What is the VIX Index and how can it help investors

Investor sentiment can shift asset prices and move the market. But predicting the outlook of other investors is very tricky. How do you know if market confidence is up or down? One tool you can use is the S&P/ASX 200 VIX index (A-VIX).

What is the VIX index?

Australia’s VIX index is a market sentiment indicator represented in real time, and generates a 30-day forward projection of investor sentiment and market volatility for the equities market. By measuring volatility it attempts to help investors paint a picture of the price movements the market may experience over time. Some investors also use it to gauge the levels of risk, fear and stress in the market.

For those investing in overseas markets, other countries have a similar tool to Australia’s VIX index, in the USA they use the CBOE Volatility Index.

How does the VIX index work?

The VIX index is based on the implied volatility of the options market for Australian equities’ benchmark index, the S&P/ASX 200. Exactly how it is calculated is hard to define, but essentially by averaging out the weighted prices of ‘put and call’ options (in other words, the prices investors are willing to buy and sell stocks at in the future), it can provide an indication of expected volatility in the S&P/ASX 200 over the next 30 days.

Not sure what options are? Check out this article.

When the VIX Index is high it suggests that there will be substantial changes in the ASX 200 and investor sentiment towards the market is uncertain. Conversely, when the index is at a low level minimal changes are expected and there is greater confidence in the market. Often the VIX index moves in the opposite direction of the ASX 200.

Can you trade the VIX index?

The VIX index is an ASX-listed product and it is possible to trade it on the futures market (S&P/ASX 200 VIX Futures). However, trading futures are considered a complex financial product and typically is not recommended for the average retail investor, particularly if you are just getting started. The VIX index may be better used to help you gauge where the market could be heading.

Compare Online Share Trading Accounts with Canstar

If you’re comparing online share trading companies, the comparison table below displays some of the companies available on Canstar’s database with links to providers’ websites. The information displayed is based on an average of six trades per month. Please note the table is sorted by Star Rating (highest to lowest), followed by provider name (alphabetical). Consider the Target Market Determination (TMD) before making a purchase decision. Contact the product issuer directly for a copy of the TMD. Use Canstar’s Online Share Trading comparison selector to view a wider range of online share trading companies. Canstar may earn a fee for referrals.

View all Canstar rated Online Share Trading products. View Disclosures.

^^ Star ratings are awarded by research analysts based on an evaluation of price and features

^ Online brokerage fee for a $15,000 trade based on the number of transactions specified in the search inputs

# Ongoing fee for the account. There may be waivers or discounts subject to account use

What is market sentiment and why is it important?

If market sentiment is optimistic, investors are likely to remain in the market, but if the outlook is more pessimistic investors will typically exit their position. And these movements, especially when they happen en masse, can affect the market’s performance and perhaps even your portfolio’s returns.

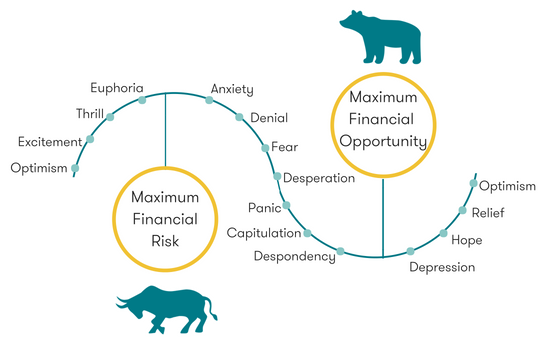

Market sentiment can, at times, definitely have an impact on asset prices and is also typically seen as cyclical, with investor’s switching between two key emotions: greed and fear. This is also known as the bull and the bear market. So, having an idea of where we are in the cycle is just another way the VIX index could be helpful to investors.

Cycles in Market Sentiment

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.