The Treasurer Josh Frydenberg told us last week that Australians saved nearly 20% of their disposable income in the second quarter, as the pandemic caused people to tighten the purse strings.

But while more cash is being stored in the bank, savings interest rates are generally fairly low right now.

Taking up cash offers on bank accounts could be one way to make a bit of extra money, if you do the sums right.

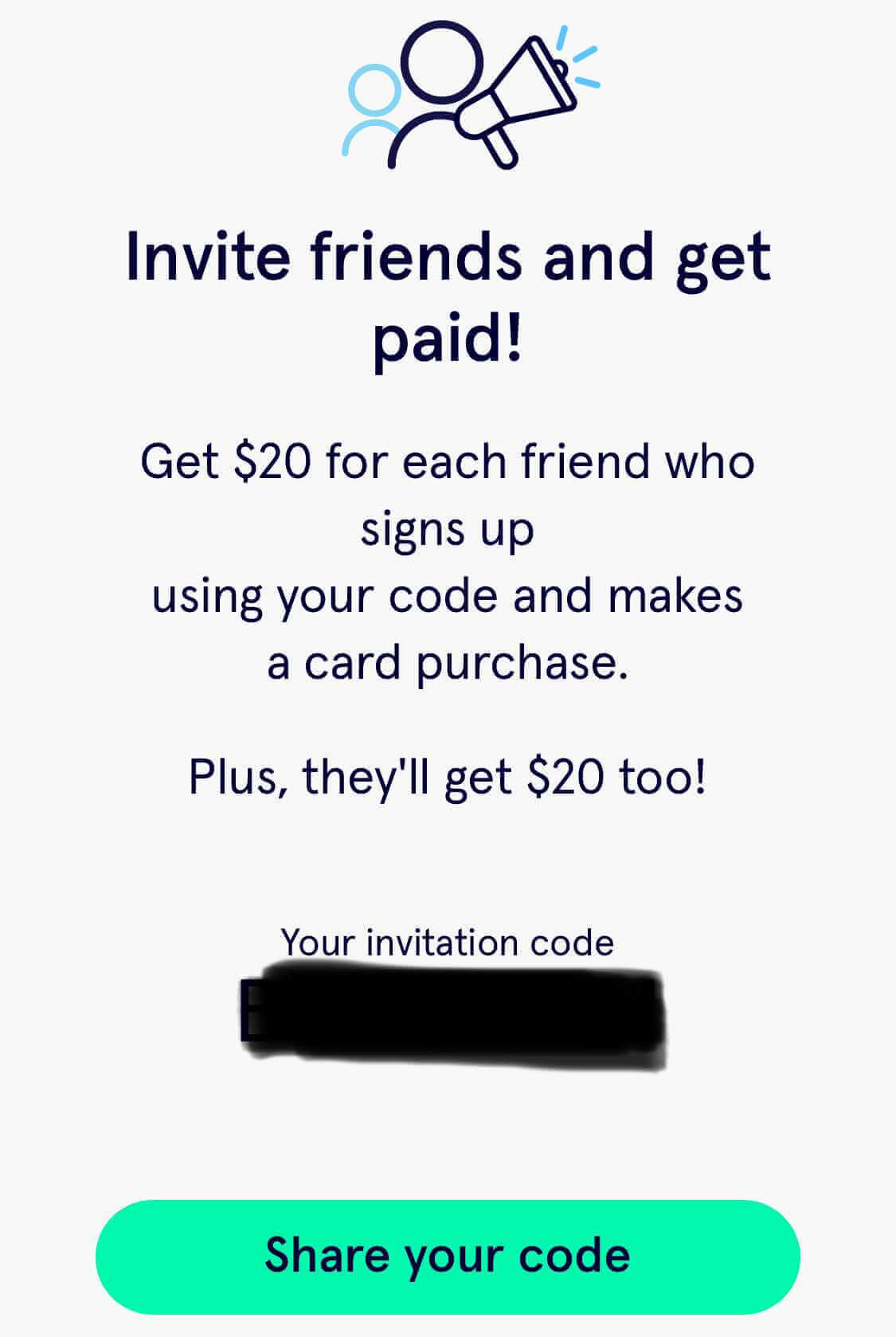

Neobank 86 400 is doubling its ‘Refer a Friend’ cash bonus in September, from $10 to $20.

Existing customers and their mates can get the bonus, with no limit on referrals, according to the bank.

86 400’s Chief Product & Marketing Officer Travis Tyler told Canstar the increased referral offer was designed to reward its early customers.

How does the 86 400 Refer a Friend offer work?

Existing 86 400 customers can obtain the increased referral bonus by taking the following steps before the end of September:

- Find their individual invite code under ‘Settings’ in the mobile app

- Share the code with their friends and family, to allow them to sign up to 86 400

- Once one of these ‘friends’ makes their first settled card purchase (meaning it’s no longer showing as a ‘pending’ transaction) by the 30 September deadline, they and the customer will each receive $20 into their 86 400 Pay account. If the purchase is settled after this date, the bonus will instead be $10 each.

With unlimited referrals, a customer could sign up five friends and earn $100, 10 friends to earn $200 or even 20 friends to earn $400, 86 400 said.

According to 86 400, ‘friends’ who were previously a customer of the bank and closed their accounts within the past 12 months are not eligible for the offer, and the digital bank retains the right to refuse to pay or cancel ‘Refer a Friend’ bonus payments. Full terms and conditions can be found on 86 400’s website.

↓ Keep reading to learn where else you could redeem similar offers

Is the offer worth the switch for new customers?

Canstar money expert Effie Zahos said if you played your cards right and the deal stood up on its own, then it’s a no-brainer to take referral cash and put your money with the bank.

If the deal isn’t great, then you’re effectively giving yourself an instant bonus interest rate and may be able to take the reward and move on, if it’s worth your trouble, she said.

“I like to push aside the sweetener and ask myself: would this product excite me on its own?” Ms Zahos said.

“If you say yes, then you’ve really got a true bonus interest rate by switching to the new bank.”

Ms Zahos said she was more cautious with cash-back offers on big financial products like home loans, because a slight difference in interest rates could outweigh the benefits of the cash reward over time.

One way to work out if a deal is worthwhile when it comes to savings accounts is by comparing what you’d earn if you put your money in the highest interest savings account instead of taking the reward.

86 400’s Save account earns up to 1.60% if you deposit at least $1,000 per month into any one of your 86 400 accounts, while the highest savings rate on Canstar’s database at the time of writing is 2% for four months from Rabobank.

Canstar’s research analysts crunched the numbers and found if a hypothetical customer deposited $1,000 into a new 86 400 account, in the first month they could earn $21.33, which would include $1.33 in interest plus September’s $20 referral bonus.

If they deposited the same amount into Rabobank’s 2% High Interest Savings Account, they could earn $1.67 in the first month.

Keep in mind that Rabobank’s interest rate is an introductory promotional rate that drops down to just 0.55% after four months, at which point 86 400’s Save account would have the higher rate (assuming rates otherwise remained the same).

We’re more likely to trust a friend’s referral when making a purchase

Marketing and consumer behaviour expert Professor Gary Mortimer told Canstar these referral schemes were a “win-win” situation for consumers and businesses, as long as the consumer understood the fine details of the offer.

He said banks, airlines and even gyms commonly offered some form of incentive to refer their products or services to a friend, which was a smart way to market a product.

“Essentially what firms are doing is expanding their sales force to their own customers and incentivising those customers to refer their products to their friends and family,” Professor Mortimer said.

“Studies have shown that consumers are more likely to believe and have trust in their friends and family when purchasing a product or service over an organisation’s claims.”

He said these types of schemes may enable a business to capture a larger market share and therefore grow their business.

Where else can I find referral bonuses?

Canstar’s research analysts found a selection of similar ‘refer a friend’ bonus offers from other providers on our database, including:

Heritage Bank

- Refer a friend, family member or colleague and you will both go into the draw to win a $1,000 Prepaid Visa gift card each (one draw per month).

- Refer up to five people per month to increase your chances.

- Additionally, if a person you have referred opens a home loan or business loan within three months of becoming a customer, you both will receive a $250 Prepaid Visa gift card

- Find out more about the offer and see the full terms and conditions on Heritage Bank’s website.

ING

- Refer a Friend is a promotion ING runs “from time to time”, where it gives existing customers a cash bonus for referring a new Orange Everyday customer.

- Existing customers will receive an email with the necessary steps if they are eligible.

- Find out more about the offer and see the full terms and conditions on ING’s website.

Northern Inland Credit Union

- Refer a friend to NICU and you both receive $50 if your friend opens a new Member Pack and has their salary deposited into their new access account (at least $1,000 per month) within one month of joining. New Member Pack includes:

- Everyday access account with access card

- Savings account

- Online banking and statements

- Find out more about the offer and see the full terms and conditions on NICU’s website.

Up

- Earn up to $10 for every friend you invite to Up.

- After they sign up, you each get $5, and if they make five purchases using their Up card or digital wallet in the first 30 days, you each get another $5.

- Find out more about the offer and see the full terms and conditions on Up’s website.

Athena (Home loan)

- Athena says it will pay $250 into your home loan redraw account every time a friend or family member you referred settles a loan with it, as well as $250 into their account.

- From now until 3 March, 2021, Athena customers who refer a friend go into the draw to have their home loan paid for a full year. One entry applies to each new unconditionally application approved via Athena’s Refer-A-Mate home loan offer.

- Find out more about the offer and see the full terms and conditions on Athena’s website.

Australian Unity (Health insurance)

- Receive a $100 gift card every time a friend you refer joins and takes out Hospital, Combined Hospital and Extras or Overseas Visitors cover, so long as they provide your details when signing up.

- Find out more about the offer and see the full terms and conditions on Australian Unity’s website.

While these sorts of offers may be attractive to people comparing financial products, it may not be worth signing up for a particular product solely for a special deal. It can be important to also consider the fundamental aspects of any product you’re considering, which may include interest rates, fees and any terms and conditions attached to the product (such as minimum monthly deposit requirements to access higher interest rates on some savings accounts).

This is not a comprehensive list of all ‘refer a friend’ bonus offers on the market.

This article was reviewed by our Sub Editor Tom Letts before it was published as part of our fact-checking process.

Interested in deals and offers? You might like the following reads:

Follow Canstar on Facebook and Twitter for regular financial updates.

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

→ Looking to find a better deal? Compare car insurance, car loans, health insurance, credit cards, life insurance, as well as home loans, with Canstar.

Share this article