How to construct a core-satellite portfolio using ETFs

Whatever your financial goals are, many investors may be considering how best to build and optimise their investment portfolio. One option to consider is core-satellite investing using ETFs. This is a flexible and cost-effective approach that can be helpful in times of market volatility as we explore in this article.

What is core-satellite investing?

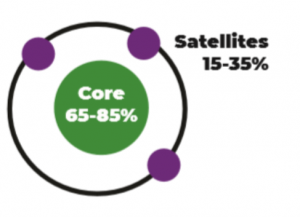

Enhanced core-satellite investing is a two-pronged approach to portfolio construction. The core is made up of passive exposures to major asset classes (mainly equities and fixed income) and the satellite investments are more opportunistic and designed to seek specific growth outcomes, sometimes at higher levels of risk. Generally, the enhanced core might make up 65-85% of the portfolio. This depends on the investor’s goals, investment horizon and risk tolerance, while satellites tend to represent 15-35%.

Investors may consider the enhanced core as where they set their strategic asset allocation – where the long-term targets are set for the investment composition to meet your goals, needs, and views. By contrast, the satellite is for tactical asset allocation – for shorter-term investments based on market and world conditions that are likely to be more temporary.

Traditionally the core passive exposures may have been broad-based, such as the entire S&P/ASX 300 or S&P 500. Today, investors are more likely to look for more tailored options to represent the exposure which may specifically identify or exclude companies based on criteria like quality and yield, or weight index assets in an alternative way to offer slightly different performance to the market. This is why we refer to an enhanced core today due to the greater sophistication or tailoring used. An example of this might be using an ETF that identifies companies from the S&P/ASX 300 based on quality and yield criteria as an exposure to Australian equities.

→Related reading: Which ETFs have the highest return on investment

Satellite investments can be investments in individual companies, real estate, targeted ETFs, or actively managed funds. In practice, this may look like an investor with a goal for high growth in the long term and higher risk tolerance may wish to use the satellite component of their portfolio to create a tilt towards riskier and higher growth areas.

For example, growth in artificial intelligence and automation or emerging market growth could be an area of interest. Or, alternatively, an investor focused on income might use the satellite components for yield or proactively switch to defensive or growth tilts to bolster their core investments, depending on market conditions. Another example would be adding increased allocations to commodities like gold which may offer a buffer in market volatility.

What makes an investment a core or satellite exposure?

Enhanced core-satellite investing is a flexible approach, so a core investment for one person might be a satellite investment for another person. It’s all down to individual goals, needs, circumstances and your situation. An investor with a high growth strategy might have a core with a higher proportion of ‘riskier’ assets like equities, while a defensive strategy might focus more on assets like gold or fixed income.

Managing investment costs

An enhanced core-satellite approach can assist with cost management for investors, depending on the investments you choose.

The core uses passive exposures which is typically lower cost when compared to actively managed funds. Using ETFs may offer additional pricing efficiencies for investors, such as lower administration and management fees as well as lower entry point compared to managed funds and listed investment trusts. For example, in the top-performing funds assessed under the Canstar Star Ratings, management fees for managed funds ranged from 0.19% up to 2.5%, with many including separate administration fees of up to 0.15% and performance fees up to 35%.

→Related reading: Do higher fees charged by managed funds result in higher returns?

By contrast, management costs for ETFs generally range from less than 0.1% to 1% – with those at the higher end typically in more complex, or difficult to access asset classes or using greater tailoring in rules criteria.

ETFs also tend to be highly liquid (depending on the assets held in the benchmark index) allowing investors to free up funds as needed, for cash needs or to access other satellite opportunities in a relatively cost-effective way.

Aiming for the bulk of a portfolio to be flexible and lower cost can be practical for many investors when considering the effect of fees on returns over the long term as well as allowing for the ability to adapt a portfolio to unexpected changes in circumstances. Investors can also consider how they allocate their ‘fee budget’ – that is how much they want to pay across their portfolio in fees – with some considering a higher budget for satellite investments where they think there may be opportunities for outperformance.

Finding the right investments for the strategy

Selecting the way you construct your portfolio is only the beginning of your investment journey, the next step is identifying what investments can help you reach your goals. The good news for investors looking at ETFs is that the continued growth of the market means it is becoming easier than ever to find tailored options to suit an enhanced core or satellite needs, or even express moral and ethical views. There’s no reason why your investment portfolio can’t be personally suited to you once you start to build it.

Cover image source: nikkimeel/Shutterstock.com

This article was reviewed by our Content Producer Isabella Shoard before it was updated, as part of our fact-checking process.

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.