In any year, there are going to be stocks which flourish and those which flounder. 2021 was no different. One might expect that with a global pandemic going on, gains might have been muted, and that the list of losers contained a number of travel, retail and hospitality stocks. It turns out neither assumption was correct. As we will investigate in this article, some of the S&P ASX300 stocks were absolutely eye-watering, and for the most part losers were generally not from sectors worst affected by the pandemic.

ASX winners in 2021

(Note: The constituents of the S&P ASX300 change regularly, indeed, NVX, LTR and VUL were only added to the ASX300 in September. For simplicity, the table above tracks the 2021 performance of the constituents of the ASX300 as at December 31, 2021).

Novonix (NVX)

Heading up the 2021 Best Stocks list is battery components manufacturer Novonix (NVX). Its 692% market-beating gain backed up a 230% surge in 2020. It’s just one of a cohort of 2021 Best Stocks which are looking to take advantage of the world’s imminent transition to electric vehicles (EV’s).

NVX has developed an environmentally friendly process which produces synthetic graphite from a relatively low-priced variant of coking coal. The synthetic graphite can be used to create battery anodes. A battery’s anode is one of the most significant components of the entire battery cell, and critically, it defines the overall performance, reliability, and cycle life of the battery. NVX’s product is cheaper to produce than most conventional anodes, and is generally superior in performance and longevity.

The company is on track to reach production of 10,000 tonnes of its synthetic graphite per year by 2023, 40,000 tonnes per year by 2025, and 150,000 tonnes per year by 2030. As the only qualified US-based supplier of synthetic graphite anode material right now, NVX aims to be a major supplier to the numerous Gigafactories planned by major US car and storage battery manufacturers in coming years.

Related article: Cheapest online share trading platforms

The Lithium trend

A number of other stocks in our 2021 Best Stocks list are also looking to cash in on the electric vehicle (EV) revolution. These include lithium-focussed companies Liontown Resources (LTR) +416%, Vulcan Energy Resources (VUL) +343%, Pilbara Minerals (PLS) +276%, Ioneer (INR) +181%, Allkem (AKE) +133%, and Piedmont Lithium (PLL) +104%. Taking up six out of the 2021 Best 20 spots is impressive, but there were also scores of other lithium stocks not presently inside the ASX300 which showed similar gains to the ones listed above. It’s safe to say lithium was the hottest segment of the Australian stock market in 2021.

Also hot were companies targeting other key battery minerals such as rare earths and platinum group metals. Here we saw the likes of Chalice Mining (CHN) +163%, Lynas Rare Earths (LYC) +156%, and Australian Strategic Materials (ASM) +104% prosper. Elsewhere, uranium mining company Paladin Energy (PDN) smashed out a 227% gain, but is not specifically an EV-related company. Clearly though, if the world is to decarbonise, alternative energy sources such as uranium are likely to figure.

The other ASX winners in 2021

Best 20 were a mix of biopharmaceutical companies (Imugene (IMU) +300%, Telix Pharmaceuticals (TLX) +105%), fund managers (Australian Ethical Investment (AEF) +174%, Pinnacle Investment Management (PNI) +116%), technology companies (Uniti Group (UWL) +160%, Life360 (360)), WA-based construction company Johns Lyng Group (JLG) +182%, retail real estate investor Home Consortium (HMC) +99%, and agricultural products company Graincorp (GNC) +97%.

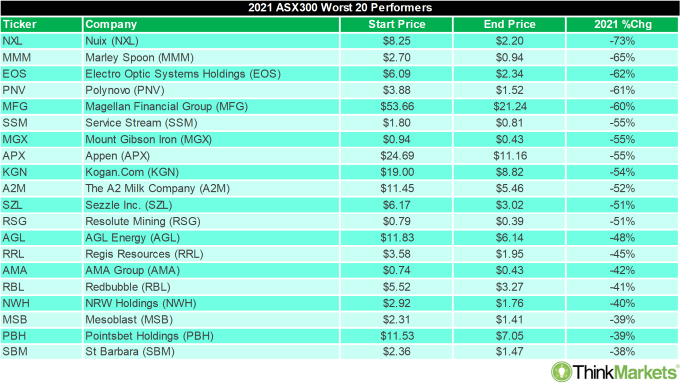

2021 losers

Nuix (NXL)

NXL has the ignominious distinction of being the worst performing stock in the ASX300 in 2021 — down a very nasty 73%. Perhaps the most startling aspect of its decline is the fact that it only listed on the ASX in December 2020. 2021 was essentially its first year of trading — how could things have gone so wrong?

NXL sells investigative analytics and intelligence software to over one thousand companies all over the world. The software helps customers analyse huge sets of data. Essentially, it’s like a Google for your own data. So, if you’re a major government organisation tracking social security scammers, or a bank looking to detect hackers, NXL’s search engine will crawl across the millions (potentially billions) of data points throughout your various applications and servers helping you identify suspicious behaviour.

As good as all of that sounds, 2021 was a horror start to NXL’s life on the ASX. All seemed well in March when it reaffirmed its first half and prospectus guidance. But as soon as April came, the company was downgrading FY21 revenues and profit forecasts. Ok, that happens, we’re in a pandemic. Then in May, media articles were speculating another downgrade was on the way. The company quickly stepped in to reassure the market these articles were scurrilous and that all was well.

End of story? Nope, on 31 May, the company downgraded revenues again. In June, both the CEO and CFO left the company, and then in November, the company received not one, but two class action claims from disgruntled investors unhappy with NXL’s disclosures from earlier in the year. It was all a bit too much for investors, who as their confidence in management eroded, so too did NXL’s share price.

The other ASX losers in 2021

Interestingly, technology stocks like NXL were a feature in the 2021 Worst Stocks list. The spectre of rising interest rates hobbled US technology shares on the NASDAQ late in 2021, and much of the negative sentiment spread to local technology shares. Alas, the market gives and the market takes. Indeed, each of the following 2021 Worst Stocks: Marley Spoon (MMM) -65%, Kogan (KGN) -54%, Sezzle (SZL) -51%, Redbubble (RBL) -41%, and Pointsbet (PBH) -39% were each on the 2020 Best Stocks list! How the mighty fell in 2021! Unfortunately, the pandemic related spending trends each of these companies rode successfully in 2020 petered out in 2021.

Other notables on the 2021 Worst Stocks list include a couple of serial ‘disappointers’ which backed up similarly awful performances in 2020. These include energy producer and retailer AGL Energy (AGL) -48% which continued to suffer as rising costs slashed its profit margins, and gold miner Resolute Mining (RSG) -45% which was plagued by ongoing operational issues. There were plenty of other tales of woe among the 2021 Worst Stocks list, but we’ll leave the investigation of these to you.

What can we expect from the ASX in 2022?

The biggest question investors generally want to know at the start of the year is which sectors are going to produce the best stocks for the current year? Our hunch is that companies leveraged to the EV revolution will continue to do well. However, we do note that some of the price charts of these companies are presently going vertical (bottom left to top, top, top right!).

The old saying is that nothing goes up in a straight line, and there will inevitably be pullbacks in these companies in 2022. However, we do feel that we are more likely to be at the beginning of the “EV megatrend” than at the end of it. So, investors should continue to keep an eye on the likes of Novonix, Pilbara Minerals, and Liontown Resources on pullbacks. Other stocks in this space which could end up in the ASX300 in 2022 if they continue on their current path of strength, include battery recycling hopeful Neometals (NMT) and US-based battery manufacturer Magnis Energy (MNS).

On the flip-side, as interest rates are set to lift-off in a number of economies in 2022 technology stocks may continue to come under pressure. Central banks are looking to step up their fight against inflation which in many countries is topping 40-year highs. Higher interest rates hurt the valuation of many technology stocks which have very high price to earnings (PE) ratios or earnings which are expected to occur fell into the future.

However, the bark might be worse than the bite on this issue, and we expect that technology shares will recover after interest rate increases commence in the USA around March. So, watch out for some potential bargains in these companies around the market’s seasonal low in May. Here, high quality technology shares with market leading positions such as Pro Medicus (PME), Altium (ALU), and Wisetech Global (WTC) should be high on investors’ shopping lists.

One thing is sure to be the case in 2022: There will once again be major winners and major losers. Unfortunately though, as the pandemic extends into its third year and central banks attempt to balance flagging economic growth with the fight against inflation, there is also going to be a decent whack of uncertainty and volatility along the way. So stay on your toes!

Main image source: Kaikoro (Shutterstock.com)

This content was reviewed by Content Producer Marissa Hayden as part of our fact-checking process.

Share this article