Health insurance providers offering up to 10% discount for young adults

If you are aged between 18 to 29, you could be eligible for a discount on the cost of your private health insurance premiums.

Health insurance providers can now offer premium discounts of up to 10% to young adults. This was introduced as part of a raft of changes to health insurance on 1 April, 2019. Here is a breakdown of who may be eligible for a discount and how much money you could potentially save each year.

Who can get the health insurance discount?

Health insurance providers have the option of offering age-based discounts on hospital insurance. To get a discount, you’ll need to be aged 18 to 29 years old and have your own health insurance policy or a policy with a partner or your own family (not covered as a dependent on a family or single parent policy).

The discount you can receive will depend on how old you are when you first purchase the hospital policy. The younger you are, the more of a discount you could get. Discounts range from 2% for 29-year-olds to 10% for 18 to 25-year-olds.

The table below shows the breakdown of the age-based discounts on offer for different ages:

Allowable age-based discounts for health insurance by age

| Person’s age at discount assessment date |

% discount provider may offer |

| 18-25 | 10% |

| 26 | 8% |

| 27 | 6% |

| 28 | 4% |

| 29 | 2% |

| 30 | 0% |

Source: Australian Government, Department of Health.

If you are on a couple or family policy, the discount applied will be the average of the discount the two adults are eligible for. So, if you had a 10% discount and your partner had no discount, the total discount applied to the policy would be 5%.

Once you have an age-based discount, that discount will apply in full until you turn 41 years old if you stay on the same health insurance policy. When you turn 41, the discount will gradually phase out by 2% each year until there is no discount applied.

It’s up to your insurance provider whether it will provide discounts and on which particular insurance products. If it does, the discount must be offered on the same basis to all eligible holders of that insurance policy.

It is also up to the insurance provider to choose whether age-based discounts will be honoured if you transfer between discounted products and funds, so it’s a good idea to check this before transferring.

Which health insurance providers offer age-based discounts?

Canstar’s database shows a number of health insurance providers offer age-based discounts for policyholders aged 18 to 29 years on selected health insurance policies. Listed in alphabetical order, those providers include:

- AAMI

- ahm Health Insurance

- Bupa

- CBHS Corporate Health

- CBHS Health Fund

- Hunter Health Insurance

- CUA Health

- Frank Health Insurance

- GMHBA Health Insurance

- Health Partners

- Latrobe Health Services

- Medibank

- Mildura District Hospital Fund

- NIB Health Insurance

- Peoplecare Health Insurance

- Phoenix Health Fund

- Qantas Assure

- Queensland Country Health Fund

- Suncorp Insurance

- Westfund Health Insurance

Source: Canstar as at 16/11/2021.

Are there health insurance discounts for students?

If you are an adult student aged between 18 to 29, you could be given an aged-based discount if you have your own policy or a policy with your partner or family. Depending on the health insurance fund your parents are with, you could be covered as a child or student dependent under their policy. This typically applies to people aged under 25 who are not married or in a de facto relationship and are studying full-time.

What is changing for young Australians with health fund reforms?

The government has proposed to allow insurance providers to increase the maximum age of dependents to 31 years. These changes were passed by Parliament in June 2021; however, they are yet to be implemented by many providers. As part of the Private Health Insurance Legislation Amendment (Age of Dependants) Act 2021, people with a disability are also able to be covered under a family private health insurance policy as a dependent regardless of age. The changes are optional for health insurance providers to introduce. If you have any questions, you can speak with your health insurance provider directly.

Being a dependent under your parents’ health insurance policy means you would also not be able to apply for age-based discounts even if you are in the eligible age bracket of 18 to 29. To be eligible for the discount, you need to have your own policy.

How much money could I save with the health insurance discount?

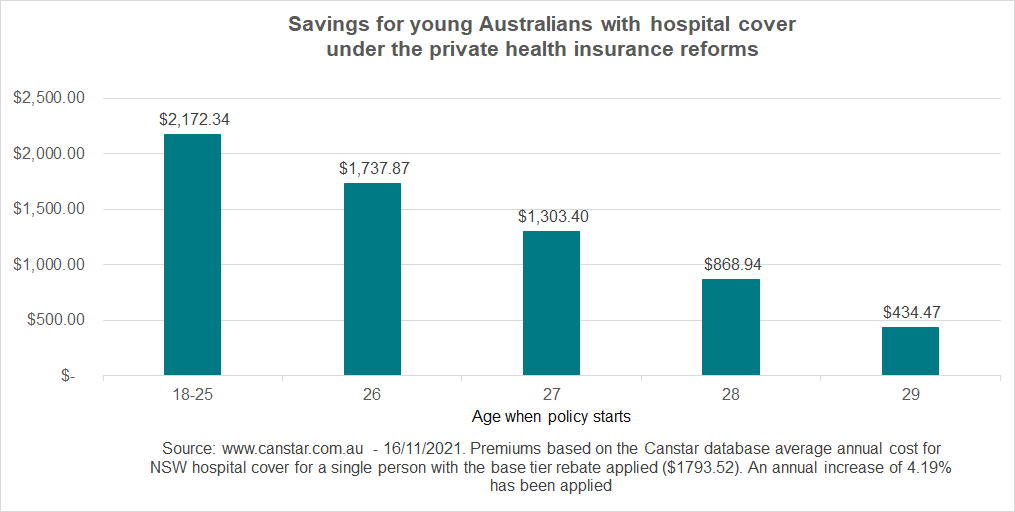

After crunching the numbers, Canstar’s Research team found the biggest savings opportunities are available to those aged 18 to 25 years old where the 10% premium discount applies.

At the time of writing, the average cost of a hospital policy for a young single male or female is $1,793.52 per year. This is based on a person in New South Wales with the base tier rebate applied.

With the 10% discount applied, a person aged between 18 and 25 could save $179.35 in the first year and $2,172.34 over 10 years compared to someone else of the same age with the same premiums whose provider decided not to offer the discount. These calculations assume an average premium increase of 4.19% per year (based on the average premium rise from Canstar’s 2020 and 2021 Star Ratings premium data).

On the other hand, a 29-year-old paying the average premium could save $35.87 in the first year and $434.47 over 10 years compared to someone not receiving the discount, assuming the same annual premium increase.

The graph above shows the potential savings impact for a hospital only policy cost over 10 years for 18 to 29-year-olds. As the graph shows, the savings potential reduces the closer you get to 30 years old before taking out a qualifying policy.

When choosing a health insurance policy, remember that price isn’t the only thing to consider. As part of the reforms, health insurance providers now have to categorise their hospital policies into four main tiers (Gold, Silver, Bronze and Basic) with differing levels of coverage. Check the inclusions of the policy before signing up and consider whether it’s suitable for your life stage. You may also want to take out extras cover, which can cover you for out-of-hospital services like dental, optical, physio and chiropractic treatment. It’s a good idea as well to review the relevant policy documents as part of your decision-making.

This article was originally published in April 2019 by Ellie McLachlan and has been updated.

Lowest average rate rise of the major health funds

Winner CANSTAR Outstanding Value Award for 8 Years

Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promoted products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promoted products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

Cover image Source: nd3000/Shutterstock.com

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

This article was reviewed by our Sub Editor Jacqueline Belesky and Finance and Lifestyle Editor (former) Shay Waraker before it was updated, as part of our fact-checking process.

Lowest average rate rise of the major health funds

Winner CANSTAR Outstanding Value Award for 8 Years

Try our Health Insurance comparison tool to instantly compare Canstar expert rated options.

SPONSORED

Join Australia's Most Trusted Health Fund

-

Mix & match hospital and extras cover to suit your needs

-

Switching to HBF is easy – do it online today!

-

Over 1 million members trust HBF with their cover