What do SMSF Trustees look for in a cash account?

What do SMSF Trustees look for in a cash account? Canstar’s extensive database reveals the results.

Over 150,000 people visited our site to compare savings accounts between July 2015 and April 2016. After some digging into this extensive database, we’ve found some interesting stats about what SMSF Trustees in Australia are looking for when managing their own money.

Compare SMSF Savings Accounts with Canstar

Features SMSF Trustees want

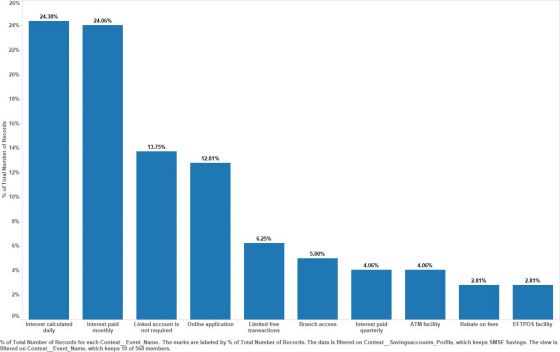

Interest is the number one thing we care about, it seems – how much we can earn, and when it will be paid to us. SMSF visitors to our site most frequently filter their comparison results by:

- Interest calculated daily: 24%

- Interest paid monthly: 24%

- Interest paid quarterly: 4%

It’s no surprise that 13% of visitors want to be able to apply online, when SMSF Trustees are typically the type to want to DIY and get things done efficiently.

Many want their money to remain accessible and “at call”, looking for:

- Branch access

- ATM access

- EFTPOS facility

Interestingly, 14% of SMSF Savers tick the box saying a linked transaction account is not required, indicating they intend to put money in and rarely take money out. This approach is fine as long as you don’t “set and forget” your account. Remember, interest rates do go up and down and this makes a big difference to how quickly or slowly your nest egg grows.

3% of visitors want a rebate on fees. It is common that if you hold multiple different products or accounts with one institution, they may waive the fees on your savings account or offer a rebate to cover the cost.

What are the outstanding value accounts for SMSF Trustees?

The majority of Australians are keen to get the best possible value out of their savings account – which makes sense since it is usually responsible for holding the largest chunk of your money.

65% of visitors to our site select an outstanding 5-star rated account, while another 19% find a 4-star rated product that suits their needs just fine.

In this year’s star ratings of savings and transaction accounts, Canstar identified 12 deposit accounts that provide 5-star rated outstanding value for SMSF saving accounts. All interest rates expressed in the article are per annum.

The 5 star-rated products are as follows.

Australian Military Bank

The DIY Super Saver Account offers (at the time of writing) an interest rate of 2.50%, with interest calculated daily and paid monthly and no account-keeping fees. Money can be accessed online or in-branch and there is no minimum deposit required.

View current details of the account here

MOVE

The MOVE Express Saver Account offers (at time of writing) an interest rate of 2.65% with interest calculated daily and paid monthly. The Express Saver Account charges no account-keeping fees. You can access your funds 24 hours a day, 7 days a week by phone or internet banking, but there is no branch or ATM access.

View current details of the account here

FCCS Credit Union

The Superfund Maximiser Account also offers (at the time of writing) an interest rate of 2.50% on amount of $1 to $250,000 and 2.25% on amounts above this. Interest is calculated daily and paid monthly and there are no account-keeping fees. Funds can be accessed via internet and phone banking, and BPAY transactions are available.

View current details of the account here

BankVic

The SMSF Saver Account offers (at the time of writing) an interest rate of 2.35%, with interest calculated daily and paid monthly and no account-keeping fees.

Facilities available include direct credit, branch access over the counter, cheque, BPAY, Pay Anyone, phone, and internet payments.

View current details of the account here

RaboDirect

RaboDirect has three 5 star products available for SMSF investors:

- Notice Saver 90 Day – SMSF

- Notice Saver 60 Day – SMSF

- Notice Saver 31 Day – SMSF

On all three accounts, interest is calculated daily and paid monthly, and there are not account keeping fees. Find out more about the 31 Day Notice Saver here, the 60 Day Notice Saver here and the 90 Day Notice Saver here.

Bank of Sydney

The Smart Net Account offers (at the time of writing) interest rates of 0.90% up to 1.60% depending on your account balance. Savers can apply online for this account and there are no account keeping fees.

The account comes with ATM facility, EFTPOS facility, Branch access and Cheque facility.

View current details of the account here

nabtrade

The High Interest Account offers (at the time of writing) interest rates of 2.15%pa. Savers can apply online for this account and track the account online 24/7. There is no minimum deposit and no account keeping fee.

View current details of the account here

Queenslanders Credit Union

The QCU GOSaver online account pays a current rate of interest of 2.30% with no monthly service or transaction fees. The account does require you to have a linked Queenslanders transaction account. You can set up any number of ‘buckets’ (secondary accounts) to keep your money separate for special purposes.

The account has mobile, net and phone banking, but not branch or ATM access.

View current details of the account here

Qudos Bank

The Qudos Bank DIY Super Saver Account pays a 1.75% pa base rate plus an additional 0.65% pa when your balance is $10,000 or more and you make no withdrawals in a month. Interest is calculated daily and credited to your account at the end of the month. There are no account keeping fees.

Money can be deposited or withdrawn via Telephone and Online Banking services or by visiting your nearest branch.

Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular product. If you decided to apply for a deposit account, you will deal directly with a financial institution, and not with Canstar. Rates and product information should be confirmed with the relevant financial institution. For more information, read our detailed disclosure, important notes and additional information.

No matter which account or institution you choose, make sure you compare your options first. You can use our website to compare SMSF Saver accounts or compare Cash Management Accounts across a broad range of features and fees.