Personal credit card debt grows as cost of living continues to bite

New Reserve Bank credit card data shows personal credit card spending increased in November 2023.

Spending on personal credit cards in the lead-up to Christmas grew compared to the same period last year with the number and value of purchases in November 2023 rising, according to newly released credit and charge card data from the Reserve Bank.

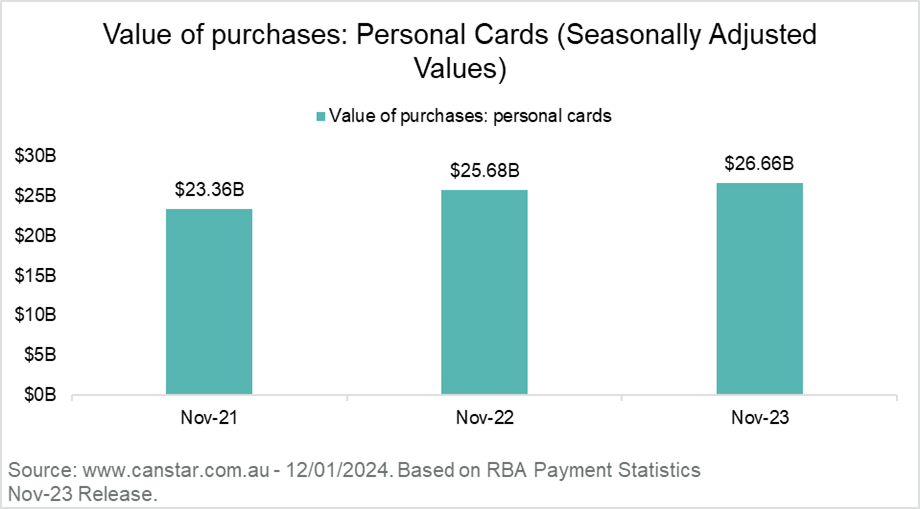

The number of new purchases on personal credit cards in November rose by 3.58% year on year to reach 285.9 million. At the same time, the value of those purchases increased by $978.7 million or 3.81% annually to hit $26.66 billion in November.

Credit card spending in November continues to climb each year as Aussie shoppers take advantage of the traditional Black Friday US sales event. The value of purchases has increased by 14.11% since November 2021 when a total of $23.36 billion in purchases were put on plastic.

The spending trend continues despite 13 Reserve Bank cash rate rises hitting mortgage holders since May 2022. Rate hikes are doing little to curb spending and may be the cause for growing credit card debt in 2024, warns Canstar.

Already debt on personal credit cards accruing interest in November is at $17.29 billion with the average balance accruing interest per card sitting at $3,603. It would take someone almost 25 years to repay the average balance accruing interest if they were only making minimum repayments and repaying their debt with an average purchase rate of 17.10%.

Finance expert at Canstar, Steve Mickenbecker says, “Australia’s love affair with American culture has seen credit cards being put to heavy use during the Black Friday sales this past November.”

“Home loan borrowers will be hoping that the Reserve Bank views the higher spending as a change of pattern and not as an economy running out of control.

“While debt accruing interest is down very modestly over the year to November, the overall balances on credit cards is up by $681 million for the period. Hopefully, Aussie card holders’ New Year’s resolutions included paying off credit cards fast during 2024 and the increase doesn’t find its way into long-term debt.

“Australians who have put Christmas 2023 on their credit card can get a leg up with the grind of repaying debt by moving their debt to a zero interest balance transfer card. Used properly, these cards mean that the full monthly payment goes towards knocking off debt, not paying the bank interest.

“Low rate cards can help but a bigger balance on the monthly credit card statement has to be a wake-up call to pare back on spending. January is a great time of year to set up a household budget.”

canstar.com.au">Top five longest 0% balance transfer offers on Canstar.com.au

← Mobile/tablet users, scroll sideways to view full table →

| Top 5 Longest 0% Balance Transfer Credit Cards | ||||||||

|---|---|---|---|---|---|---|---|---|

| Provider | Card Name |

Balance Transfer Duration (Months) |

Balance Transfer Revert Rate |

Balance Transfer Fee |

Purchase Rate |

Annual Fee |

Minimum Credit Limit |

|

|

St.George |

Rainbow Vertigo Visa/ Vertigo Visa – Balance Transfer Offer |

32 | 21.49% | – | 13.99% | $55 | $500 | |

| Bankwest | Zero Mastercard/ Zero Platinum Mastercard |

28 | 14.99% | 3.00% | 14.99% | $0 | $1,000/ $6,000 |

|

| Westpac | Low Rate Card – Balance Transfer Option |

28 | 21.49% | – | 13.74% | $59 | $500 | |

| NAB | Low Rate Card | 28 | 21.74% | 2.00% | 12.49% | $59* | $1,000 | |

| ANZ | Low Rate – Balance Transfer Offer |

28 | 21.99% | 2.00% | 13.74% | $58* | $1,000 | |

Source: www.canstar.com.au – 12/01/2024. Based on personal, unsecured credit cards with a 0% balance transfer offer on Canstar’s database. Top 5 selected based on the longest balance transfer period. Table sorted in descending order by balance transfer period, followed by ascending order by balance transfer revert rate.

*$0 in the first year.

Summary of Reserve Bank Personal Credit Card stats for November 2023

← Mobile/tablet users, scroll sideways to view full table →

| Personal Credit Card Statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Nov-22 | Oct-23 | Nov-23 | Highest/ Lowest Since |

Difference | % Change | |||

| MoM | YoY | MoM | YoY | |||||

| No. of Accounts (Original) |

12.4 million |

12.6 million |

12.6 million |

Highest since Mar-2021 |

9,024 | 180,651 | 0.07% | 1.45% |

| Balances Accruing Interest (Original) |

$17.30 billion |

$17.40 billion |

$17.29 billion |

Lowest since Sep-2023 |

-$115.4 million |

-$18.8 million |

-0.66% | -0.11% |

| Average Balance Accruing Interest^ (Original) |

$3,659 | $3,629 | $3,603 | – | -$27 | -$56 | -0.73% | -1.54% |

| Total Balances |

$33.44 billion |

$33.95 billion |

$34.12 billion |

Highest since Dec-2020 |

$168.1 million |

$681.4 million |

0.50% | 2.04% |

| No. of Purchases |

276.0 million |

285.5 million |

285.9 million |

Highest since Sep-2023 |

364,149 | 9.9 million |

0.13% | 3.58% |

| Value of Purchases |

$25.68 billion |

$26.39 billion |

$26.66 billion |

Highest since Sep-2023 |

$268.0 million |

$978.7 million |

1.02% | 3.81% |

| No. of Cash Advances |

1.11 million |

1.06 million |

1.04 million |

Lowest since Sep-2021 |

-29,180 | -73,789 | -2.74% | -6.65% |

| Value of Cash Advances |

$399.8 million |

$392.2 million |

$382.7 million |

Lowest since Apr-2022 |

-$9.5 million |

-$17.0 million |

-2.42% | -4.26% |

Prepared by www.canstar.com.au. Data source: RBA Credit and Charge Card Statistics, Nov-2023. All values are in seasonally adjusted terms unless otherwise stated, in which case statements about trends should be made with caution.

^Assumes 38% of personal credit card accounts are revolving a balance and therefore accruing interest, based on the Canstar 2022 Customer Satisfaction Survey (n=4936).

If you’re thinking about switching, you can compare credit cards with Canstar to find a deal that might be suitable for you.

Compare Low Rate Credit Cards with Canstar

The table below displays some of our referral partners’ low rate credit cards for Australians spending around $2000 per month. The results shown are sorted by highest Star Rating, then lowest purchase rate, then alphabetically by provider name. Consider the Target Market Determination (TMD) before making a purchase decision. Contact the product issuer directly for a copy of the TMD. Use Canstar’s credit cards comparison selector to view a wider range of credit cards. Canstar may earn a fee for referrals.

0.00% p.a. interest rate on balance transfers for 24 mths. Rate reverts to 12.99% p.a. Balance transfer fee of 3% applies. Offer available until further notice. See provider website for full details. Terms and conditions apply.

Apply in full online

Apply in full online

Fraud protection

Fraud protection

0.00% p.a. interest rate on balance transfers for 24 mths. Rate reverts to 12.99% p.a. Balance transfer fee of 3% applies. Offer available until further notice. See provider website for full details. Terms and conditions apply.

Apply in full online

Apply in full online

Fraud protection

Fraud protection

Get $350 Back once you spend $1,000 or more on eligible purchases you get $50 cashback for each month for 7 consecutive statement periods. Offer available until further notice. See provider website for full details. Terms and conditions apply.

24hr approval available

24hr approval available

Apply in full online

Apply in full online

Fraud protection

Fraud protection

0.00% p.a. interest rate on balance transfers for 20 mths. Rate reverts to 21.99% p.a. Balance transfer fee of 3% applies. Offer available until further notice. See provider website for full details. Terms and conditions apply.

24hr approval available

24hr approval available

Apply in full online

Apply in full online

Fraud protection

Fraud protection

Get 10% Back once you spend at selected supermarket and petrol stations (up to $500 total cashback) . Offer available until further notice. See provider website for full details. Terms and conditions apply.

6.99% p.a. interest rate on balance transfers for 12 mths. Rate reverts to 21.99% p.a. Balance transfer fee of 2% applies. Offer available until further notice. See provider website for full details. Terms and conditions apply.

24hr approval available

24hr approval available

Apply in full online

Apply in full online

Fraud protection

Fraud protection

Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular credit card product. If you decide to apply for a credit card, you will deal directly with a financial institution, and not with Canstar. Rates and product information should be confirmed with the relevant financial institution. For more information, read Canstar’s Financial Services and Credit Guide (FSCG), detailed disclosure, important notes and liability disclaimer. Products displayed above that are not “Sponsored or Promoted” are sorted as referenced in the introductory text and then alphabetically by company. Canstar may receive a fee for referral of leads from these products. See How We Get Paid for further information.

Cover image source: kitzcorner/Shutterstock.com

This article was reviewed by our Senior Finance Journalist Alasdair Duncan before it was updated, as part of our fact-checking process.

Save $69 with a first year card fee of $0. Annual ongoing card fee is $69. Offer available until further notice. See provider website for full details. Terms and conditions apply.

Try our Credit Cards comparison tool to instantly compare Canstar expert rated options.