Where are Australians like you investing?

Have you ever wondered where Australians like you are investing? The latest data from the Canstar Investor Sentiment Survey could provide you with some insight.

So you’ve saved up the cash to invest, but where should you put your money?

Answering this question requires research, along with deep consideration of your personal needs, tolerance to risk and long term goals. Understanding how you feel about the share market performance and what type of investment you may be interested in can also go a long way in your decision making.

The Canstar Investor Sentiment Survey aims to get a glimpse of the investment mindset of Australians to see where they are investing, how they feel about the short term performance of the share market and what they would put their money into should they choose to invest.

According to the latest data from the Canstar Investor Sentiment Survey, if you’re looking to invest but don’t currently have any investments, you’re in the 13%.

25% of Aussies are already investing, whereas a majority (58%) have no plans to invest and 4% are unsure if they want to invest or not.

How are Australians feeling about investing?

Looking ahead to the next six months, the survey data found that most Aussies are feeling positive about the share market performance. 37% believe the share market will rise in the short term, 45% agree it is neither likely or unlikely, and only 18% believe it is unlikely to continue growing.

Overall, 61% of people who are currently investing are likely to add to their portfolio in the short term, whereas 45% of people are likely to exit all of their investments in the next six months.

View all Canstar rated Online Share Trading products. View Disclosures.

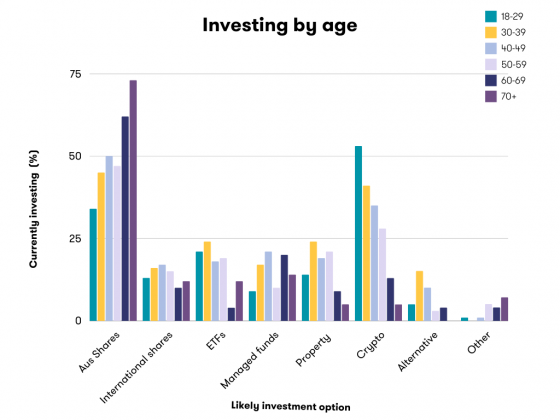

Where are Australians my age investing?

If you’re under 29, you’re likely to be investing in Australian shares or cryptocurrency according to the survey data, whereas 30-39-year-olds are most likely to be looking for returns in property. Investing overseas is popular among 40-49-year-olds and Millennials prefer ETFs more than the other age bracket who answered the survey.

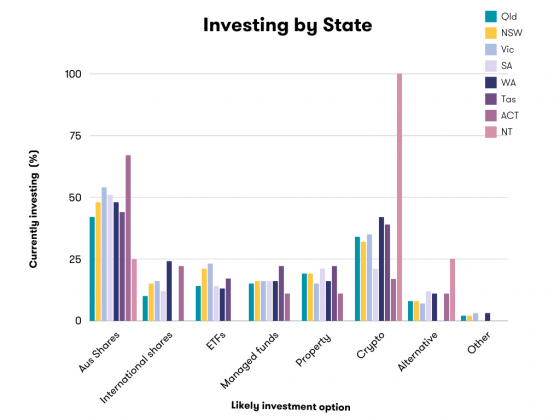

How are people in my state investing?

Across the board, Australian shares are the investment vehicle of choice, with the ACT strongly concentrated in the asset class at 67%. The NT is leading the way in crypto investing with 100% of all respondents looking to make digital currency their next investment. If you’re in WA, perhaps you’re more likely to consider international shares compared to in Tassie where Managed Funds are most popular.

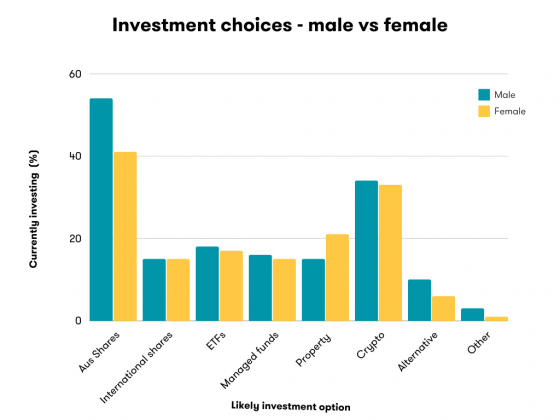

What are females investing in compared to males?

While there isn’t a huge difference in investment choices between males and females in this survey, it’s interesting to note property investing is more popular among women, whereas men are more likely to invest in managed funds. More women are considering cryptocurrency as their next investment whereas the same percentage difference of men is interested in alternative investments.

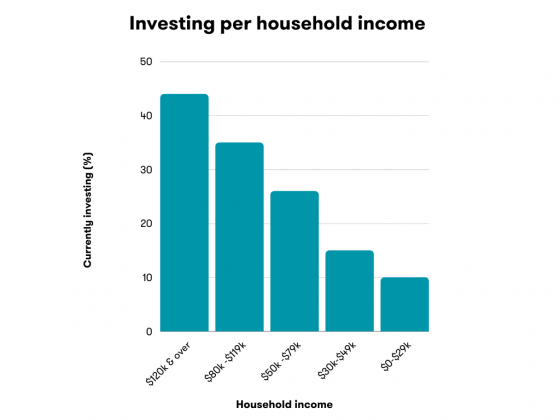

Are people with my income investing?

Perhaps it’s not a surprise that those on a higher income are more likely to invest. There are still 53% of people earning over $120,000 who aren’t investors and 35% of those have no plans to invest. Looking back over previous months of data, the number of Aussies in lower-income brackets that are considering investing is growing (up by 3% from last month). As the saying goes, sometimes it’s not how much money you make, it’s about how you spend it.

Where should I invest?

While this survey data may provide an overview of how and where people in your demographic are investing, it’s important to consider your needs and risk profile before making any investment decisions. Be sure to research thoroughly and consider speaking to a professional before deciding where to make your next investment.

Cover image source: Tippa Patt/Shutterstock.com

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.