The 20 cheapest ETFs listed on the ASX

Low fees are one of the reasons that ETFs are popular. Here are the 20 cheapest ETFs on the ASX plus we look at how they’ve performed.

ETFs are a popular option for investors. The Australian ETF industry grew by $1.7 billion over the month of October reaching a fresh record high of $126.9 billion, according to the BetaShares Australian ETF Review for the month ending October 2021. Over the past 12 months industry growth has been 72%.

“ETFs are a great investing innovation and fees are likely to drop further as they receive greater adoption and continue to scale, in addition to price competition amongst ETF issuers,” said Marc Jocum, Senior Investment Manager at Stockspot.

Not all ETFs are cheap, though. Some can be a lot more expensive. The more specific or ‘exotic’ an ETF, the higher the fee is likely to be and there will probably be fewer offerings to choose from, explained Evan Lucas, chief market strategist at InvestSMART.

The 20 Cheapest ETFs on the ASX

So what are the cheapest ETFs on offer? The table below shows the 20 cheapest ETFs ranked by Management Expense Ratio (MER) to 31 October 2021.

As you can see the list includes international share ETFs, Australian share options as well as a cash ETF and a few fixed income options.

Where available, the table also includes one-, three- and five-year returns, as well as the returns of the index it tracks, so you can get an idea of how these ETFs have performed.

20 Cheapest ETFs on the ASX by Management Expense Ratio (MER)

← Mobile/tablet users, scroll sideways to view full table →

| ASX Code |

Name Benchmark Index |

Sector | MER | Average Annual Return | ||

|---|---|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | ||||

| VTS | Vanguard US Total Market Shares Index ETF |

Equity – Global | 0.03% | 34.68% | 19.33% | 19.24% |

| CRSP US Total Market Index | 34.71% | 19.35% | 19.26% | |||

| IVV | iShares S&P 500 ETF | Equity – Global | 0.04% | 33.14% | 18.73% | 18.95% |

| S&P 500 Index | 33.03% | 18.51% | 18.83% | |||

| A200 | Betashares Australia 200 ETF | Equity – Australia |

0.07% | 28.63% | 12.00% | – |

| Solactive Australia 200 Index | 28.73% | 12.10% | 11.00% | |||

| BILL | iShares Core Cash ETF | Cash | 0.07% | 0.01% | 0.74% | – |

| S&P/ASX Bank Bill Index | 0.03% | 0.73% | – | |||

| IJH | iShares S&P Midcap ETF | Equity – Global | 0.09% | 38.84% | 14.49% | 14.94% |

| S&P Mid-Cap 400 Index | 38.69% | 14.29% | 14.78% | |||

| IJR | iShares S&P Small-Cap ETF | Equity – Global | 0.09% | 48.23% | 12.36% | 15.50% |

| S&P Small-Cap 600 Index | 48.06% | 12.14% | 15.31% | |||

| IOZ | iShares Core S&P/ASX 200 ETF | Equity – Australia |

0.09% | 27.85% | 11.80% | 10.73% |

| S&P/ASX 200 Accumulation Index | 27.96% | 11.92% | 10.88% | |||

| VEU | Vanguard All-World ex US Shares Index ETF |

Equity – Global | 0.08% | 21.38% | 10.24% | 10.28% |

| FTSE All World Ex-US Index | 21.76% | 10.26% | 10.34% | |||

| IESG | iShares Core MSCI Australia ESG Leaders ETF |

Equity – Australia Strategy |

0.09% | – | – | – |

| MSCI Australia IMI Custom ESG Leaders Index |

– | – | – | |||

| SPY | SPDR S&P 500 ETF Trust | Equity – Global | 0.0945% | 33.40% | 18.96% | 19.06% |

| S&P 500 Index | 33.62% | 19.15% | 19.24% | |||

| IHVV | iShares S&P 500 AUD Hedged ETF | Equity – Global | 0.10% | 40.82% | 18.29% | 16.90% |

| S&P 500 Hedged AUD Index | 40.85% | 18.45% | 16.91% | |||

| IWLD | iShares Core MSCI World ex Australia ESG Leaders ETF |

Equity – Global | 0.10% | 38.86% | 17.08% | 16.41% |

| MSCI World Ex Australia Custom ESG Leaders Index |

38.22% | 17.52% | 16.68% | |||

| VAS | Vanguard Australian Shares Index ETF |

Equity – Australia |

0.10% | 28.66% | 12.29% | 10.99% |

| S&P/ASX 300 Index | 28.57% | 12.26% | 11.03% | |||

| ISEC | iShares Enhanced Cash ETF | Cash | 0.12% | 0.13% | 0.92% | – |

| S&P/ASX Bank Bill Index | 0.03% | 0.73% | – | |||

| IYLD | iShares Yield Plus ETF | Fixed Income – Australia Dollar |

0.12% | -0.03% | – | – |

| Bloomberg AusBond Credit and FRN Ex Big 4 Banks Index |

0.18% | – | – | |||

| IHWL | iShares Core MSCI World ex Australia ESG Leaders (AUD Hedged) ETF |

Equity – Global | 0.13% | 47.27% | 17.05% | 15.16% |

| MSCI World Ex Australia Custom ESG Leaders Index 100% Hedged to AUD |

46.45% | 17.72% | 15.55% | |||

| STW | SPDR S&P/ASX 200 Fund | Equity – Australia | 0.13% | 27.97% | 11.83% | 10.75% |

| S&P/ASX 200 Index | 27.96% | 11.92% | 10.88% | |||

| E200 | SPDR S&P/ASX 200 ESG Fund | Equity – Australia Strategy |

0.13% | 24.60% | – | – |

| S&P/ASX 200 ESG Index | 24.71% | – | – | |||

| IAF | iShares Core Composite Bond ETF | Fixed Income – Australia Dollar |

0.15% | -5.50% | 2.54% | 2.40% |

| Bloomberg AusBond Composite 0+ Yr Index |

-5.30% | 2.72% | 2.58% | |||

| VAF | Vanguard Australian Fixed Interest Index ETF |

Fixed Income – Australia Dollar |

0.15% | -5.49% | 2.54% | 2.40% |

| Bloomberg AusBond Composite 0+ Yr Index |

-5.30% | 2.72% | 2.58% | |||

Source: www.canstar.com.au. Prepared on 16/11/2021. Management Expense Ratios and Sector categories sourced from the ASX Investment Products October 2021 monthly update. ETF and Benchmark returns are effective to the end of October 2021 and are sourced from the providers’ sites. Whether or not management fees are taken into account in the return figures differs by provider, refer to the provider’s site for more information. Table sorted in ascending order by MER, followed by descending order by 3 year return. Past performance is not a reliable indicator of future performance.

Why an ETF may have a different return to its index

You will notice that the return may be different to the index – in most cases it will be lower. Why is that? “This is what is often referred to as ‘tracking error’ or ‘tracking difference’ in the industry,” Mr Jocum told Canstar. “Fees contribute to a difference in returns. For example, both STW and IOZ track the same index (the ASX 200), but while the index returned 10.9%pa over the past five years, STW and IOZ returned 10.8%pa and 10.7%pa respectively.

“However, fees are not the only factor affecting this difference in returns. The ETF may choose to replicate the index by buying all the underlying shares. For example, an ETF that tracks the ASX 200 would buy all 200 shares in their basket of securities. However, not all types of ETFs replicate their index in this way, and therefore their returns will be different to the index returns.”

Another explanation for tracking differences is if an ETF employs securities lending, which is when the underlying shares in the ETF are lent out to investors, explained Mr Jocum. “The incremental revenue from this type of lending can sometimes help boost the return of the ETF, leading to differences in performance with the underlying index.”

Why fees matter

“When choosing ETFs, fees are one of the most important factors to consider. That’s because the less fees you pay, the more returns you can keep in your pocket,” said Mr Jocum. “Many people tend to hold ETFs over a longer period of time, and generally speaking, the longer you hold an investment, the more important fees become.”

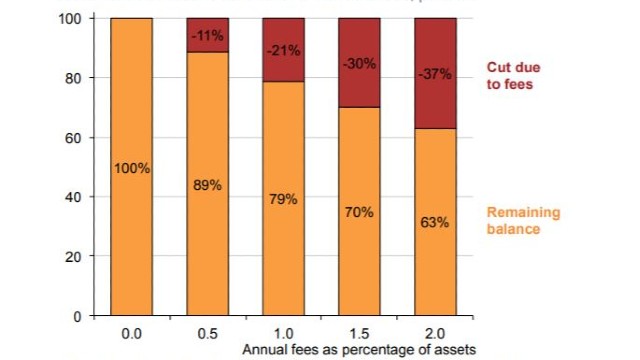

Mr Lucas agrees, saying that over the long term even a 0.5% difference in fees can have a big impact on your returns. Mr Lucas provided the below chart from the Grattan Institute which shows the impact fees could have on retirement balances. Even a fee of 1% can reduce retirement income by more than 20%, assuming a 40-year contribution period.

Retirement balances relative to fund with zero fees, percent

Source: Grattan Institute, supplied by InvestSMART.

You also need to factor in transaction fees, such as brokerage, pointed out Mr Lucas. For example, if you invested $1,000 and paid $20 brokerage to buy the ETF and a further $20 to sell, you would need to make at least $40 to break even on that transaction. Add in the management fee and the return will need to be even higher. “The lower the fees the better your compounding returns will be over the long term,” added Mr Lucas.

Key factors to consider when choosing ETFs

Of course, fees aren’t the only thing to consider when choosing an ETF. “To make a decision about two different ETFs, an investor shouldn’t just consider fees and performance. It’s also important to consider other factors like diversification (the different types of assets, sectors and regions the fund is spread across), exposure (the underlying strategy and companies invested), liquidity (how easy it will be to sell), the bid-ask spread (trading costs), and size (how much money is in the ETF),” said Mr Jocum.

“For example, at Stockspot we invest in the more expensive emerging markets ETF (IEM) as opposed to the cheaper Vanguard alternative (VGE) because IEM has exposure to more emerging market countries, is bigger in size with lower spreads, and has also outperformed VGE over the long term.”

Although fees are one of the main factors InvestSMART considers when it chooses ETFs there are several others, Mr Lucas told Canstar. One is market capitalisation or funds under management. Generally, the bigger the fund the more liquid it is likely to be. “Smaller funds can be sluggish and their ability to replicate the market can be harder,” explained Mr Lucas. InvestSMART also looks for ETFs that offer as close a replication of the underlying market as possible.

The price per unit is another important consideration, said Mr Lucas. He offered the example of two ETFs offering exposure to the ASX 200 – the Betashares Australia 200 ETF (A200) with an MER of 0.07%pa and the iShares Core S&P/ASX 200 ETF (IOZ) with an MER of 0.09%pa.

“Although A200 is cheaper at 0.07%, its price per unit is very expensive,” said Mr Lucas. “At $126 our ability to buy enough units to meet each portfolio’s required risk weighting is very constrained when compared to IOZ’s price per unit of about $30 which does allow us to weight each portfolio more easily,” he explained.

Cover image source: Christian Horz/Shutterstock.com

Try our ETFs comparison tool to instantly compare Canstar expert rated options.