-

Home Loans

-

Personal Loans

-

Car Loans

-

Credit Cards

-

Home Insurance

-

Car Insurance

-

Health Insurance

-

Life Insurance

-

Travel Insurance

-

Pet Insurance

-

Account & Transfers

-

Travel products

-

Superannuation

-

Investing

-

Calculators

-

Verticals

-

About Us

-

Canstar Blue

-

This advice is general and has not taken into account your objectives, financial situation, or needs. It is not personal advice. Consider whether this advice is right for you, having regard to your own objectives, financial situation and needs. You may need financial advice from a suitably qualified adviser. For more information, read Canstar’s Financial Services and Credit Guide (FSCG) and our detailed disclosure. Canstar may receive a fee for referring you to a product provider – for further information, see how we get paid. Payment of fees for ads does not influence our Star Ratings or Awards.

Canstar is a comparison website, not a product issuer, so it’s important to check any product information directly with the provider. Consider the Product Disclosure Statement (PDS), Target Market Determination (TMD) and other applicable product documentation before making a decision to purchase, acquire, invest in or apply for a financial or credit product. Contact the product issuer directly for a copy of the PDS, TMD and other documentation.

Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular credit product or loan. If you decide to apply for a credit product or loan, you will deal directly with a credit provider, and not with Canstar. Rates and product information should be confirmed with the relevant credit provider. For more information, read the credit provider’s key facts sheet and other applicable loan documentation for that product. Read the Comparison Rate Warning.

-

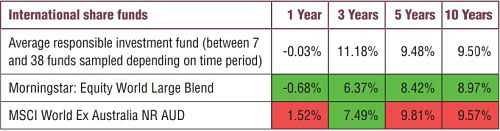

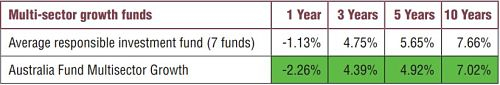

All information about performance returns is historical. Past performance should not be relied upon as an indicator of future performance; unit prices and the value of your investment may fall or rise.

Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular product. The information has been prepared without taking into account your individual investment objectives, financial circumstances or needs. Before you decide whether or not to acquire a particular financial product you should assess whether it is appropriate for you in the light of your own personal circumstances, having regard to your own objectives, financial situation and needs. You may wish to obtain financial advice from a suitably qualified adviser before making any decision to acquire a financial product. Please refer to the product disclosure statement (PDS) and Canstar’s Financial Services and Credit Guide (FSCG) for more information, and read our detailed disclosure, important notes and liability disclaimer.

-

Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular product. If you decided to apply for a product, you will deal directly with a financial product provider, and not with Canstar. Cost and product information should be confirmed with the relevant product provider. For more information, read the product disclosure statement (PDS), Canstar’s Financial Services Guide (FSG), detailed disclosure, important notes and liability disclaimer.

The benefits or inclusions mentioned represent a selection of what is covered at the time of writing. Additional terms and conditions may apply to different features. Additional fees may apply to the product. Please ensure that you read the product disclosure statement (PDS) to determine all the current options and inclusions for the product you are considering.

-

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promotion products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promotion products may be displayed in a fixed position in a table, regardless of the product's rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

- Privacy Policy

- Terms of use

- Licence Details & FSCG

- How we get paid

- Advertising Policy

- Conflicts of Interest

- Star Ratings and Awards Methodologies

- New Zealand

- Complaints Process

Any advice provided on this website is general and has not taken into account your objectives, financial situation or needs. Consider whether this advice is right for you. Consider the Product Disclosure Statement and Target Market Determination before making a purchase decision. Canstar provides an information service. It is not a credit provider, and in giving you information about credit products Canstar is not making any suggestion or recommendation to you about a particular credit product. Research provided by Canstar Research AFSL and Australian Credit Licence No. 437917. You must not reproduce, transmit, disseminate, sell, or publish information on this website without prior written permission from Canstar.