Banks slash term deposit rates ahead of RBA announcement

A flurry of banks have begun to cut term deposit rates in the lead up to Tuesday’s RBA cash rate decision.

A flurry of banks have begun to cut term deposit rates in the lead up to Tuesday’s RBA cash rate decision.

KEY POINTS

- Over 20 banks have reduced term deposit rates ahead of the RBA’s cash rate decision, with cuts of up to 0.95 percentage points.

- While some banks still offer high savings rates (up to 5.50%), potential RBA rate cuts could bring these down to 4.50% by the end of the year.

- Australians have saved a record $1.57 trillion in banks, but those with term deposits may face lower returns when their fixed terms mature.

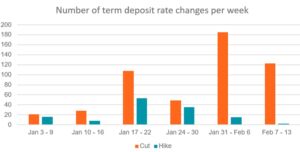

Canstar research shows in the last two weeks over 20 banks have cut at least one term deposit rate, including the big four banks.

NAB and ANZ have each made an array of cuts of up to 0.20 percentage points, Westpac has made one cut to its 11-month special rate by 0.05 percentage points, while CBA has made a number of cuts of up to 0.95 percentage points and a small handful of hikes.

Source: Canstar.com.au. Based on personal, non-compounding term deposits on Canstar’s database, available for all deposit amounts. All payment frequencies are considered.

Highest rates still over 5% – for now

Canstar research shows there are just six banks offering at least one term deposit rate of 5% or higher across any term deposit rate or loan size.

← Mobile/tablet users, scroll sideways to view full table →

| Highest term deposit rates | ||

|---|---|---|

| Term | Bank | Rate |

| 6 months | 5.10% | Australian Military Bank |

| 1 year | 5.05% | Family First |

| 2 years | 4.70% | Qudos Bank |

| 3 years | 4.50% | Judo Bank, Qudos Bank |

Source: Canstar.com.au. Highest term deposit rates listed above are for each specific term listed.

Term deposit rates have been on the downward trend since mid-2023. On the Canstar database, the highest 1-year term deposit rate was 5.45% until July 2023 and the highest 2-year rate was 5.35% until December 2023.

-

Interest paid end of term

-

For deposit amounts $5,000 - $10,000,000

Protected by the Australian Government's guarantee

Manage your term deposit online

-

Interest paid end of term

-

For deposit amounts over $5,000

-

Interest paid end of term

-

For deposit amounts $10,000 - $1,000,000

-

Interest paid end of term

-

For deposit amounts $10,000 - $1,000,000

Invest Between $5,000 - $2,000,000.

Interest Paid at Maturity Up to 12 Months

-

Interest paid end of term

-

For deposit amounts over $5,000

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promotion products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promotion products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

Savings account rates to tumble on back of cash rate cuts

The majority of savings rates have, by and large, held firm since the beginning of the year, with the highest ongoing savings rate remaining at 5.50%, available from four banks – ING, MOVE, BOQ and ubank.

Two cash rate cuts could see these highest rates drop to 5%, while four standard RBA cuts, as CBA and Westpac are predicting, could see them drop to 4.50% by the end of the year.

← Mobile/tablet users, scroll sideways to view full table →

| Current highest ongoing savings rates | |||

|---|---|---|---|

| Account | Max rate |

Monthly conditions for max rate |

If conditions not met: |

| ING Savings Maximiser |

5.50% | Deposit $1K+ to ING bank acct, make 5+ purchases and grow savings balance. Balances up to $100k. |

0.55% |

| MOVE Bank Growth Saver |

5.50% | Deposit $200+ into savings account + no withdrawals. Balances up to $25k. |

0.10% |

| BOQ Future Saver |

5.50% | Ages 14 – 35. Deposit $1k+ into BOQ bank acct, make 5+ transactions. Balances up to $50k* |

0.05% |

| ubank Save | 5.50% | Deposit $500+ into linked account. Balances up to $100k. |

0.00% |

Source: Canstar.com.au. BOQ waives monthly conditions for customers under 18 years.

← Mobile/tablet users, scroll sideways to view full table →

| Highest ongoing savings rates with no monthly conditions | ||

|---|---|---|

| Account | Rate | Max deposit for ongoing rate |

| Australian Unity Freedom Saver |

5.10% | $250,000 |

| Macquarie Savings account |

5.00% | $1 million^ |

| ANZ Plus Flex Saver |

5.00% | $5,000 |

Source: Canstar.com.au. Based on the highest ongoing savings rates with no monthly terms and conditions. Excludes accounts where highest rates are not available on low balances. Excludes kids and young adult accounts.

^Intro rate of 5.35% for 4 mths on bal up to $250K

Households have record savings in the banks

The banks have cut term deposit rates at the same time that Australians have stashed a record amount of money in the bank.

Latest APRA Monthly Authorised Deposit-taking Institution Statistics, for the month of December, showed the total amount saved in the bank by households hit $1.57 trillion – up $125.2 billion (8.7%) compared to a year earlier. Note: this includes money in offset accounts.

← Mobile/tablet users, scroll sideways to view full table →

| APRA total deposits by households | ||

| Amount | Monthly change | Year-on-year change |

| $1.57 trillion | +$21.9 billion

+1.4% |

$125.2 billion

+8.7% |

Source: APRA Monthly Authorised Deposit-taking Institution Statistics, released 31 January 2025, prepared by Canstar.com.au. Note: deposits from households include term deposits, transaction accounts, mortgage offset accounts and savings accounts on the books of ADIs.

Canstar data insights director, Sally Tindall says, “An easing of the cash rate is always a double-edged sword and this recent deluge of term deposit cuts is an unfortunate but timely reminder of this.”

“In the past two weeks, we’ve seen more than 20 banks cut at least one term deposit rate including each of the big four banks.

“Right now there’s still a small handful of banks offering term deposit rates of 5 per cent or more however, with the RBA set to cut the cash rate, potentially as soon as Tuesday, these offers have a target on their back.

“Australians with money in term deposits could get a shock when their fixed period matures and they’re facing much lower interest rates. For those looking to lock up their hard-earned money in another term deposit, time may be of the essence.

“High-interest savings accounts haven’t yet seen much movement recently, with four banks still offering ongoing savings rates up to 5.50 per cent, something keen savers have been relishing for more than a year. However, this could soon come to an abrupt end under the hammer of the RBA.

“Savers looking to extend the high-rate honeymoon for as long as possible should shop around for a competitive rate before they start to fall.

“Banks are expected to pass on cash rate cuts to their savings customers, however, moving your nest egg into a high interest saving rate should help cushion the blow.”

Compare products, monitor your credit score, track interest rate changes, and access the deals, download the Canstar app.

Cover image source: Robyn Mackenzie/Shutterstock.com

This article was reviewed by our Content Editor Alasdair Duncan before it was updated, as part of our fact-checking process.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

50% min deposit

50% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.