge you.

Credit reporting agencies generally do not specify how much being declared bankrupt will affect your credit score. However, bankruptcy will almost certainly have a negative effect on your credit score, and this may continue for some time. Illion says a ‘Zero score’, for example, may indicate you have something negative on your file, such as a court judgement or bankruptcy.

→ You can check your credit score for free

How long does bankruptcy stay on your credit report?

Credit reporting agencies keep note of a bankruptcy for the longer of:

- five years from the date you become bankrupt

- two years from the date your bankruptcy ends

Bankruptcy generally lasts for three years and one day from the date you are declared bankrupt. However, a trustee can submit an objection to extend a period of bankruptcy to either five or eight years under certain circumstances.

Can you improve your credit score after bankruptcy?

There is no quick fix to restoring your credit score and credit rating after bankruptcy, but there are general steps you can take to improve your credit score. Consumer Action Law Centre (CALC) cautions that Australians in debt may be at risk from ‘debt vultures’, with approximately 1.4 million to 1.9 million Australians paying for debt management or credit repair services in the 12 months to December 2020. These companies are almost entirely unregulated and can target Australians who are in financial hardship with debt advice and services, CALC says.

Can bankruptcy affect your ability to get a loan?

While a poor credit score can reduce your chances of being approved for a loan or other credit product, bankruptcy may prevent you from even being able to obtain one. Many lenders have a policy to decline loan applications made by people who are bankrupt. Even after bankruptcy no longer appears on your credit report, a prospective lender might check the National Personal Insolvency Index (NPII), discover you are a discharged bankrupt and choose to decline your loan.

In certain circumstances, it is a criminal offence for people who are bankrupt or subject to a debt agreement to obtain, or seek to obtain, credit. If you do want to go ahead and apply for a loan, it is important to do your research, and consider seeking financial and legal advice if you need help. Your options will most likely be quite limited, and only include smaller-scale forms of lending, such as personal loans, depending on the lender in question and the size of the loan you’re applying for. You might be more vulnerable to loans charged at a higher rate of interest, with more terms and conditions attached, or from lenders who are less credible.

What do you need to disclose if you apply for a loan after bankruptcy?

If you do apply for a loan above a certain limit you must let the lender know about your bankruptcy. This limit is indexed quarterly. At the time of writing, the indexed credit limit set in the Bankruptcy Act and regulations is $5,881. This means for loans worth more than $5,881, you must disclose your bankrupt status when:

- seeking to obtain goods or services on credit, by hire purchase, or cheque

- leasing, hiring, or promising to pay for goods and services

- seeking to obtain an amount by promising goods or rendering services

Current information about indexed financial amounts that apply with the Bankruptcy Act and Regulations is available from AFSA.

Where can you get financial and legal support with bankruptcy?

If you are in financial difficulty and are concerned you may be heading for bankruptcy, it is a good idea to seek advice. Free advice is available from a financial counsellor through the National Debt Helpline (NDH) on 1800 007 007. The NDH helps consumers find individual counsellors and organisations near to them. The NDH also offers information and resources on what your rights are if you are experiencing financial hardship.

Community legal services and legal aid agencies, as well as consumer credit legal services, may be able to help you if you need legal help to assist with bankruptcy matters. Free advice and support is available to eligible Australians, with services offered across states and territories in Australia. AFSA maintains a list of state and territory legal assistance services available to support Australians.

The National Self-Representation Service can also assist if you cannot afford legal representation, but need to attend Federal Court or Federal Circuit Court. The service is provided by LawRight in Queensland; Legal Aid WA in Western Australia; JusticeNet in South Australia and the Northern Territory; and Justice Connect in New South Wales, Victoria, Tasmania and the Australian Capital Territory.

Cover image source: TypoArt BS (Shutterstock).

Additional reporting by James Hurwood.

→ Looking to find a better deal? Compare car insurance, car loans, health insurance, credit cards, life insurance and home loans with Canstar.

About the author:

![]()

Jacqueline Belesky is a Sub Editor at Canstar. She brings over 15 years of experience in corporate communications, media and publishing and holds a Bachelor of Journalism (Distinction) from Queensland University of Technology and postgraduate qualifications in Writing, Editing and Publishing from the University of Queensland. Jacqui was previously a Global Content and Media Manager for ABB in the UK and in Oslo, Norway, and has worked in Australia as a journalist for News Corp and editor for the Queensland Government, John Wiley & Sons and the University of Queensland. Jacqui’s articles have been published in The Courier-Mail, The Gold Coast Bulletin and on www.news.com.au. She also brings experience managing the editorial production of annual reports, financial statements, research papers and supplements on topics such as business sustainability and the global financial crisis. You can follow Jacqui on LinkedIn and X, and Canstar on Facebook.

Share this article