How to consolidate your super funds

About one in four people with super have an account with more than one fund which could see them losing out by paying multiple fees. Many people choose to consolidate their multiple super accounts into one fund as they plan for their retirement.

But consolidating might not always be possible, and it might not be right for you, so here are some of the things you need to consider.

How many people have multiple super funds?

More than 12.6 million people – about three out of four of the superannuation population – had only one super account at 30 June, 2022, according to the Australian Tax Office (ATO). The rest – about 3 million people – had two or more accounts. About 1% – or one in 100 – had four or more accounts.

Percentage of accounts held by an individual

→ Learn more: How to choose a super fund

If that’s you, you might want to consider consolidating your accounts. The ATO says you could be paying unnecessary fees and charges on these multiple accounts, and that could reduce your overall retirement income.

“Fewer super accounts usually means less fees and more money for your future,” an ATO spokesperson told Canstar.

The reason why you may have multiple accounts could be because you’ve changed jobs and your new employer opened up an account for you in its preferred or ‘default’ super fund. You don’t have to accept that preferred fund and can ask your employer to contribute to your existing super fund.

The number of people with multiple super accounts has declined over a four-year period as people opt to consolidate their accounts. The ATO says it’s easy to consolidate your super by using the myGov website, and we’ll explain how later.

Consolidated super accounts

Should you consolidate your super funds?

It may be helpful to seek some independent advice on whether consolidating your multiple super accounts is right for you, and which would be your fund of choice that meets your retirement plan.

Check to see if there is any life insurance or other benefits with any of the accounts and whether you’d lose those. You also need to check whether your employer contributes more than the minimum required to its preferred fund if you are thinking of consolidating away from that to one of your other funds.

Compare Superannuation with Canstar

The table below displays some of the superannuation funds currently available on Canstar’s database for Australians aged 30 to 39 with a super balance of up to $55,000. The results shown are sorted by Star Rating (highest to lowest) and then by 5 year return (highest to lowest). Performance figures shown reflect net investment performance, i.e. net of investment tax, investment management fees and the applicable administration fees based on an account balance of $50,000. To learn more about performance information, click here. Consider the Target Market Determination (TMD) before making a purchase decision. Contact the product issuer directly for a copy of the TMD. Use Canstar’s superannuation comparison selector to view a wider range of super funds. Canstar may earn a fee for referrals.

- Performance, fee and other information displayed in the table has been updated from time to time since the rating date and may not reflect the products as rated.

- The performance and fee information shown in the table is for the investment option used by Canstar in rating of the superannuation product.

- Performance information shown is for the historical periods up to 31/01/2024 and investment options noted in the table information.

- Performance figures shown reflect net investment performance, i.e. net of investment tax, investment management fees and the applicable administration fees based on an account balance of $50,000. To learn more about performance information, click here.

- Performance data may not be available for some products. This is indicated in the tables by a note referring the user to the product provider, or by no performance information being shown.

- Please note that all information about performance returns is historical. Past performance should not be relied upon as an indicator of future performance; unit prices and the value of your investment may fall as well as rise.

- Any advice on this page is general and has not taken into account your objectives, financial situation or needs. Consider whether this general financial advice is right for your personal circumstances. You may need financial advice from a qualified adviser. Canstar is not providing a recommendation for your individual circumstances. See our Detailed Disclosure.

- Not all superannuation funds in the market are listed, and the list above may not include all features relevant to you. Canstar is not providing a recommendation for your individual circumstances.

- Canstar may earn a fee for referrals from its website tables, and from Sponsorship or Promotion of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees. Sponsored or Promotion products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored or Promotion products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a Sponsored or Promoted product does not indicate any ranking or rating by Canstar. For more information please see How We Get Paid.

- Click here for additional important notes and liability disclaimer.

Performance and Investment Allocation Differences

- Fee, performance and asset allocation information shown in the table above have been determined according to the investment profile in the Canstar Superannuation Star Ratings methodology.

- Some providers use different age groups for their investment profiles which may result in you being offered or being eligible for a different product to what is displayed in the table. See here for more details.

- Australian Retirement Trust Super Savings’ allocation of funds for investors aged 55-99 differ from Canstar’s methodology – see details here.

- The Australian Retirement Trust Super Savings (formerly Sunsuper for Life) product may appear in the table multiple times. While you will not be offered any single investment option, this is to take into account the different combinations of investment options Australian Retirement Trust may apply to your account based on your age. For more detail in relation to the Australian Retirement Trust (formerly SunSuper for Life) product please refer to the PDS issued by Australian Retirement Trust for this product.

- Investment profiles applied initially may change over time in line with an investor’s age. See the provider’s Product Disclosure Statement and TMD and in particular applicable age groups for more information about how providers determine their investment profiles.

In the end you may decide it’s in your interest to keep some or all your multiple accounts because of the benefits they provide, or you may decide it’s time to consolidate.

The Association of Superannuation Funds of Australia says the main reason why people haven’t consolidated their multiple accounts is because they haven’t got around to doing it. One in five people also said they didn’t know how to consolidate their accounts.

So if you do decide to transfer any of your multiple accounts into another fund, here’s what you need to know.

How to consolidate your super funds

There are several ways you can consolidate your multiple super accounts and perhaps the easiest is via the myGov website.

If you haven’t already signed up for an account, then you can do so at my.gov.au.

Once you’ve logged into your account, you can link to the ATO.

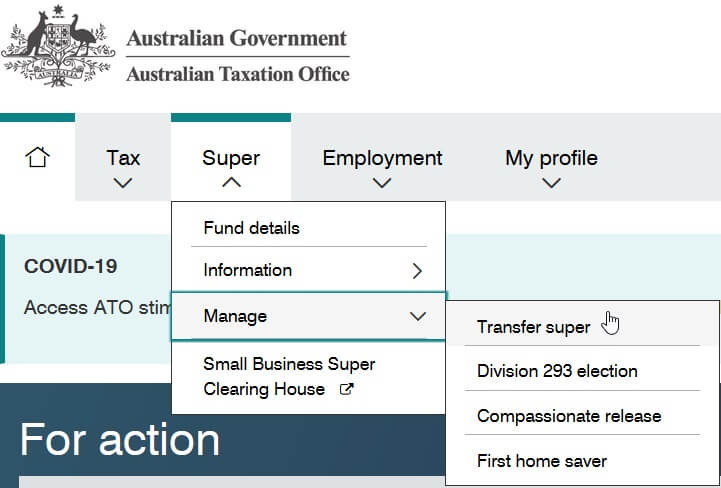

When you have done that:

- Click through to the ATO.

- From the top menu, select the Super option.

- In the dropdown menu, select Manage.

- Then, select Transfer Super.

If you only have one super account registered with the ATO, or you have other funds that don’t allow funds to be transferred, you won’t be able to progress any further online. For example, the public sector super funds PSS and CSS don’t allow you to transfer your account to another fund.

If you think you should see multiple accounts, then you may need to check with each super fund provider to find out why the fund isn’t showing up.

“Remember to ensure that all of your contact information is up to date, both with the ATO and your super fund/s,” said the ATO spokesperson.

“This will help us reunite you with any unclaimed super accounts held by the ATO and reduce the chance that your super fund loses track of you.”

If you do see multiple accounts listed, you can then select the ones you wish to transfer, and to which account.

“About five minutes and a couple of clicks is all it takes, and it could save you hundreds or even thousands of dollars,” said the spokesperson.

If you don’t want to consolidate the accounts online via the myGov website, then you can contact the provider of the account you wish to transfer from, and get them to help.

Or you use the ATO’s rollover request form.

What does your employer need to know about your preferred super?

Whatever you decide to do with your multiple super accounts, make sure you tell your current employer so it can pay its contribution into your preferred fund.

→ Learn More: What superannuation details does your employer need?

If you don’t, and your employer’s preferred fund is one you’ve transferred away from and now closed the account, this could cause problems.

The ATO says this could result in your employer making those contributions to its own default fund.

Award Winning App Helps You Stay In Control

Super Returns, Super Advice, Super Helpful

Canstar Outstanding Value for superannuation

Read PDS & TMD at australiansuper.com

$70 Billion In Total Assets

With more than 1,000,000 members

Low fees

Australia’s largest sustainable investor

Invest With Heart. Choose Australian Ethical Super

Read the PDS & TMD on our website. AFSL 526 055

Canstar may earn a fee for referrals from its website tables and from Promotion or Sponsorship of certain products. Fees payable by product providers for referrals and Sponsorship or Promotion may vary between providers, website position, and revenue model. Sponsorship or Promotion fees may be higher than referral fees.

On our ratings results, comparison tables and some other advertising, we may provide links to third party websites. The primary purpose of these links is to help consumers continue their journey from the ‘research phase’ to the ‘purchasing’ phase. If customers purchase a product after clicking a certain link, Canstar may be paid a commission or fee by the referral partner. Where products are displayed in a comparison table, the display order is not influenced by commercial arrangements and the display sort order is disclosed at the top of the table.

Sponsored or Promoted products are clearly disclosed as such on the website page. They may appear in a number of areas of the website, such as in comparison tables, on hub pages, and in articles. The table position of the Sponsored or Promoted product does not indicate any ranking or rating by Canstar.

Sponsored or Promoted products table

- Sponsored or promoted products that are in a table separate to the comparison tables in this article are displayed from lowest to highest annual cost.

- Performance figures shown for Sponsored or Promoted products reflect net investment performance, i.e. net of investment tax, investment management fees and the applicable administration fees based on an account balance of $50,000. To learn more about performance information, click here.

- Please note that all information about performance returns is historical. Past performance should not be relied upon as an indicator of future performance; unit prices and the value of your investment may fall as well as rise.

Cover image source: maradon 333/Shutterstock.com

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

This article was reviewed by our Deputy Editor, Canstar Amanda Horswill before it was updated, as part of our fact-checking process.

Michael is an award-winning journalist with more than three decades of experience. As a senior finance journalist at Canstar, Michael's written more than 100 articles covering superannuation, savings, wealth, life insurance and home loans. His work's been referenced by a number of other finance publications, including Yahoo Finance and The Motley Fool.

Michael's worked as a reporter and producer for the BBC and ABC, including for Australian Story. He's also worked as a feature writer for The Courier-Mail and as a science and technology editor and commissioning editor at The Conversation.

Michael's professional awards include a Queensland Media Award and a highly commended in the Walkleys. In 2021 he was part of a team that was a finalist in the Australian Museum Eureka Prize for Science Journalism. He holds a Bachelor of Science in mathematics and applied physics (Manchester Metropolitan University) and a Masters of Science in pure mathematics (Liverpool University).

You can connect with Michael on LinkedIn.

Try our Superannuation comparison tool to instantly compare Canstar expert rated options.

SPONSORED

Super Returns, Super Advice, Super Helpful

-

Canstar 2022, 2023 and 2024 Outstanding Value Super Award

-

Get Expert Advice to Grow Your Super

-

Delivering Super advice and Super returns.

-

Managing investments for over 1 million Australians

-

Local call centres in Perth and Melbourne