Understanding Market Sentiment and How It Affects Asset Prices

When an asset’s price rises or falls generally market sentiment has had a part to play. So, what is market sentiment and why is it important to investors?

What is Market Sentiment?

Broadly speaking, market sentiment is typically characterised as either being bullish (positive and optimistic) or bearish (negative and pessimistic). Market sentiment has historically been observed to be a highly cyclical phenomenon which has been driven fundamentally by human emotion. Cycles in market sentiment have led to significant fluctuations in asset prices including across property and shares.

How Your Emotions Affect Asset Prices

As a whole, investors typically cycle through two intrinsic key emotions: fear and greed. That is, fear of losses and the fear of missing out on future gains. Swings in market sentiment to either extreme have characteristically been driven by these emotions. There are boundless examples of the impact of market sentiment on asset prices. As a result, it is commonly accepted amongst the investment community that asset prices often deviate from their intrinsic value due to changes in market sentiment.

Cycles in Market Sentiment

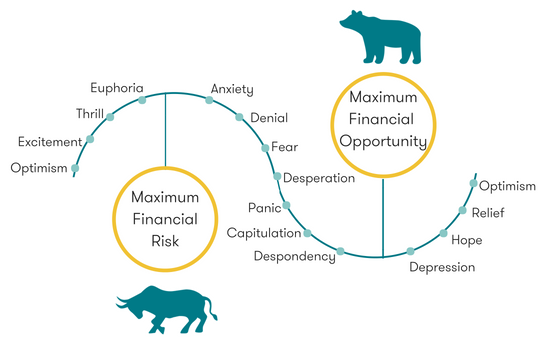

A typical cycle in market sentiment is shown above. The cycle encompasses an initial stage of optimism followed by peak euphoria, marking the top of an asset’s price. This generally marks the point where every potential buyer has already entered the market. There may not be many investors left or willing to purchase the asset, if any existing investors do decide to sell. In this situation, the asset’s price may give way to selling pressure, particularly if it trades above its intrinsic value.

Generally, a sell-off may be overdone if investor greed gives way to fear of further losses. Panic may take hold, leading some investors to sell an asset below its intrinsic value. Capitulation and despondency may mark an asset price’s trough as investors have already exited en masse from their positions. Once a trough has been reached, over time the asset price may then trend towards its intrinsic value and the cycle may repeat itself.

Why is Understanding Market Sentiment Important?

Successfully recognising and evaluating market sentiment before making investment decisions may allow investors to objectively take a step back and evaluate an asset on its fundamental merits. As well as, identify how the crowd is positioned and what stage of the market sentiment cycle we are in.

Related Article: So, You Want to Pick Stocks? Here’s What You Need to Know.

A Case Study: Bitcoin in 2017

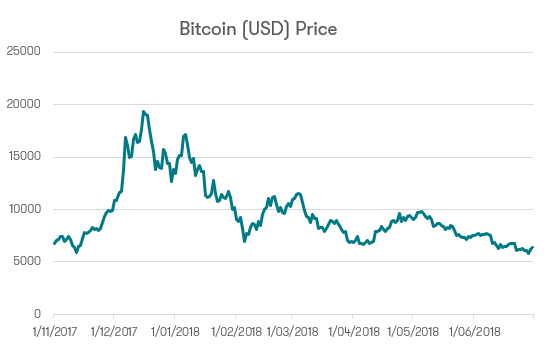

An example of a dramatic swing in market sentiment would be the rise and fall of cryptocurrencies, the most infamous of which is Bitcoin. In this case study, we’ll look at the rally towards the end of 2017, Bitcoin was garnering a significant amount of attention. There was an abundance of articles and news stories bringing attention to Bitcoin’s astronomical rise. Market conditions were extremely exuberant and it felt like everyone was rushing in to cash in on the action. According to Bloomberg, even the US investment bank Goldman Sachs was exploring the addition of a cryptocurrency desk.

However, this did not last for long. Cryptocurrencies, including Bitcoin, were sold-off heavily, leading to significant losses for investors who were late to the party. As seen in the graph below, investors who purchased Bitcoin at over US$19,000 per Bitcoin in mid-December 2017 had already seen the value of their investment drop by more than half by early February 2018. As of mid-June 2018, those who are still holding on to their Bitcoins, and who purchased at the peak have lost over 60% of their initial investment value. Interest in Bitcoin dropped significantly at the first peak in 2017. L

Looking at the prices of Bitcoin recently throughout the 2021 rally, this sentiment tells a different story. Learn why the price of Bitcoin has risen through 2021.

Measuring Market Sentiment

Given that market sentiment is a collective intangible feeling it is not simple to measure. However, market sentiment can be observed through the views of investors and their actions.

Common barometers of market sentiment include: investor surveys and market indicators. For those interested in the U.S. equity market, CNN Money has a fear and greed index based on prevailing market conditions.

The Bottom Line

Being aware of the impact of market sentiment and actively identifying measures of market sentiment represent an important aspect within investing. After all, the end goal is to make money, and everyone wants to buy low and sell high.

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.