In new modelling estimates, investment bank UBS found it takes the “typical” first home buyer 40 years to save a 10% house deposit to buy at the average Sydney house price of around $1.2 million.

Imagine what else the typical young person could do with their savings during that length of time – a lot can be achieved in 40 years.

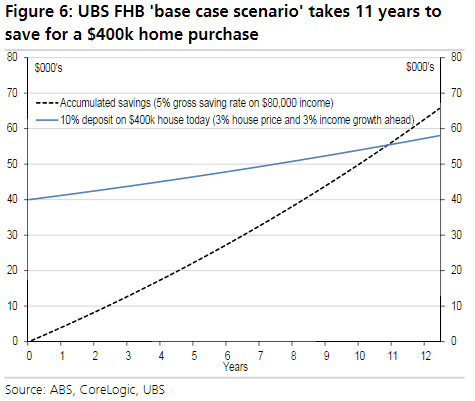

If you are not keen on waiting nearly half a decade before you can afford to buy the home of your dreams, the results show it would take just 11 years to save up a 10% deposit for the national median house price of $400,000.

Of course, that may mean compromising an inner-city location for an outer-suburb or regional area.

The system for working out the required deposit by first home buyers assumed several constants in the UBS modelling:

- A 10% deposit is required

- Individual income is at average weekly ordinary time earnings (AWOTE) of $80,000 per year

- Saving rate is 5% of gross income, or $4,000 per year

- House price today is $400,000 (national average first home buyer price)

- House prices grow in line with household income ahead at 3% per year

‘Deposit Gap’ a key issue for first home buyers

UBS says the ‘deposit gap’ – the gap between our wage increases (around 4%) and house price growth (around 7%) – is currently preventing young people from entering the property market.

Identifying this issue as a key driver of time to save for a house deposit, the report says that if this pattern of house price versus income growth were to repeat, then first home buyers “would likely never be able to save a 10% deposit”.

Unless, that is, they were given at least part of the deposit from the “bank of mum and dad“, but this can cause its own financial problems.

Due to constant changes regarding housing incentives and taxes in government policy, this UBS model excluded such factors into the calculations.

For instance, the recent First Home Super Saver Scheme announced in the 2017 Federal Budget could potentially reduce the time it takes to save by several years.

People saving for their first home could be given a tax break to help them grow a deposit @telester #7News pic.twitter.com/YAwmsDoXR2

— 7NEWS Brisbane (@7NewsBrisbane) April 30, 2017

Share this article