Rising Stars: Canstar’s Australian Property Market Report 2023

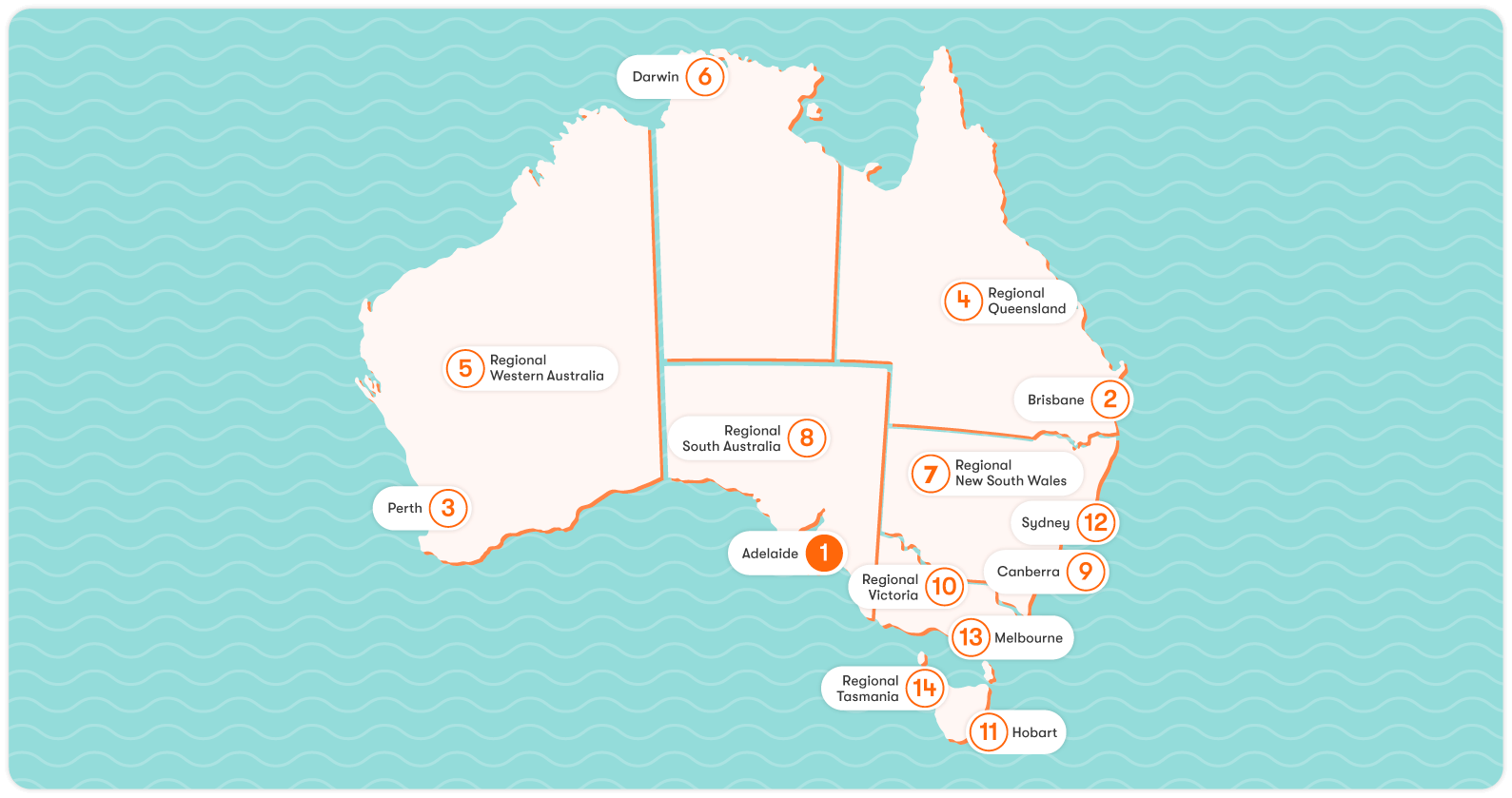

Rising Stars – Canstar’s annual Australian Property Market Report powered by Hotspotting – is back for its second year. Using a series of forward-looking indicators the Rising Stars report forecasts the prospects for annual price growth in each of the nation’s major market jurisdictions.

It ranks 14 jurisdictions nationally – comprising eight capital cities and six regional states and territories – based on five key metrics. These are sales volumes, quarterly price growth, vacancy rates, rental growth and infrastructure spending.

Each of the 14 market jurisdictions is ranked from one to 14 on each of the five metrics. These rankings are then used to determine an overall ranking for each of the jurisdictions.

We have also identified 110 ‘Rising Star’ suburbs across the country. These have been selected based on outperformance in each of the five metrics.

Download now

There has been quite a shake-up in the rankings of Australian real estate markets. Last year regional locations dominated the top three spots but this year it’s the smaller capital cities that shine. Adelaide is at the top of the leaderboard, with the best prospects for future capital growth of the 14 jurisdictions assessed. The South Australian capital is followed by Brisbane and Perth.

There has been quite a shake-up in the rankings of Australian real estate markets. Last year regional locations dominated the top three spots but this year it’s the smaller capital cities that shine. Adelaide is at the top of the leaderboard, with the best prospects for future capital growth of the 14 jurisdictions assessed. The South Australian capital is followed by Brisbane and Perth.

All three markets have been strongly resistant to the downturn pressures and have benefited from the pursuit of affordability, which is the strongest theme pervading property markets across Australia in 2022.

Regional Queensland has dropped slightly from second to fourth but the outlook is still promising. As the nation’s leading recipient of population growth from internal migration, it continues to benefit from the ‘Exodus to Affordable Lifestyle’ trend.

The sharpest decline in property markets has been in New South Wales, both in Sydney (which dropped from fourth to 12th) and in Regional New South Wales (which fell from first to seventh). This has coincided with a notable drop-off in the state’s economy. Sydney and many of the high-profile regional markets have become very expensive locations for housing in the recent boom – and it is the top end markets that have declined noticeably.

Canberra, another very expensive city for housing, has dropped down the rankings from fifth to ninth. Melbourne – one of our biggest and priciest capital cities – is second last in our rankings, dropping two places from 11th last year.

In last place is Regional Tasmania. After a prolonged boom, the property market has passed its peak.

Brisbane. Ranked 2nd (Ranking last year: 8th)

The Brisbane market declined overall early in 2022, damaged by major weather events and by state government legislation that deterred investors, but the future is looking bright. In the next 12 months, Brisbane is likely to produce growth numbers boosted by internal migration and major infrastructure projects, with the 2032 Olympics a beacon for investment.

Regional Queensland. Ranked 4th (Ranking last year: 2nd)

Regional Queensland ranks fourth overall and is first among the regional markets. Few other states can offer Queensland’s line-up of strong regional cities with vibrant local economies and attractively low house prices. It will continue to attract home buyers under the ‘Exodus to Affordable Lifestyle’ trend and population trends will continue to boost markets across the state.

Sydney. Ranked 12th (Ranking last year: 4th)

Sydney dropped from fourth place last year to 12th spot and is among the weakest jurisdictions in the nation on sales volumes, recent price growth and vacancy rates. The decline in the market does not mean that all sectors are weak. Middle-ring municipalities that offer relative affordability and well-located apartment precincts still have good buyer demand.

Regional New South Wales. Ranked 7th (Ranking last year: 1st)

It was last year’s top-ranked market but Regional New South Wales is in seventh place this year. Even though markets have cooled it’s not all bad news. There are many regional centres where local economies remain strong and demand for real estate is continuing to rise. The real estate growth emphasis is now switching from seaside locations to inland areas.

Canberra. Ranked 9th (Ranking last year: 5th)

Known for its steadiness, the Canberra market has maintained its status as the Goldilocks of Australian real estate – not too cold, not too hot, just right. What Canberra lacks though is affordable houses – the cheapest suburb has a median house price above $700,000. As a result, many investors and home buyers are turning to apartments in central locations and this is one market still rising.

Melbourne. Ranked 13th (Ranking last year: 11th)

The Melbourne market is subdued overall and some of its forward indicators are quite weak, relative to other market jurisdictions. This has resulted in Melbourne dropping two spots to 13th. On a positive note, Melbourne is a resilient city and many of the key market sectors – affordable locations, in particular – are still travelling fairly well.

Regional Victoria. Ranked 10th (Ranking last year: 10th)

Regional Victoria was one of the first areas to benefit from the ‘Exodus to Affordable Lifestyle’ trend. It started with markets one to two hours’ drive from Melbourne and it spread to locations further away during the pandemic. After nearly five years of strong growth, things have tapered off a little. Most of the Regional Victoria centres where buyer demand is rising are regional cities or hill change towns.

Hobart. Ranked 11th (Ranking last year: 13th)

Hobart has been at the forefront of price growth in Australia for the past five years. Previously the cheapest capital city market, Hobart dwellings are now considerably dearer than Adelaide, Perth and Darwin – and not much below Brisbane and Melbourne. It has become harder to find Hobart suburbs with rising momentum and a degree of affordability.

Regional Tasmania. Ranked 14th (Ranking last year: 12th)

Someone has to come last and this year it is Regional Tasmania. After a prolonged boom, which saw many areas experience extraordinary price growth, the property market overall has passed its peak. Even though prices are still solid, rental growth has slowed down and sales activity has tapered off. Identifying growth locations has become harder.

Adelaide. Ranked 1st (Ranking last year: 9th)

After many years of flying under the radar of property investors, Adelaide is no longer an underrated market. It has been at the forefront of price growth nationwide for the past two years and continues to have one of Australia’s busiest and most competitive property markets. This has helped Adelaide land the top spot in our rankings this year, up from ninth last year.

Regional South Australia. Ranked 8th (Ranking last year: 14th)

It might not be a property market that investors talk about but Regional South Australia has a lot going for it and has jumped from last spot to eighth in our rankings. There are notable lifestyle towns, resources-related centres and regional centres which provide good options for investment, particularly for those seeking cheaper prices and higher yields.

Perth. Ranked 3rd (Ranking last year: 7th)

Perth has defied the downturn in markets in the bigger capital cities in 2022 and continues to experience a busy and competitive housing market. Having endured a prolonged market downturn, Perth is now one of the nation’s cheapest capital cities. That level of affordability and the strength of the underlying state economy are boosting the Perth property market.

Regional Western Australia. Ranked 5th (Ranking last year: 3rd)

The future is looking bright for property markets in Regional Western Australia. It ranks in fifth place in this national analysis, boosted by very low vacancies, strong rental growth and an uplift in buyer activity. Price growth has been solid but subdued over the past couple of years, but the strength of the forward indicators suggests higher growth may lie ahead.

Check out Regional Western Australia’s Top 5 Rising Star suburbs

Darwin. Ranked 6th (Ranking last year: 6th)

Darwin is perhaps Australia’s most underrated and overlooked property market. It has rising sales activity, vacancy rates are below 1% in virtually every postcode and it has the highest rental yields among the capital cities. Capital growth has not been as high as in other cities but if some of the major developments being discussed go ahead, they may translate into more dramatic growth.

Important Information

To the extent that any advice is contained in Canstar’s Australian Property Market Report (Powered by Hotspotting by Ryder), such advice is general and has not taken into account your objectives, financial situation, or needs. It is not personal advice. Consider whether this advice is right for you, having regard to your own objectives, financial situation and needs. You may need financial advice from a suitably qualified adviser. Consider the product disclosure statement (PDS) and Target Market Determination (TMD) before making a decision about a financial product. Contact the product issuer directly for a copy of the PDS and TMD. For more information, read Canstar’s Financial Services and Credit Guide (FSCG), and read our Detailed Disclosure.

This report has been prepared as a guide only and is not a recommendation about taking any particular action. We recommend that you seek professional advice from a suitably qualified adviser before electing to make any property investment decision.

All information about performance returns is historical. Past performance should not be relied upon as an indicator of future performance. The value of your investment may fall or rise. Forecasts about future performance are not guaranteed to occur.

A property investment may not be suitable for all people and the information in this report does not take into account your individual needs or investment risk profile. There are no certainties in property investment and as with any investment, there are always risks and variables that need to be taken into account.