RBA holds: House prices falling as strained property owners enter spring selling season

The property market’s impact on Aussie households and the economy is on the minds of Australia’s central bankers, who’ve decided to keep the cash rate on hold this month. The numbers show house prices have fallen during the pandemic, and there are now concerns that strained property owners could be tempted to panic-sell to keep their heads above water.

The board of the Reserve Bank of Australia (RBA) decided to leave the cash rate on hold at 0.25% today at its monthly meeting.

Dr Lowe also announced the RBA would provide further support to authorised deposit-taking institutions (ADIs) – a measure which was first launched in March – which is expected to reduce bank funding costs and in turn help reduce interest rates for borrowers.

RBA Governor Philip Lowe said the central bank would not raise the cash rate until progress was made towards full employment and inflation of 2-3%.

“In Australia, the economy is going through a very difficult period and is experiencing the biggest contraction since the 1930s,” Dr Lowe said.

“As difficult as this is, the downturn is not as severe as earlier expected and a recovery is now under way in most of Australia.

“This recovery is, however, likely to be both uneven and bumpy, with the coronavirus outbreak in Victoria having a major effect on the Victorian economy.”

The recession has gripped the RBA’s attention not just when it comes to making decisions about monetary policy, but also the property market.

In its recent discussion paper titled How Risky is Australian Household Debt?, the RBA investigated the effect of house prices falling by 40% – a scenario the researchers described as “extreme but plausible”.

Despite the considerable amount of mortgage debt in Australia, the RBA concluded that Australia’s banks would likely be resilient enough to withstand rising household debt caused by a severe stress such as a sharp drop in employment and house prices, similar in scale to the shock experienced by some countries during the global financial crisis, due to the “moderate loan-to-valuation ratios” on most home loans.

The scenario the RBA drew up was hypothetical, but Australian house prices have already fallen this year.

→ Related story: Will COVID-19 be as bad as the GFC?

House prices, property listings and asking prices have fallen during the pandemic

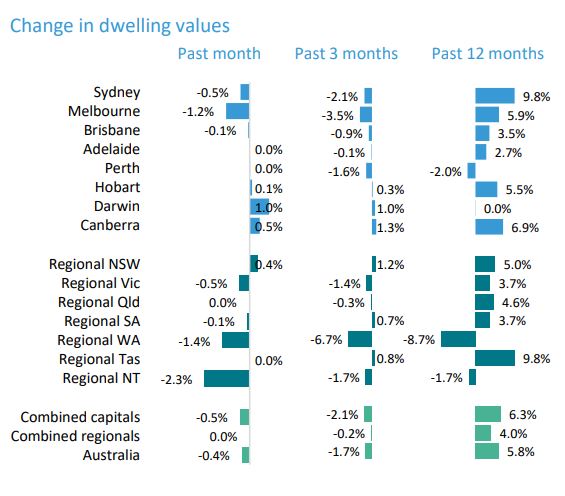

Research released today showed national house prices recorded four months of decline, down 0.40% in August, but the rate of property price falls slowed over the past two months, according to CoreLogic’s Hedonic Home Value Index.

This decline in the housing market has been “intrinsically linked” to social distancing policies and border closures that have unsurprisingly weakened economic performance, according to CoreLogic head of research Tim Lawless.

He said Melbourne’s market was feeling the heat the most out of the capital cities due to the extent of the virus outbreak in Victoria, with its house prices having fallen 1.2% in August.

It’s not all bad news across the board though, as only three of the eight capital cities recorded falling values in August – Sydney, Melbourne and Brisbane. The others remained steady or recorded a rise in values.

Regional markets have also generally been more resilient than capital cities, which CoreLogic said was likely due to these areas being less impacted by the pause in migration and having cheaper, lower-density housing, as well as the fact that with remote work becoming more common, living in capital cities could be “less of a factor in home purchasing decisions”.

SQM Research also released figures today that showed national residential property listings decreased in August by 6.3%, and were down by 10% compared to a year ago.

Melbourne recorded the highest decrease out of the capital cities, with listings falling by 13.2%.

The average asking price for both houses and units also fell in capital cities in August, down 0.3%, with the average asking price now at $564,300 for units and $980,500 for houses.

→ Related story: Key considerations when buying distressed property

September could spark pressure to panic-sell property

September could prove a pivotal month for many Australian homeowners and property investors.

Strained property owners could be faced with decisions about how to safeguard their finances as income support services taper off. This coincides with the start of the spring selling season, which could see some property owners panic-sell in a bid to keep their finances afloat.

Canstar finance expert Steve Mickenbecker said September was a likely turning point for many homeowners and investors hoping to see the year out in better shape and avoid selling their property under duress.

“With JobKeeper and JobSeeker winding back from 28 September and many mortgage holders nearing the end of repayment pauses with their banks, September will be a testing time,” Mr Mickenbecker said.

CoreLogic noted in its research report today that the number of strained properties on the market could change towards the end of the year and into next year if lenders became less lenient on distressed borrowers who have taken repayment holidays. Many borrowers’ six-month repayment holidays will also come to an end around the end of September, CoreLogic noted.

“Now is the time to safeguard yourself by picking up new money savings habits, and making a decision to renegotiate your loan or refinance to a lower-cost option,” Mr Mickenbecker said.

A recent Canstar survey revealed that 57% of property owners have not done anything to cut the cost of their repayments this year.

“There are likely better rates out there for you. We know lenders have been moving rates out of step with the Reserve Bank, and the moves have been largely cuts, with just one variable rate increase since July. Widespread rate rises still seem a while off,” Mr Mickenbecker said.

| Lenders that Moved Home Loan Rates | ||||

| July | August | |||

| Cuts | Hikes | Cuts | Hikes | |

| Variable | 14 | 1 | 17 | 0 |

| Fixed | 21 | 11 | 12 | 8 |

| Source: www.canstar.com.au, 1 September, 2020. Based on owner-occupier and investment loans available for $400,000, at 80% LVR with principal & interest and/or interest-only payments in Canstar’s database. Includes new-to-bank interest rates (including specials). Excludes honeymoon, intro-rate, and first home buyer-only home loans. | ||||

“The banks have been battling each other for lower fixed interest rates, with 12 lenders cutting 112 fixed rates in August. If you are nearing the end of a repayment pause, you should at least be considering this as an option to lock in low repayments.

“Interest-only rates have been coming down in the past couple of months, so if you’re an investor this might be an option to cut repayments for short-term relief.”

Interest rate wrap for August

- Canstar data shows 17 lenders made 63 cuts to variable home loan rates and no lenders increased variable home loan rates.

- 12 lenders cut 112 fixed interest rates, while 8 lenders increased 81 fixed rates.

- Variable rates were cut by an average of 0.20 percentage points.

- Fixed rates were cut by an average of 0.29 percentage points and increased by an average of 0.24 percentage points.

This article was reviewed by our Sub-editor Tom Letts before it was published as part of our fact-checking process.

The comparison rate for all home loans and loans secured against real property are based on secured credit of $150,000 and a term of 25 years.

^WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Owner occupied

Owner occupied

20% min deposit

20% min deposit

Redraw facility

Redraw facility

Try our Home Loans comparison tool to instantly compare Canstar expert rated options.