How To Get Started Investing With A Robo-Advisor

We’ve explored the adoption of robo advice and robo investing in Australia, including what it is, how it works, how much it costs and other investment options.

Once upon a time, tailored investment advice was typically reserved for high net-worth individuals. Wealth managers themselves could be expensive, and initial investment deposits were significantly higher than the beginner investor may have wanted to part with.

While a robo advisor may not be able to tell you the odds of navigating an asteroid field, they can assist with everything from investment selection, super fund management and retirement planning.

View all Canstar rated Online Share Trading products. View Disclosures.

What is a robo advisor?

Robo advisors have been around in the US since 2008 but started gaining ground in Australia around 2014. For more information, you can read our article below on what you should know about robo advisors.

→ Related article: What are robo advisers & what should I know?

Betterment was the first robo advisor app. It launched in the US and began taking money from investors in 2010. While robo advisors themselves are newer, the automated portfolio allocation software they typically use isn’t.

Many non-roboid, or “human” wealth managers have been using this software for the better part of nearly two decades. It was not, however, accessible to the general public.

What are the fees for robo advice?

These days robo advice is predominantly offered by FinTech startups and online platforms. Robo advice platforms also tend to focus on Exchange Traded Funds. Some of the biggest in Australia include:

InvestSMART offers eight portfolios to investors, ranging from diversified income to property & infrastructure, equity growth and more. InvestSMART’s fees begin from $55 p/a.

SixPark offers portfolios with a mix of up to seven asset classes, ranging in their degree of risk and projected return. These asset classes are in the form of an ETF. SixPark charges $9.95 per month on invested amounts between $5,000 and $19,999. Fees for higher amounts are then calculated on a percentage of investment per annum.

Founded in 2013, Stockspot is an online investment advisor. Their portfolios focus on ETFs, both with growth and dividend yield objectives. For account balances of $10,000 or less, management fees are calculated at $5.50 monthly and increase from there based on a percentage of the total account balance.

QuietGrowth manages individual, joint, trust and self-managed super fund investments through its online advisor service. QuietGrowth does not charge fees for investments up to $10,000, and investments beyond this begin incurring a 0.6% annual fee.

Who else offers robo advice?

The above are just a sample of robo advice platforms available in Australia. In fact, many micro-investing apps employ robo advisors to help keep costs low.

Both Raiz & Spaceship Voyager’s platforms use robo advice, and initial investments in these platforms are lower than those listed above.

→ Related article: What is micro-investing and is it worth exploring?

So how do you get started?

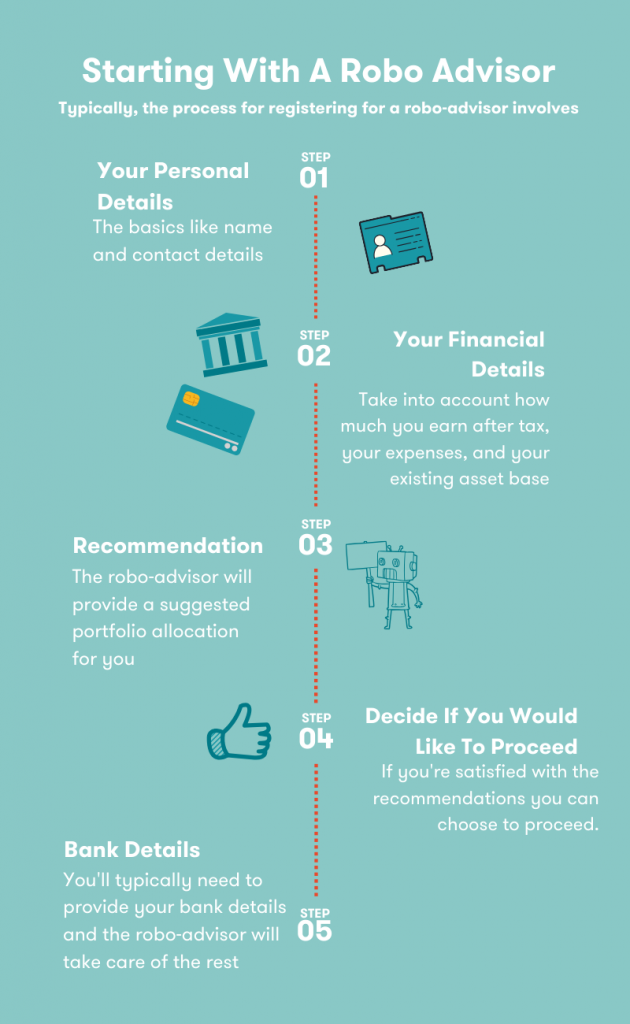

The convenient thing about robo advice is it can be done anywhere with an internet connection. Most platforms typically go through a questionnaire process, before making recommendations and requesting authorisation/investment deposits, as below.

Pros and Cons of robo advice

Robo advisors offer several benefits: they’re significantly cheaper than traditional advisors as the cost of human labour is removed, and are more accessible as all you need is an internet connection. They also typically don’t require as large of an investment to get started, and their advice/decisions will always remain consistent as they are free from human bias.

However, robo advisors may not always take into account your whole situation. Any outstanding debt or loans may not be taken into account. They also won’t be able to correct human errors, so check, double-check and triple-check any figures you plug into a robo advice calculator. Similarly, if your situation changes remember you’ll need to update this with your investment platform.

Also, for all their complex algorithms, remember robo advisors are no more able to guarantee a stock market trend than any human advisor. They work on modern portfolio theory and track indexes/attempt to outperform the market through a series of complex AI and automation. They are still subject to unexpected market changes, or portfolio underperformance.

If you decide robo advice is right for you, it may be worth comparing multiple different platforms to determine which suits you and your investment strategy best.

Alternatively, if you’d like to choose individual stocks yourself, you can always consider an Online Trading Platform.

This article was reviewed by our Content Producer Marissa Hayden before it was updated, as part of our fact-checking process.

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.